Almost 1,000 dialogues with companies to address ESG issues

In 2022 Nordea’s ESG experts engaged in nearly 1,000 dialogues with companies in the name of our investment funds. The dialogues were held to address issues such as climate change, human rights and governance.

As an active owner, Nordea uses its influence as shareholders to improve the practices of the companies we invest in. This work is done in the name of our investment funds and requires resources and expertise. In practice, it can be done in many ways: voting at annual general meetings, engaging in dialogues directly with company representatives, being a member of nomination committees, conducting field visits to factories and taking part in investor initiatives.

Because investment funds pool the money of large numbers of individual investors, companies consider the funds important shareholders and are therefore willing to hear their views and suggestions regarding climate change, human rights and corporate governance.

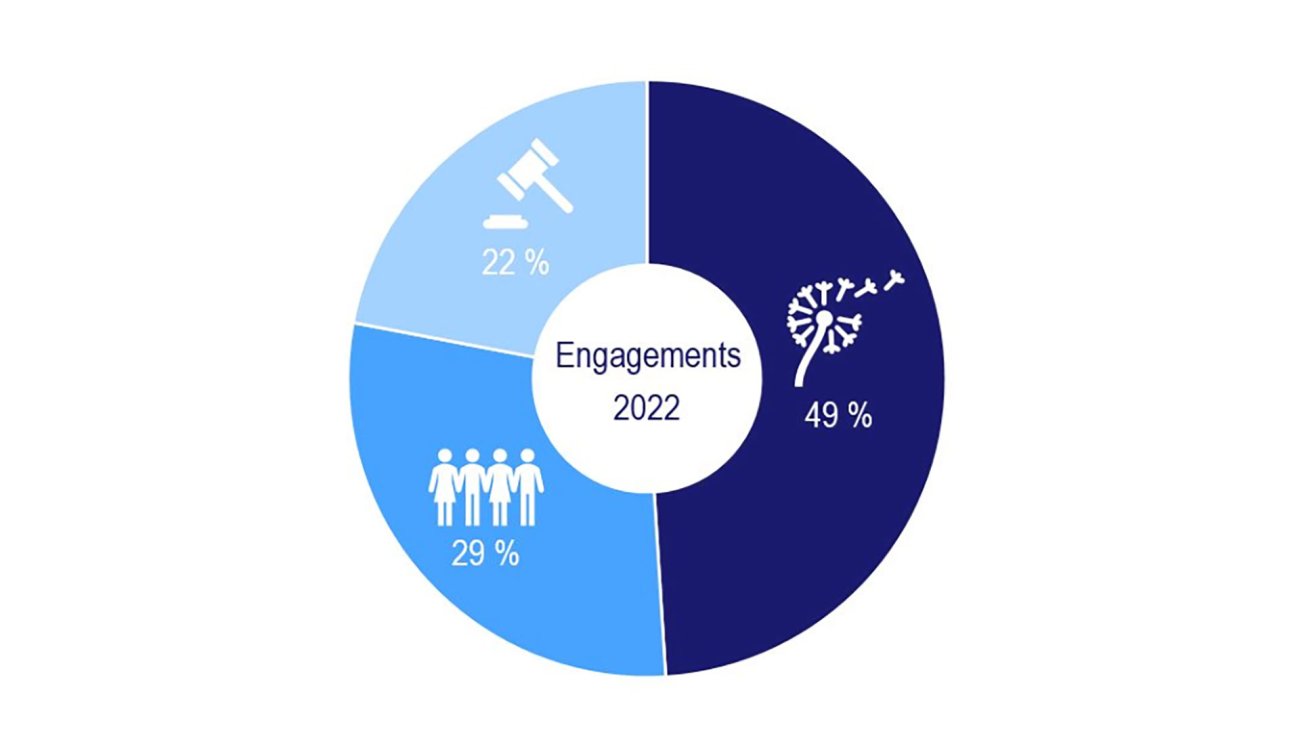

In 2022 we engaged globally in 944 dialogues with companies we invest in to address ESG issues. Almost half of the dialogues (49%) were about the climate, the environment and biodiversity. One-third of the dialogues (29%) covered people and social matters and one-fifth (22%) was about the way the invested companies are governed.

As in previous years, most of the companies we engaged in dialogues with were European (35%) but the share of North American companies was almost as high (32%). One-fifth (22%) of the dialogues concerned Asian companies.

This is how we voted in 2022

AGM voting is an important part of the active engagement carried out by Nordea’s funds. Since the AGM is the highest decision-making body of a company, voting results may also determine the company’s future direction.

Last year we voted to support initiatives related to the climate and environment, human rights and enhancing biodiversity in particular. Moreover, we voted in matters related to data security, equality and companies’ remuneration policies. In 2022 we exercised our voting rights thousands of times through Nordea’s fund holdings at more than 3,900 AGMs.

In our online Voting Portal , you can see how we voted at various meetings.

Impact power through co-operation with other investors

In addition to having one-to-one dialogues with various companies, Nordea’s Responsible Investments team of around 30 ESG professionals participated in a total of 33 joint international investor initiatives. Last year eight new initiatives were introduced.

One of last year’s new joint initiatives is the Collaborative Sovereign Engagement on Climate Change. The initiative aims to support governments issuing major sovereign bonds to take action on climate change. The initiative has identified governments where collaborative engagement could have the greatest impact.

Another important joint investor initiative from 2022 is the Investor Initiative on Hazardous Chemicals where 20 institutional investors encourage chemical companies to increase transparency and stop the production of persistent chemicals. The aim of the initiative is to reduce adverse impacts from hazardous chemicals and thereby the exposure to the associated financial risks.

If you would like to know more about the 25 previously launched sustainability initiatives, you can find them in our Responsible Investments Report 2022.