Our investment case

We are the largest bank in the Nordics with a 200-year history of supporting and growing the Nordic economies.

Nordea is listed at the stock exchanges in Helsinki, Stockholm and Copenhagen and we have around 570,000 private shareholders.

Below you can find some of the key reasons why you should consider being one of them.

- Nordea and its businesses are exposed to various risks and uncertainties.

- This information contain certain statements which are not historical facts, including, without limitation, statements communicating expectations regarding, among other things, the results of operations, the bank’s financial condition, liquidity, prospects, growth and strategies; and statements preceded by “believes”, “expects”, “anticipates”, “foresees” or similar expressions.

- Such statements are forward-looking statements that reflect management’s current views and best assumptions with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors.

- Important factors that may cause such a difference for Nordea include but are not limited to: (i) the macroeconomic development, (ii) change in the competitive environment, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels.

- This presentation does not imply that Nordea and its directors have undertaken to publicly update or revise these forward-looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that lead to changes compared with the date when these statements were provided.

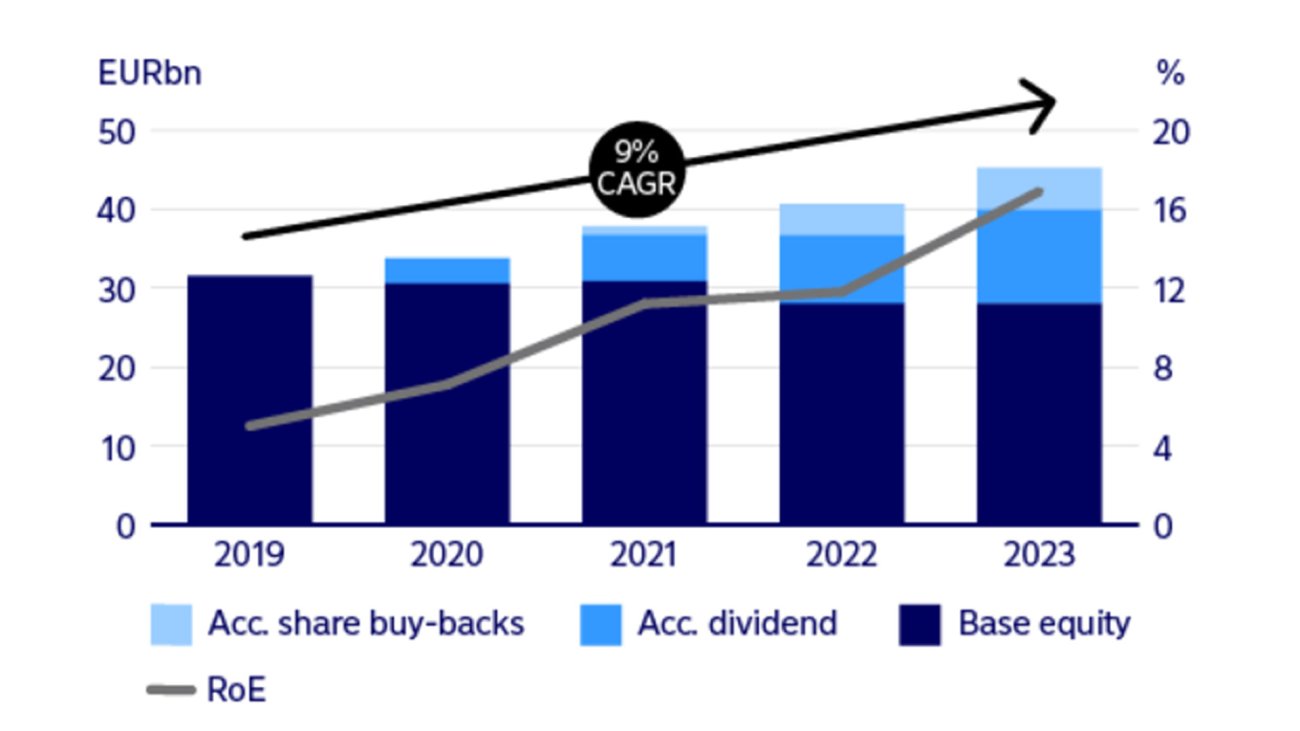

We have paid out 8.7 billion euros in dividends over the past four years – and were one of the first banks in Europe to start implementing share buy-backs in 2021.

