PA: The majority of corporate bond issuers in the Nordic region have access to several alternative sources of liquidity that can be tapped in case of a sustained closure of the local and international bond markets. For many Nordic blue chips, the revolving credit lines are intended to remain undrawn and are usually used to back up commercial paper issuance and other capital market debt. It is therefore more likely that corporates would explore alternative liquidity sources ahead of such drawings, such as establishing bridges to bonds, bilateral loans, convertible bonds or even equity issuance.

We do not, however, envisage a prolonged primary debt-market freeze. It will be paramount for the ECB to secure the functionality of especially the EUR investment grade bond market, given that it has greatly increased in importance for corporates as a funding vehicle over the past five years. And the ECB is itself a big investor in this market.

From an all-in yield perspective, corporates have a very benign pre-crisis starting point, with the ten-year EUR swap rate now only 10 bp from the August 2019 low. This means recent credit spread widening is mitigated, albeit not fully neutralised.

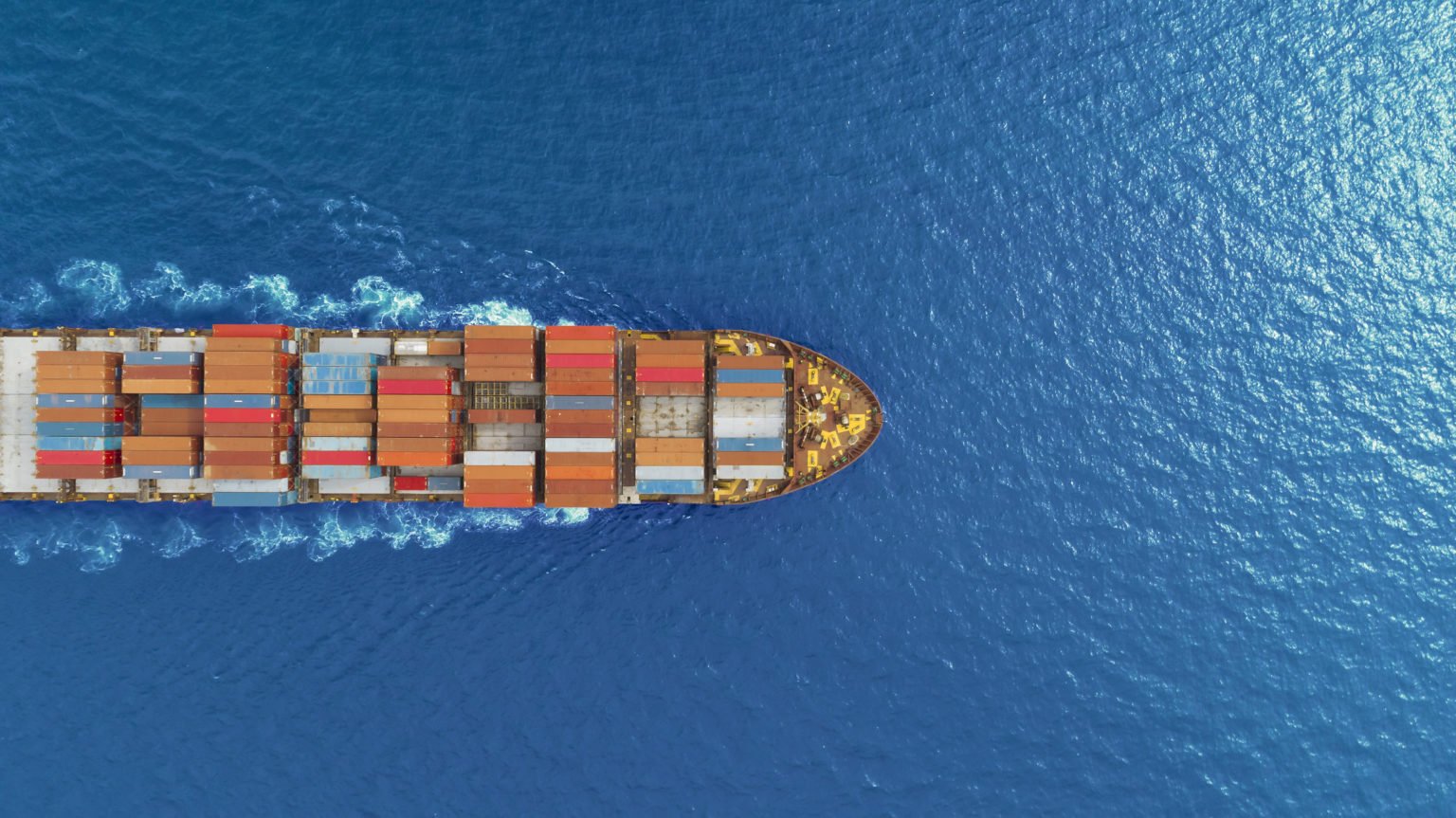

The most affected sectors have been transportation (freight and airlines), energy-related, and consumer-driven sectors such as brewers. And, as always when the market is in ’risk-off’ mode, high-beta issuers with aggressive capital structures underperform the overall market.