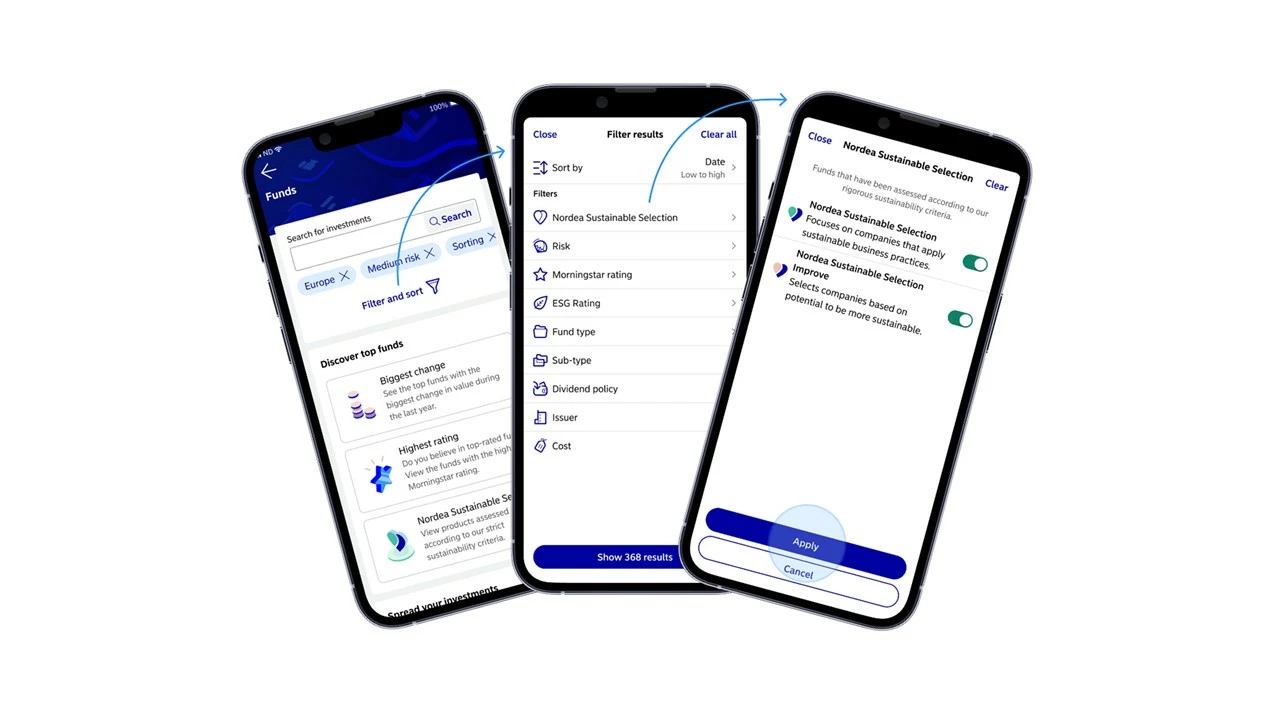

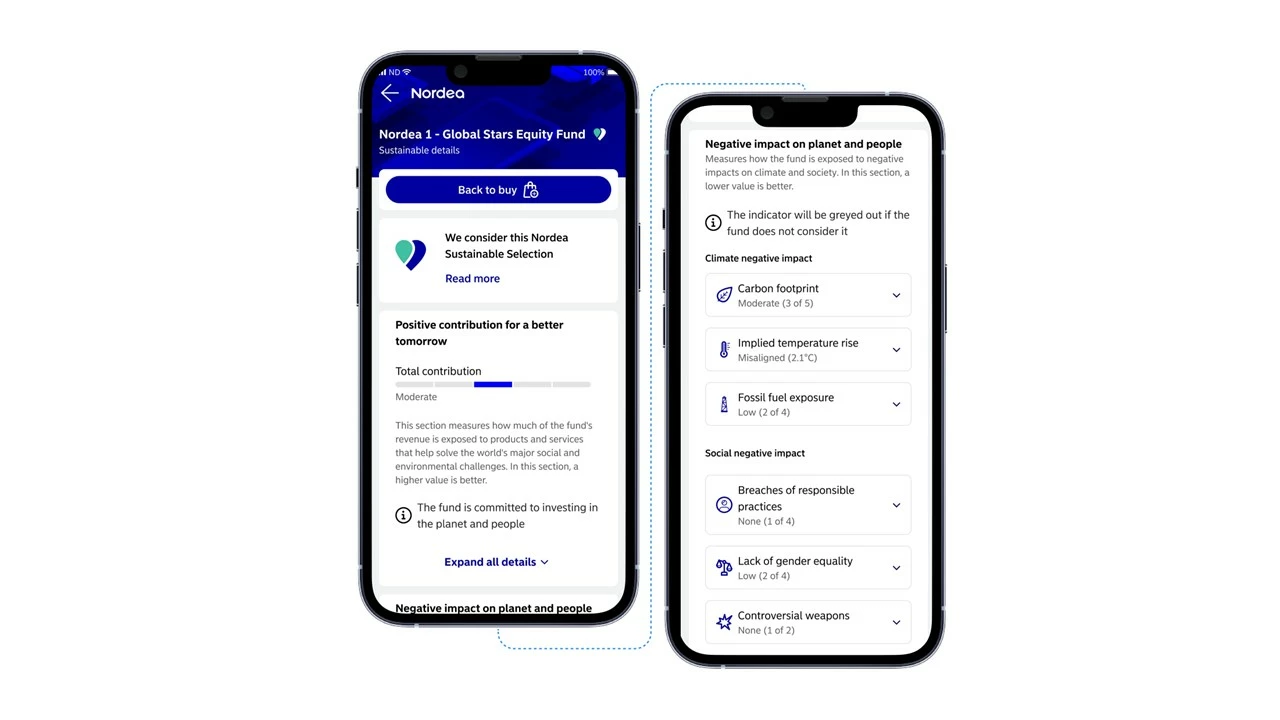

Nordea Sustainable Selection and Nordea Sustainable Selection – Improve

Nordea Sustainable Selection is a range of products that we have assessed and selected based on our rigorous ESG criteria. We assess both the products and the product managers behind them.

These are some of the things we look at in our assessment for Nordea Sustainable Selection:

- Sustainability factors (ESG factors) are an integrated part of the investment process.

- Controversial companies and companies working against sustainable development are excluded. For example companies involved in tobacco, gambling and pornography.

- Product managers are active in using their power to influence the companies they invest in to move in a more sustainable direction.

Nordea Sustainable Selection – Improve is a subcategory with funds that focus on selecting companies based on their potential to become more sustainable over time. These funds have active ownership at the core of the investment process.