What do you want from the mobile banking app? That’s one of the questions Nordea colleagues were invited to consider as part of a cross-Nordic user experience pilot that ran from late December 2021 to March 2022.

The response exceeded expectations. “We were flooded with great ideas,” says Outi Verosaari from the Mobile Channel Office. “We received everything from proposals for small text changes to big ideas for the future – plus things to fix before we could launch.”

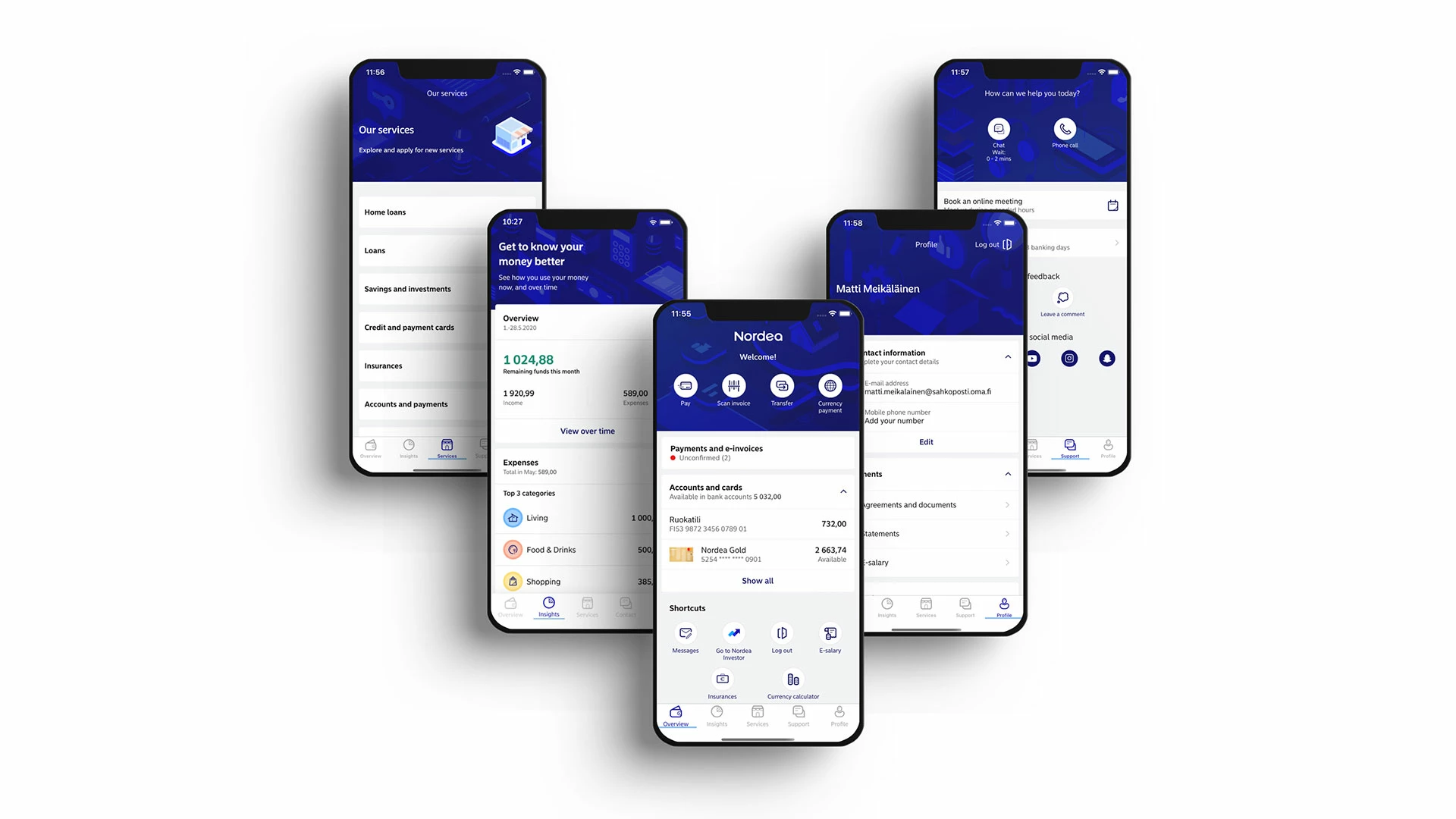

Now, all the feedback has been processed, the developers have made their tweaks and the improved app has begun launching across the Nordic countries – but what’s new for the users?

Major changes aimed at empowering customers

“There are two major changes. First, there’s the revamped Overview tab, which enables customers to see all their financial products at a glance – including those with other banks. They can also hide or rearrange content on the page to personalise their experience,” Outi Verosaari explains.

“Then there’s the brand new Insights tab, where customers can ‘take the pulse’ of their finances by viewing their expenses, income and transfers across all bank accounts in one place.”

“Employee feedback was particularly helpful here,” she stresses: “Participants said it would be useful to be able to set the date the presentation was based on – for example, the day their salary came out. Our developers took that on board and added a filter-by-date functionality.”

The Insights tab also lets users categorise uncategorised transactions to improve the experience further.

“Basically, customers will be able to ‘train’ the app so it offers them increasingly accurate and relevant information – although hopefully our employees have given them a head start there: the pilot already involved quite a bit of categorisation work by the participants,” explains Outi Verosaari.