A low-carbon complement to renewable energy

Despite its challenges, nuclear does provide something that’s valuable but difficult to value: a large and stable source of energy which reduces the risk of supply-demand imbalances in a fully renewable system.

“We could see it being one part of the solution in specific circumstances,” says Kisic.

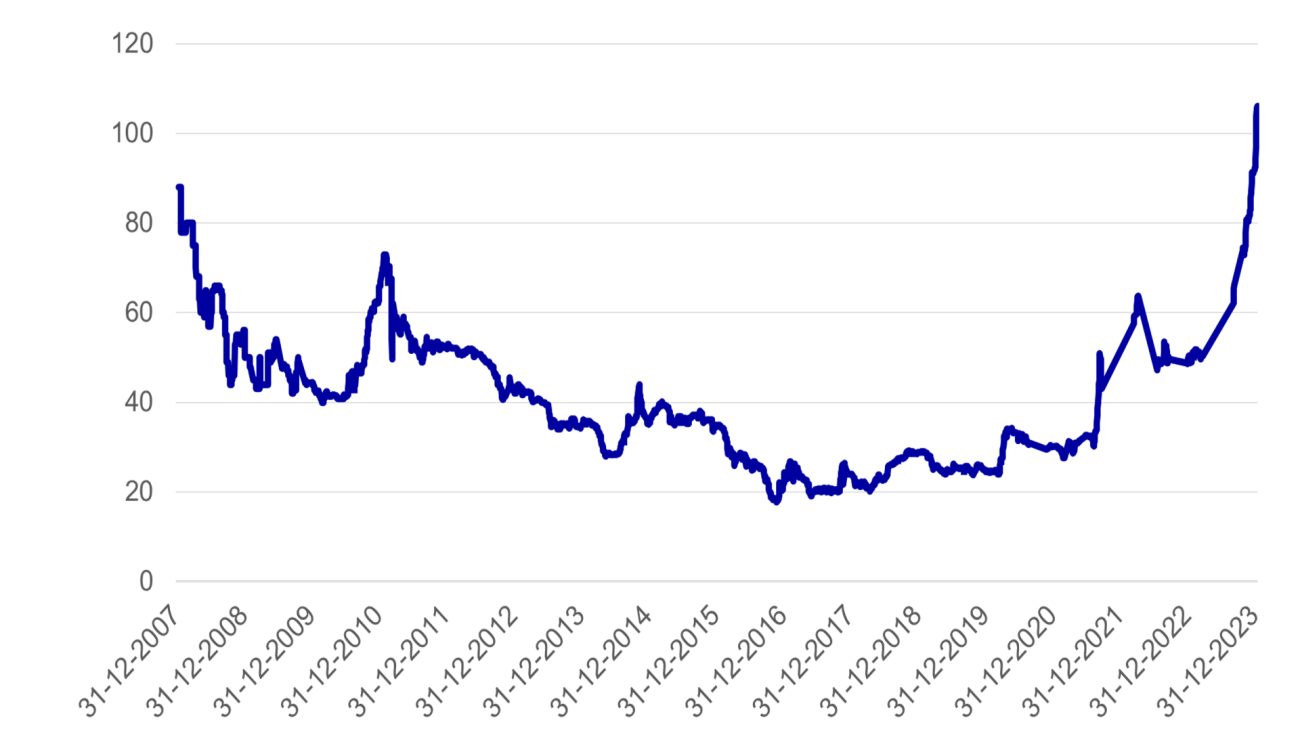

As countries make progress towards their climate targets and energy security is prioritised, nuclear power is increasingly being seen as a valid low-carbon complement to more volatile renewable energy. Prices of uranium, the energy source for nuclear power, are reacting accordingly, reaching their highest levels in 17 years.