Over

€0bn

paid out in dividends over the past 4 years

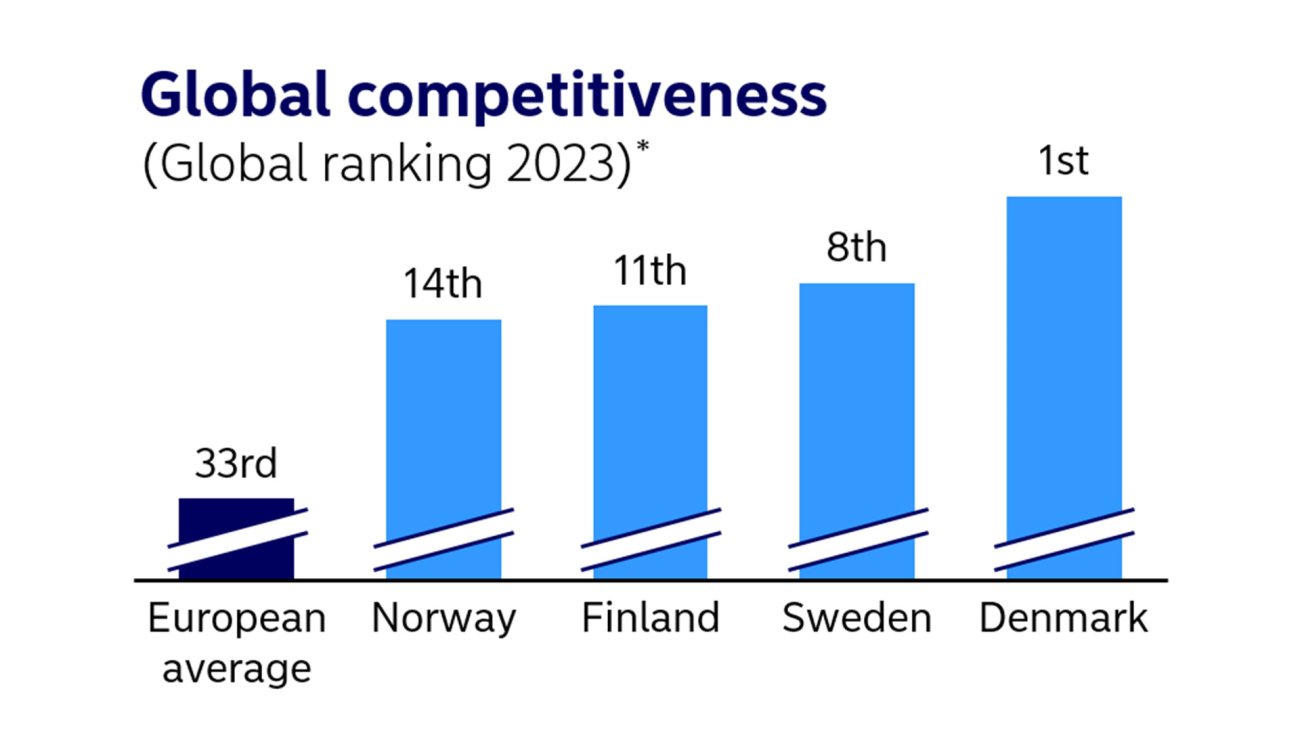

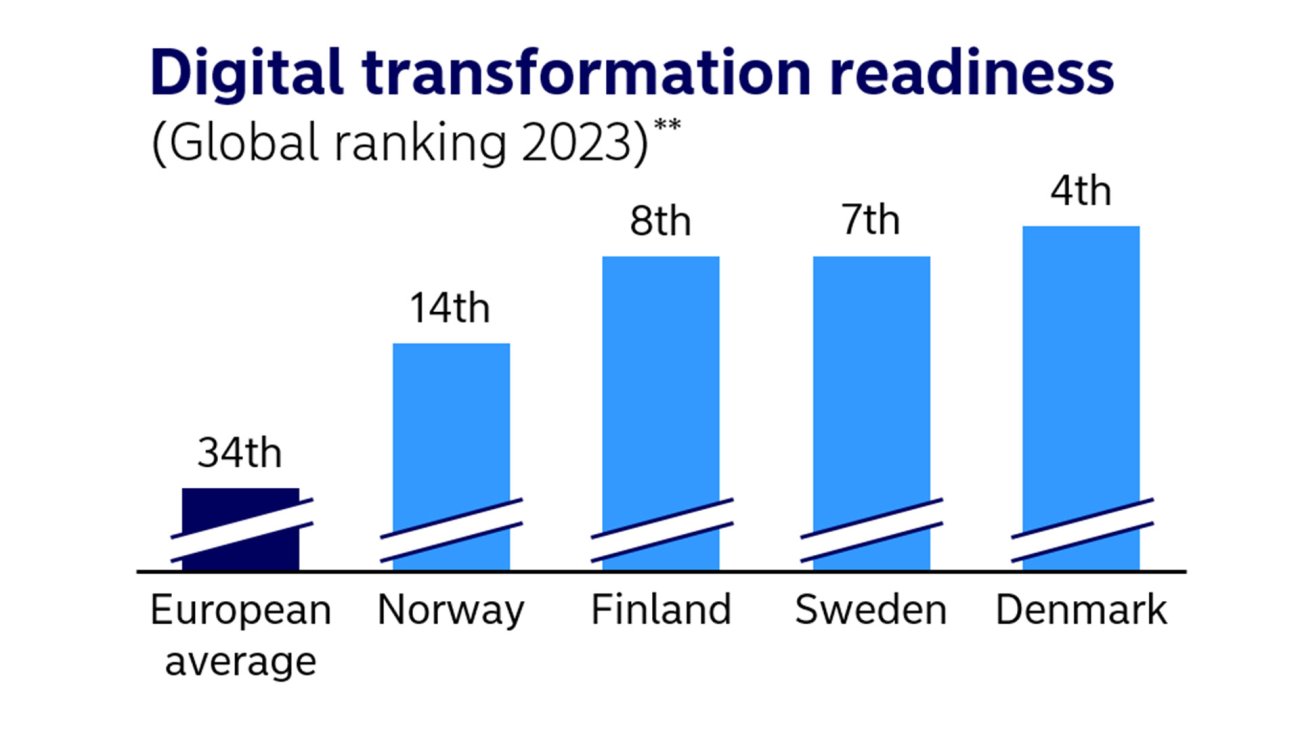

2. We operate in a structurally attractive Nordic banking environment

Our operating environment:

-

Nordic GDP growth is steady and above euro area average

-

Nordic unemployment rates are lower than euro area average, with significant social safety nets

-

Nordic countries are highly digitalised in global context

-

Nordic banking market is stable, safe and profitable with high returns, driven by cost efficiency and low loan losses

* Source: IMD World Competitiveness Ranking 2023 (analyses and ranks countries according to how they manage their competencies to achieve long-term value creation)

