- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

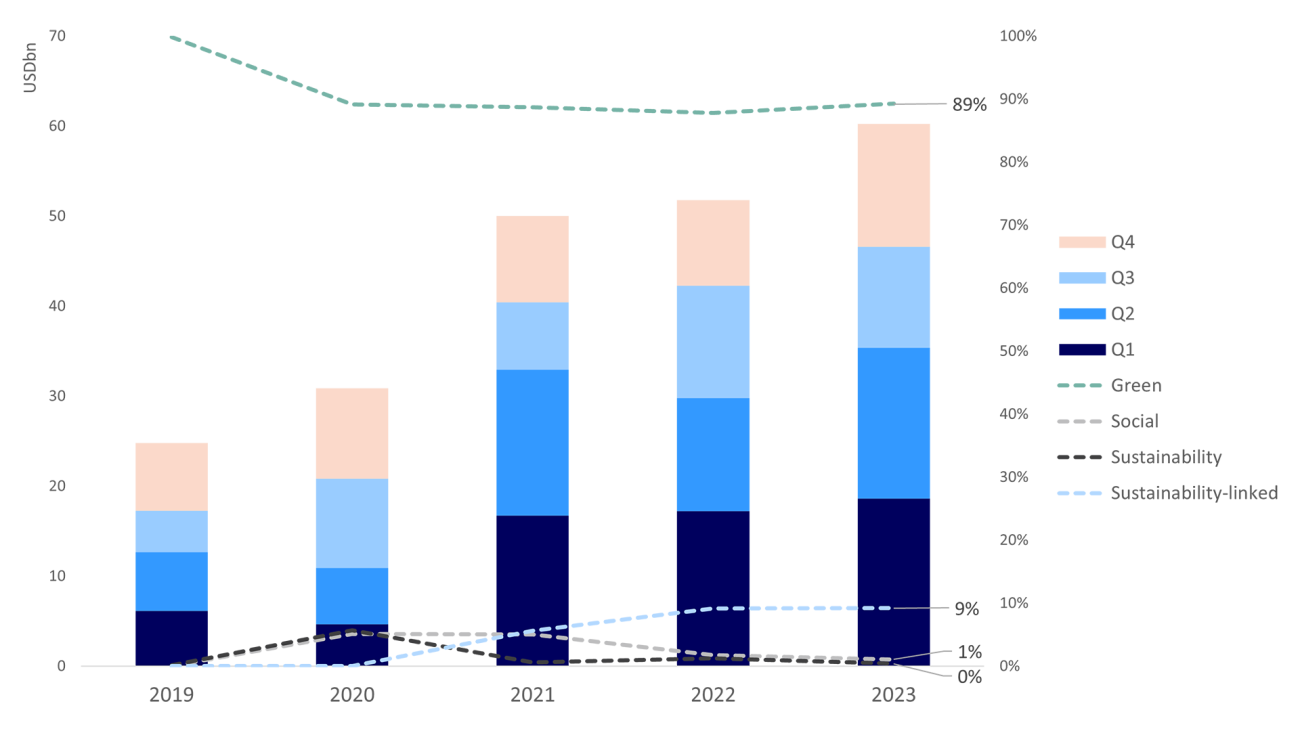

With just over USD 60 billion in sustainable issuance in 2023, the new record beat out the 2022 high by 16%. Record Q4 issuance rounded out the best ever year for the Nordic sustainable bond market, with quarterly volume up 44% on last year’s figures and 22% on the previous quarter.

Once again, the Nordic sustainable bond market outshone the global sustainable bond market. Although yearly global sustainable issuance surpassed USD 1 trillion in 2023, supply fell 15% short of the peak yearly levels seen in 2021. While Nordic issuance finished on a high note, global sustainable bond market issuance dropped off in relative terms through the latter part of the year, where Q3’s reduced supply continued to further dampen into Q4, making it the least active quarter of the year.

Not only did the Nordic sustainable bond supply demonstrate its strength relative to the aggregate global market through healthy Q4 issuance, its relative maturity was also evident in the distribution of issuance throughout the year. Three out of four quarters in 2023 saw record levels of issuance, with Q3 being the only quarter to buck the trend.

Nordic sustainable bond supply per quarter and sustainable format shares by volume

This consistency can be found as we look at the dynamics of the Nordic sustainable bond market during 2023. Distribution across the Nordic countries remained relatively stable compared to last year’s figures, with Denmark and Finland (22% and 17% shares) taking a slight increase in share from Norway and Sweden (26% and 36% shares).

