We take the next steps for your sake

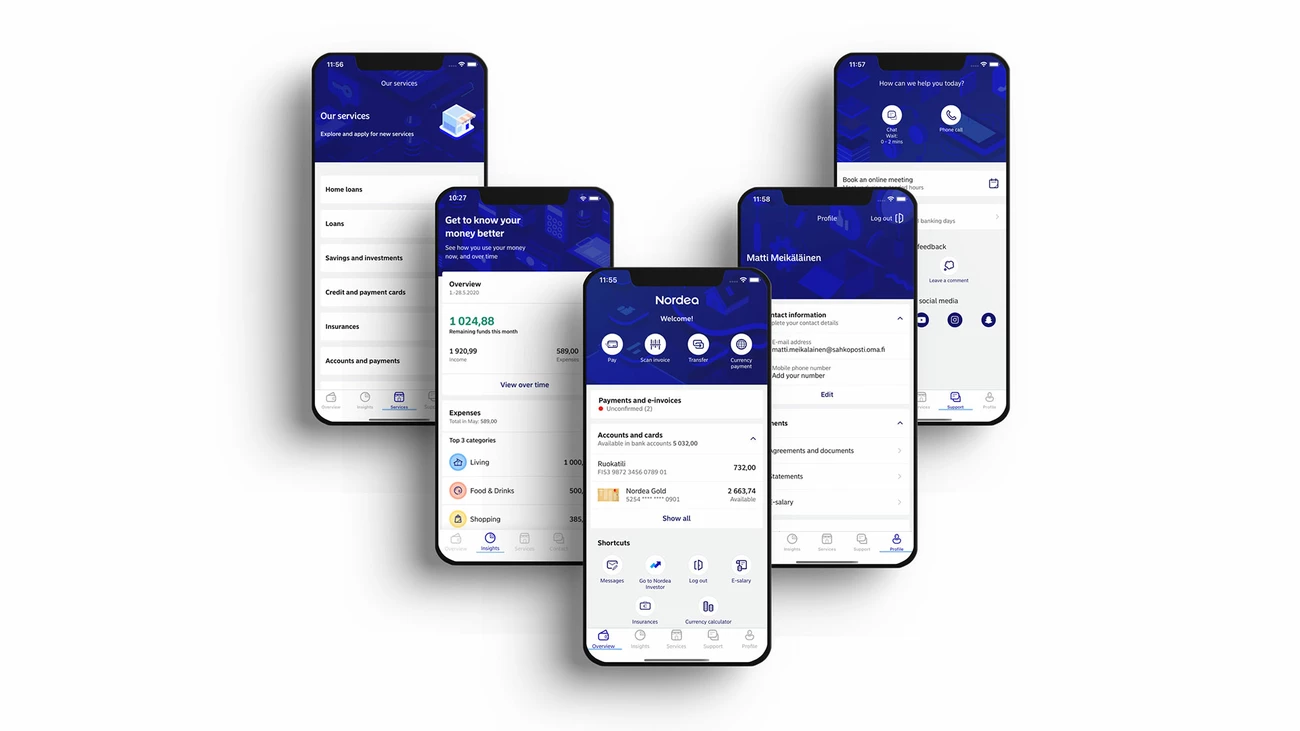

Developing our systems, that is, our payment systems, apps and online bank that our customers use every day is our top priority. We develop the systems to constantly meet our customers’ needs and changed behavior. Also, we protect against cyber attacks, detect fraud and generally safeguard our customers from financial crime.