** Source: IMD World Digital Competitiveness Ranking 2023

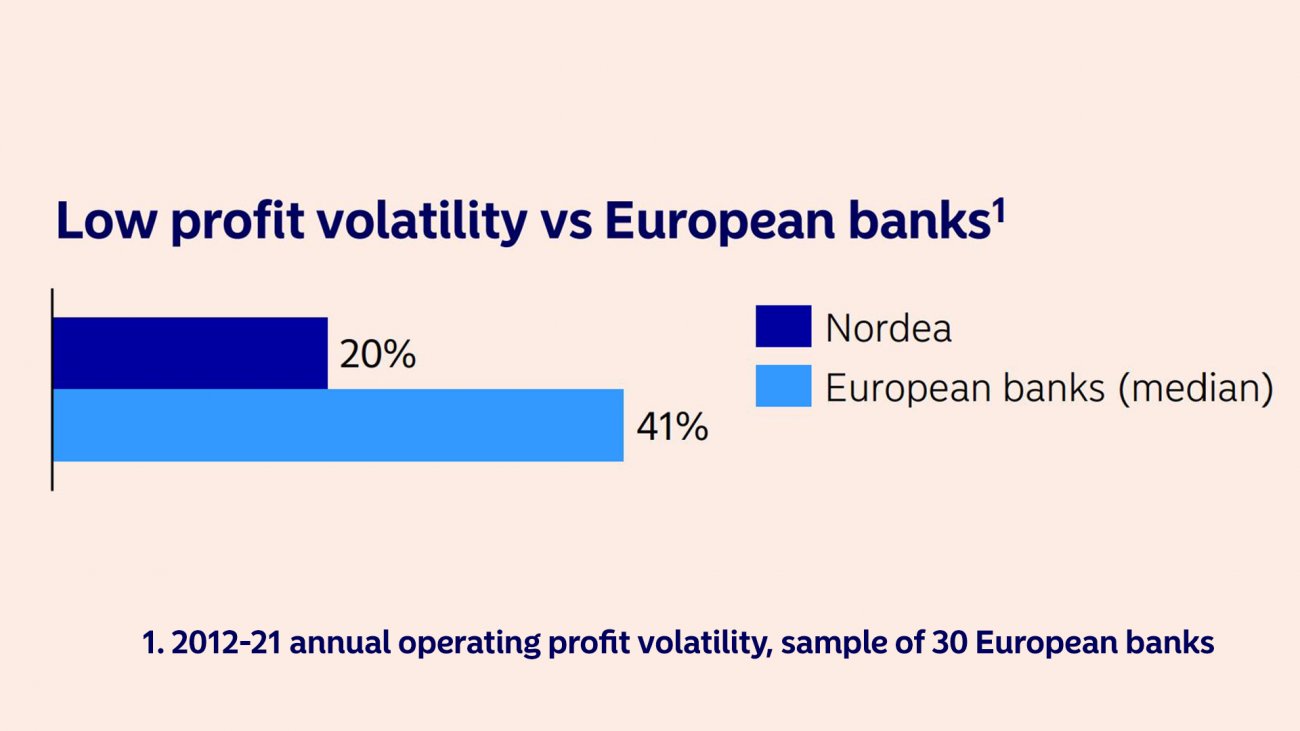

3. We are the largest financial services group in Nordics with low earnings volatility and unique growth opportunities within our four business areas

"Our quarterly operating profit volatility has decreased significantly – after already being historically low compared with the European banking sector average."

Frank Vang-Jensen, Nordea's Group President & CEO

Our position in the Nordics:

#1 Personal Banking

#1 Business Banking

#1-2 Large Corporates & Institutions

#1 Asset & Wealth Management

Primary levers to drive profitability improvements

-

Accelerate savings growth

-

Allocate more capital to profitable lending growth

-

Increase operational efficiency

-

Reduce low-yielding economic capital

Our growth in recent years:

Net interest income

+0%

2023 vs 2022

Operating profit

+0%

2023 vs 2022

Group income

+0%

2023 vs 2022

4. We are a globally leading digital bank supporting great customer experiences

Our future as a digital leader is all about customer experience. We use our knowledge and the latest technological developments to continually expand our range of digital products and services for the benefit of our customers.

We continue to expand our self-service features, making it easier for customers to manage their finances in real time. Our target is to have doubled the number of available digital products and services by 2025 compared with 2022.

Nordea is a recognised digital leader

Best performer

- Best in 6 categories in round one of 2023 World’s Best Digital Bank Awards (Global Finance)

- No.1 in FI Digital leader assessment 2023 (BearingPoint)

- Best Digital Performer’ among retail banks in Europe Q1 '23 (D-Rating)

#1 mobile bank in the Nordics

According to AppStore ratings.