We also only observed relatively small changes in the types of issuers using sustainable formats at the Nordic level, with FIG issuance taking a 43% share, corporate issuance a 39% share and SSA issuance an 18% share. The sustainable formats used by these issuers remained stable as SLBs maintained a share of 9%. The green bond format continued to rule in 2023, making up 89% of yearly volume.

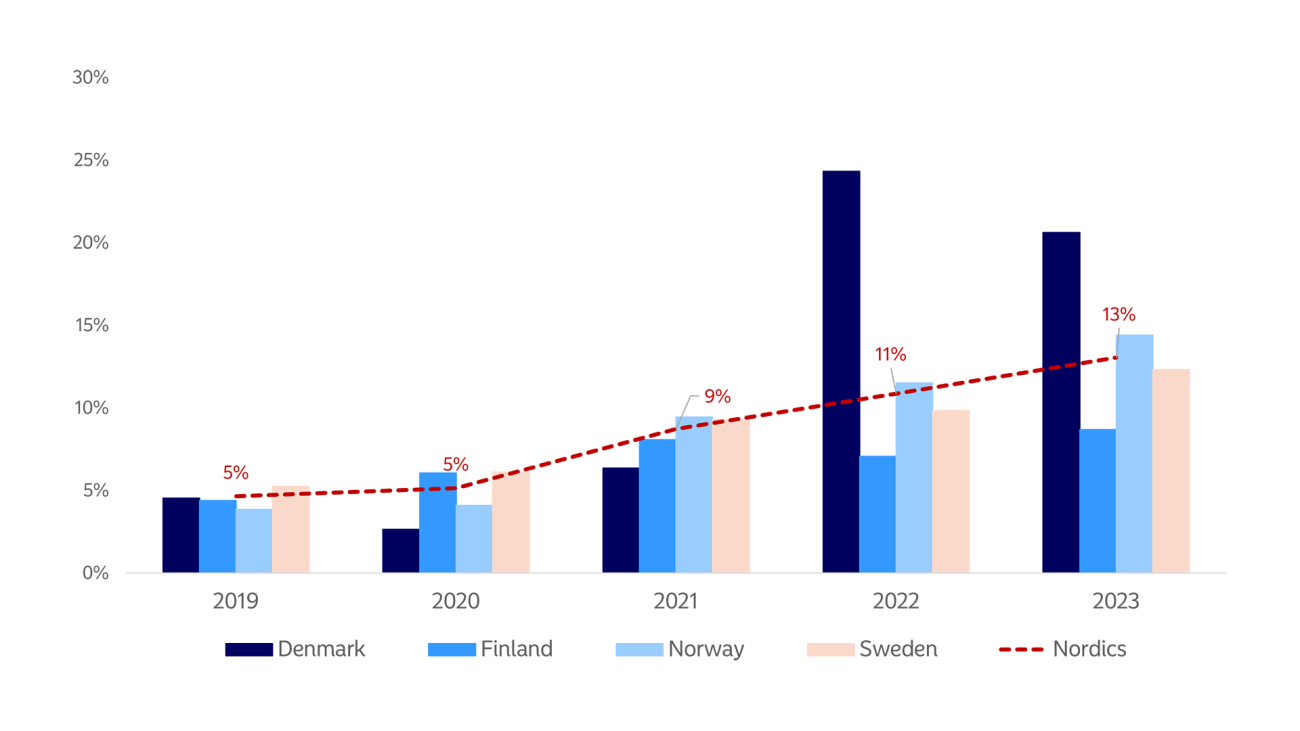

Not only is the Nordic sustainable bond market a positive outlier in terms of sustainable issuance growth in absolute terms, it also impresses with its growth relative to the bond market as a whole. While global sustainable bond issuance has remained largely flat at around just under 2% of total bond volume for the past few years, the Nordic sustainable bond market has grown its share rather consistently.

Sustainable share of total Nordic bond volume by country and year

The proportion of Nordic bond volume issued with a sustainable label – green, social, sustainability or sustainability-linked – represented 13% of the total Nordic bond market in 2023, up from 9% in 2021 and 11% in 2022. While we arguably observed some wavering in the resilience of sustainable formats during the broader market uncertainty of H2 2022, with the sustainable share of Nordic issuance dropping just below 10% across Q3 and Q4 of 2023, we saw this bounce back during 2023.