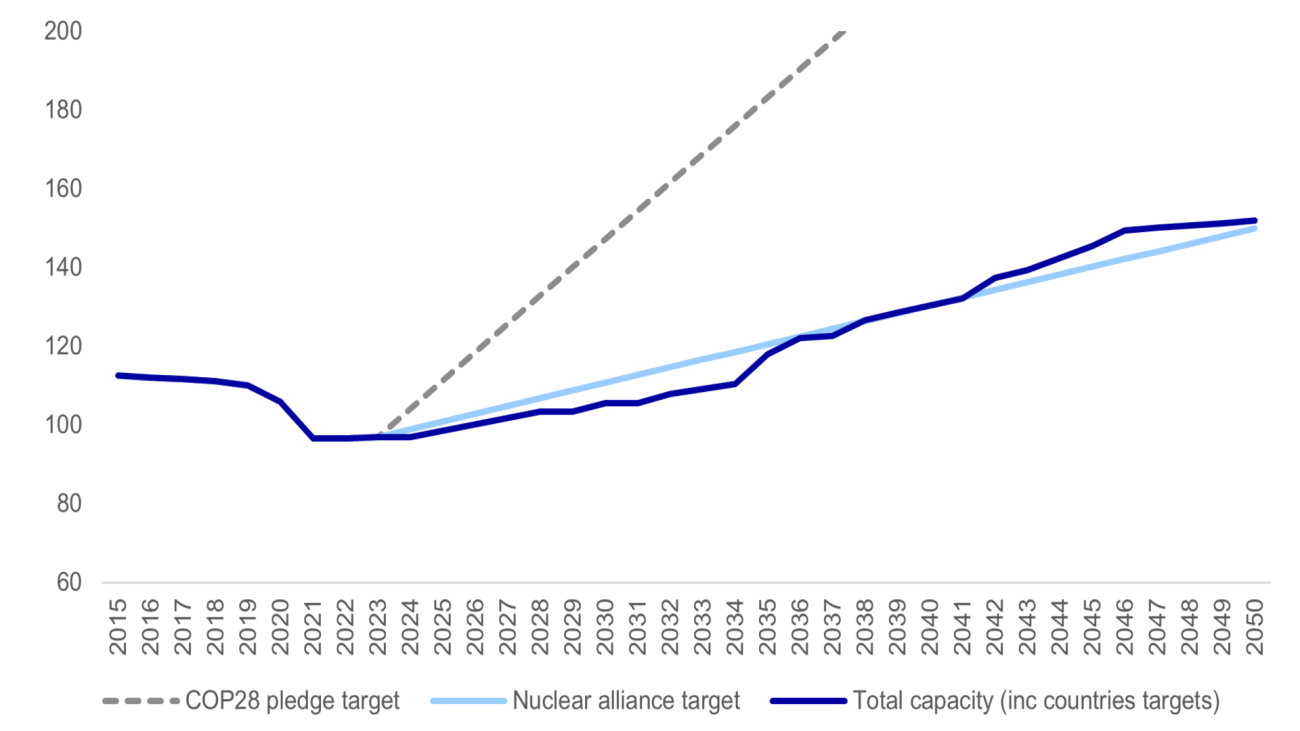

At COP28, the UN climate change conference in late 2023, 22 countries, including the US, Japan, France, Sweden, Finland, the UK and the UAE, launched a multilateral commitment to triple global nuclear energy production by 2050.

In the EU, the inclusion of nuclear in the EU Taxonomy, the sweeping classification system for sustainable activities, marked a turning point. In May 2023, 16 European countries launched the “Nuclear Alliance,” lobbying to recognise the role of nuclear in reaching the EU’s climate targets by moving from a 2040 “renewable target” to a “low-carbon” one that would allow nuclear in.

Nuclear is the second largest source of electricity production in the EU after fossil fuels, although it is concentrated in just a few countries, including France, Spain, Sweden, Finland, Hungary, Slovakia and Czech Republic.

Sweden’s ambitious plan

The Swedish government has also launched an ambitious roadmap to aggressively expand the nuclear asset base of the country. The goal is to open two new reactors by 2035 and up to ten by 2045, a build-out not seen in Europe for several decades.

Kisic notes that, despite the challenges, the Swedish government appears resolute and has already lifted restrictions on developing greenfield nuclear.

“We see the development of phase one of the roadmap as a moderately likely possibility,” he says. “However, a whole new industry would need to emerge.”