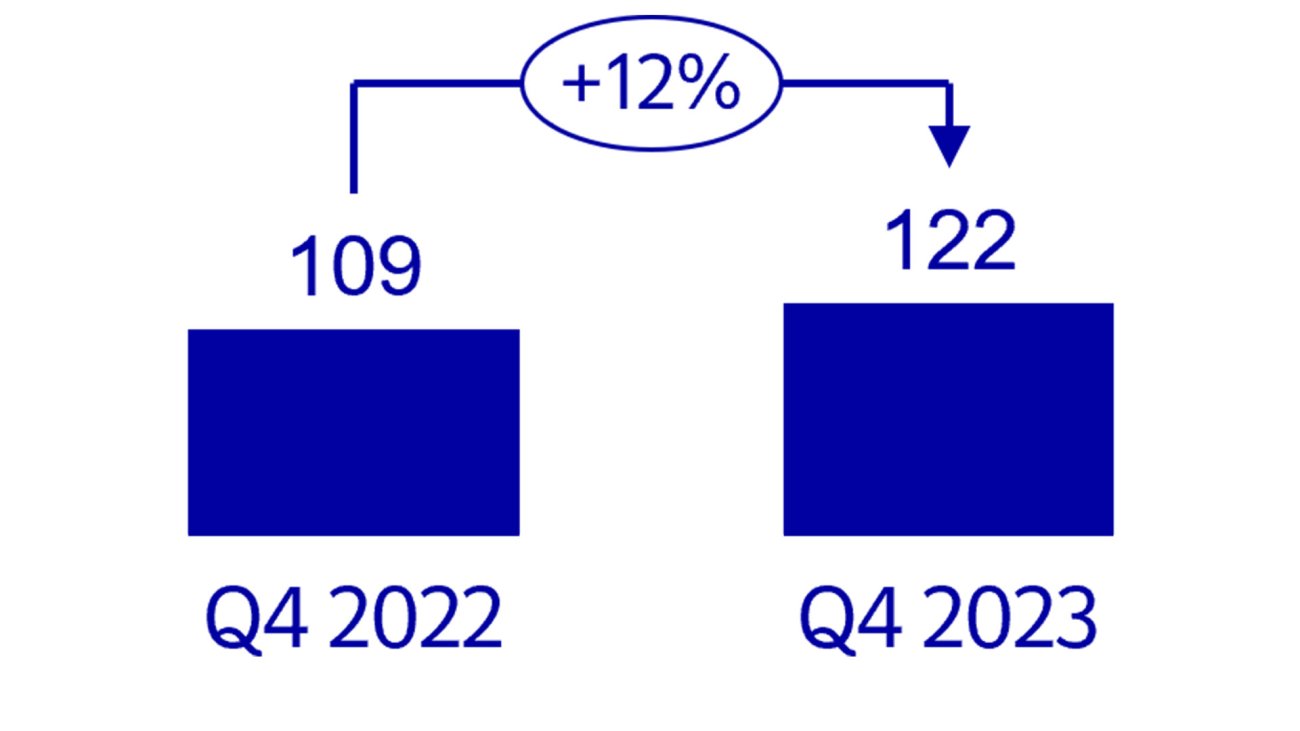

Growth in digital engagement

Logins to digital channels (millions)

5. Sustainability is at the core of our strategy

We have made sustainability an integrated part of our business strategy, introduced measurable medium and long-term objectives and set 2023–2025 targets to help drive a greener and more sustainable future.

Our sustainability objectives:

Net-zero

emissions by 2050 at latest

40–50%

reduction in emissions across investment and lending portfolios by 2030.

50%

reduction in emissions from internal operations by 2030.

Strong progress since 2019

Reducing the bad

-

-29% reduction in emissions in our lending portfolio

-

-26% reduction in emissions in Life & Pension

-

-38% reduction in emissions in our Asset & Wealth Mgmt

-

-51% reduction in emissions from internal operations

Increasing the good

-

135bn sustainable financing facilitation

Related links

-

Sustainability Factbook 2023 XLSX, 693KB

Want to know more about being a Nordea shareholder?

Contact Investor RelationsExplore more

Capital Markets Days

Here you can find the presentations and the webcast recording from Nordea's Capital Markets Day held in February 2022.

Read more

Latest interim results

Nordea’s latest interim results, reports, presentations, webcasts and more.

Read more

Latest annual report

Here you can see the highlights and key figures from the latest annual report.

Read more