Summary of the quarter:

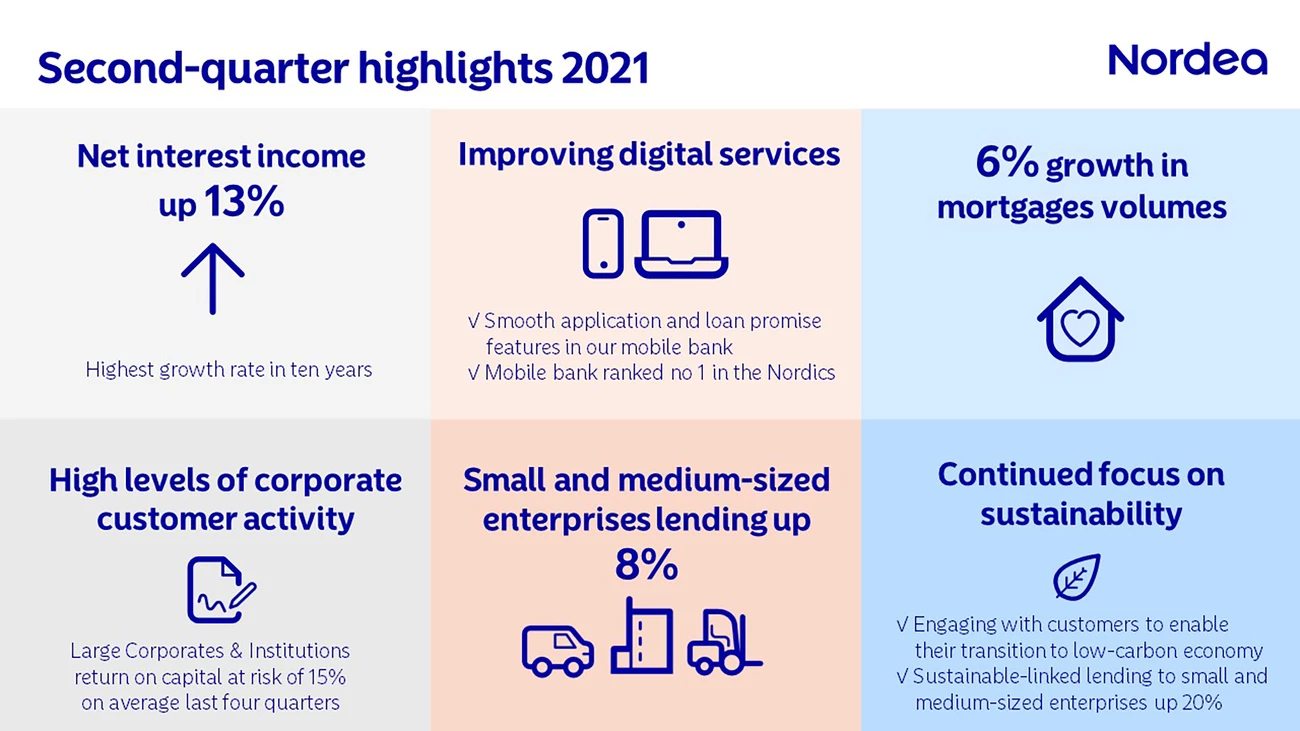

Strong result, with high income growth. Operating profit increased to EUR 1,338m from EUR 306m in the same period last year, driven by a significant increase in total operating income, strong cost control and low loan losses. Net interest income grew by 13% and net fee and commission income increased by 30%. Net fair value result was solid and at a more normalised level than in the first quarter.

Continued strong growth in customer business volumes across Nordics. Nordea drove high levels of business activity and gained market shares across the Nordics. Mortgage volumes continued to grow significantly, increasing by 6%, year on year, and SME lending increased by 8%. Assets under management increased by 24% to an all-time high of EUR 387bn, driven by strong performance and continued solid net inflows, especially into retail funds and Private Banking.

Underlying costs unchanged – outlook updated due to significantly higher business activity. Total costs excluding resolution fees increased by 9% due to the inclusion of Nordea Finance Equipment, higher variable pay linked to strong performance and exchange rate effects. Adjusted for these items, costs were unchanged. Given this, costs for 2021 are now expected to be around EUR 4.6bn (previously below EUR 4.6bn).

Strong credit quality with net loan loss reversals. Net loan losses and similar net result amounted to net reversals of EUR 51m or 6bp in the quarter, compared with a 85bp charge in the same quarter last year. Realised net loan losses remained at low levels. Net loan losses in 2021 are expected to be significantly below the 2020 level.

Cost-to-income ratio and profitability improving. Nordea's cost-to-income ratio improved to 49% from 52% a year ago, supported by strong income growth and improved cost efficiency. Return on equity increased to 11.4%, despite the very high equity base arising from undistributed dividends and excess capital. Earnings per share increased to EUR 0.25 from EUR 0.06.

Strong capital generation – capital position among best in Europe. Nordea’s CET1 ratio increased to 18.0% from 15.8% a year ago, even after the deduction of the unpaid dividends for 2019-20 and the accrued 2021 dividend. As previously disclosed, Nordea is ready to distribute the unpaid 2019-20 dividends (totalling EUR 0.72 per share) in October, after the current restrictions are repealed. Nordea also plans to start share buy-backs and has commenced the application process.

On track to meet 2022 financial targets. Nordea continues to focus on its three key priorities: to create great customer experiences, drive income growth initiatives and optimise operational efficiency. Nordea is progressing well towards consistent delivery of its financial targets: a cost-to-income ratio of 50% and a return on equity above 10%.