The Danish sustainable bond market has impressed in recent years, both in absolute terms, seeing 98% volume growth from 2021 to 2022 and 26% volume growth from 2022 to 2023. As seen in the chart above, this growth outpaces the growth of the Danish bond market as a whole over the same timeframe, with sustainable issuance having gone from making up 6% of yearly Danish bond volume in 2021 to a staggering 21% in 2023.

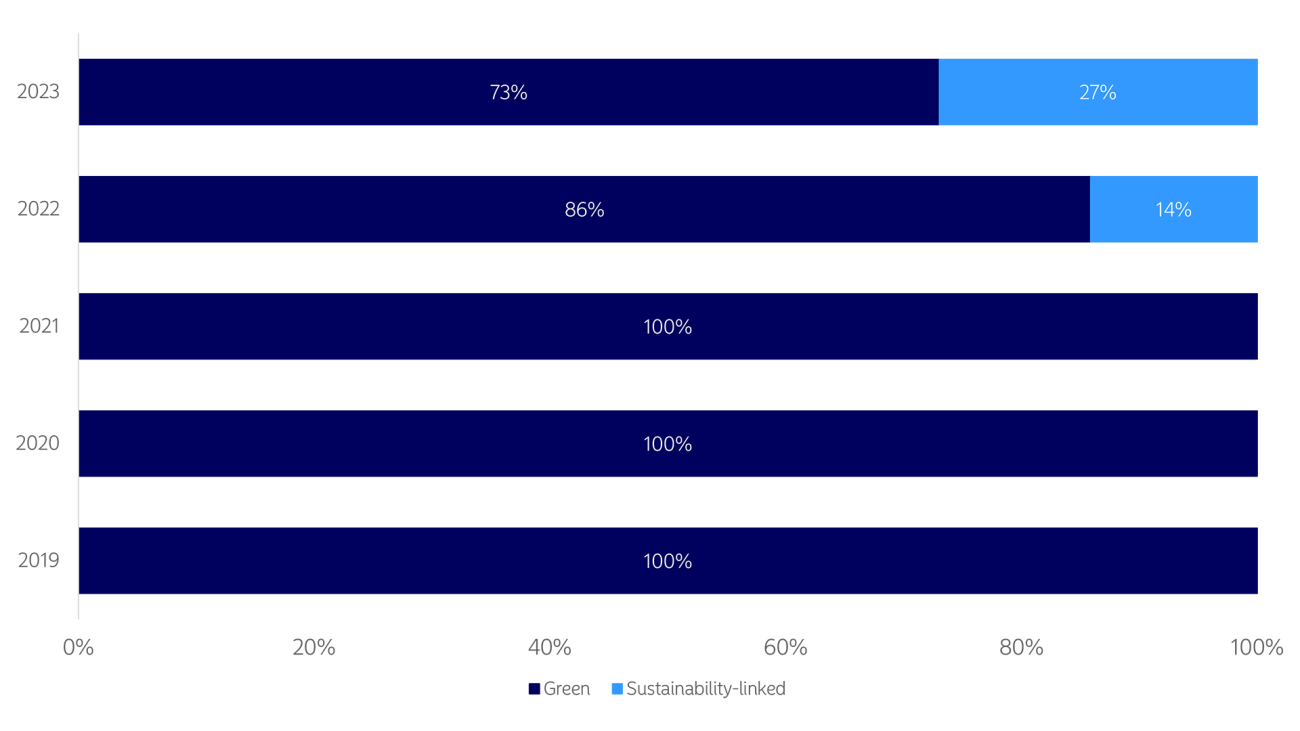

Danish sustainable bond supply volume by format share

Underlying this trend, Denmark also appears to be an outlier in the type of sustainable bonds issued, both globally and across the Nordics. The volume share of sustainability-linked bonds appears to have reached a stagnation point of around 9% in the Nordics as a whole, and is even seeing a decline globally, where the share dropped from 9% to 7% in 2023. The Danish share of sustainability-linked bonds, however, has seen rapid growth over the past two years, making up 14% of domestic sustainable bond issuance in 2022 and 27% in 2023. While relatively late adopters of the format, Denmark has seen new issuers applying the format in 2023, as well as issuers continuing to issue SLB frameworks.

Stay on top of the latest developments in the fast-moving world of sustainable finance. Receive a curated monthly digest and occasional flash updates with the latest news, insights and data from our Sustainable Finance Advisory team.

Register here