The Sustainability and Ethics Committee

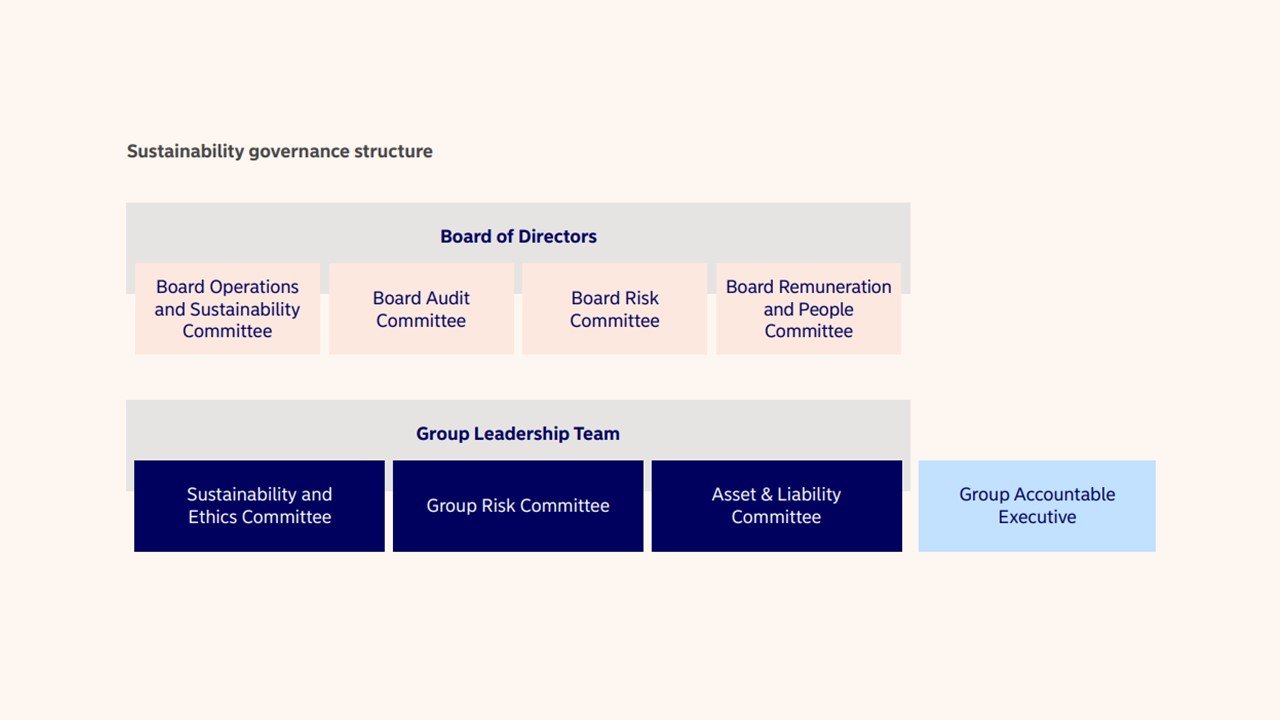

We also have an executive-level Group-wide committee – the Sustainability and Ethics Committee (SEC) – as a sub-committee of the CEO’s Group Leadership Team (GLT). The SEC consists of representatives from the business areas and Group functions, including Group Risk, Group People, Group Corporate Legal, and Group Finance, and supports the Group CEO, the GLT, the BOSC and the Group Board in their oversight responsibilities concerning sustainability. SEC is mandated to facilitate the integration of sustainability into our business strategy and support the integration of ESG factors into our risk management framework. It is tasked with recommending to the Group CEO a long-term plan for fully integrating sustainability into our business strategy and ensuring appropriate implementation to achieve the Group level targets. Part of this is to approve sector and thematic guidelines. It is also responsible for influencing and following the Group’s status and progress regarding ethics and culture in line with our purpose and values. This involves advising the Group CEO on decisions on whether Nordea should participate in or withdraw from voluntary commitments related to sustainability and providing guidance to the business areas regarding ethical business dilemmas.

To ensure that sustainability is integrated into all business areas and Group functions, a Group-wide implementation programme has been established with dedicated work streams and an Operational Steering Committee. The programme’s progress is monitored by the SEC and the BOSC on a quarterly basis.

The Risk Committee

The executive-level Group Risk Committee (RC) promotes interaction and coordination within the Group on risk matters. With respect to sustainability, the RC is responsible for overseeing the implementation of ESG factors as embedded drivers of existing risks. In addition to the RC, the SEC also monitors and, when relevant, supports the business areas and Group functions in risk management activities related to the long-term plan for fully integrating sustainability into our business strategy and the associated targets.

ESG-related targets in the remuneration

Nordea has integrated ESG-related targets to the remuneration of the Group Leadership Team and other senior leaders across Nordea, both in the short-term incentive plans and, as of 2023, the long-term incentive plan, to support Nordea in fulfilling its sustainability objectives. The targets for the short-term incentive plan refer to three key areas:

- progress in relation to Nordea’s sustainability implementation plan,

- increase the volume of green financing and

- improve the gender balance at senior leadership levels.

The targets for the long-term incentive plan (LTIP) have been set so that the maximum outcome will require achieving exceptional financial and sustainability performance. The assessment of performance during the LTIP performance period will be based on the following performance criteria with the introduction of ESG targets for 2023-2025:

- Total shareholder return.

- Cumulative adjusted earnings per share (aEPS).

- ESG scorecard e.g. on sustainable financing, net-zero committed assets under management, gender balance and credit profile.

This is in addition to the current non-financial KPIs on employee engagement, customer satisfaction and risk, compliance and conduct priorities, as well as goals supporting Nordea’s financial targets. This means that a material portion of the GLT members’ and senior leaders’ non-financial goals for remuneration measured at group level are linked to ESG goals.

Furthermore, as of 2023, Nordea has also integrated ESG-related targets into the variable remuneration and profit sharing plan applicable for the wider workforce of Nordea.