JT: Are you aiming for an optimal WACC for the group? Are you thinking in WACC terms for big investments decisions, such as big capex projects becoming less value-accretive if the group has an overly strong balance sheet with a higher WACC?

GSI: We have definitely considered our WACC when deciding on leverage targets, dividend policy, and business priorities, although we have not focused much on external communication about our thinking on WACC. We do estimate the WACC for each business area, which can be found in our annual report.

With the dramatic changes in our maritime end-markets and to our company, we have remained on a journey for an optimal capital structure. We are building competences and learning from our experiences. An important part of this has involved our operational management – anchoring with them and ensuring they are on board with our priorities, our view on risks, and that capital is a scarce resource that should be used in a way that is best for our shareholders. This has become even more relevant now that we have 4-5,000 employees who are also shareholders in the company.

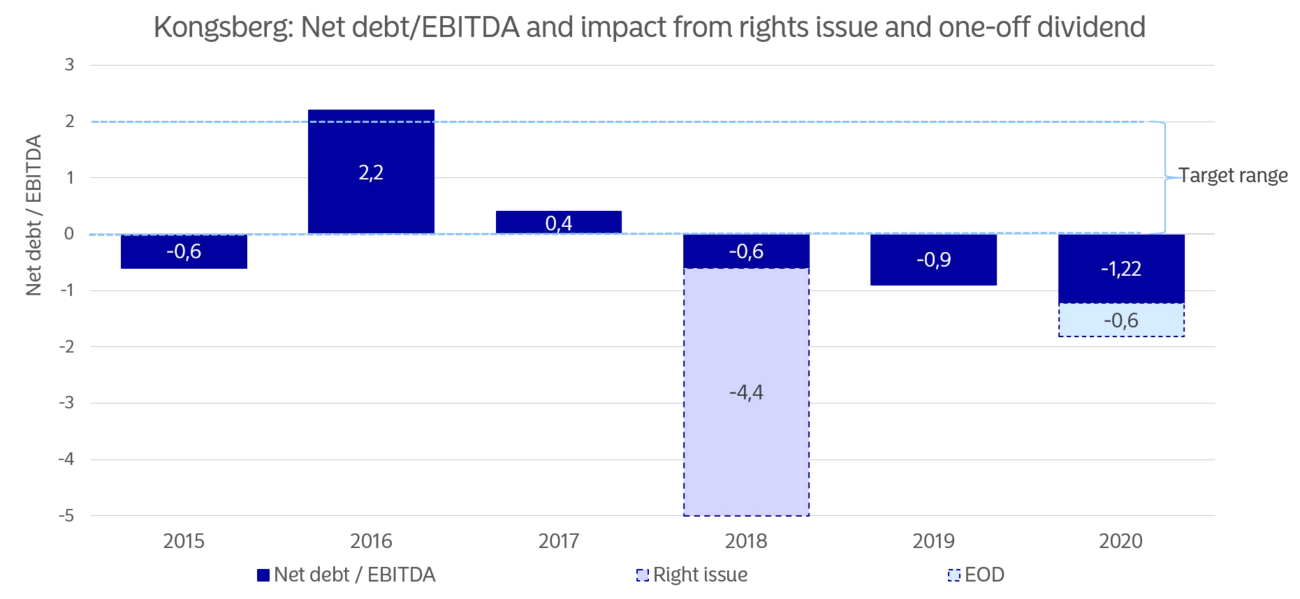

We believe we have an optimal capital structure and WACC at present, but we see the potential of a higher share of debt, as we continue to evolve and benefit from our acquisitions.

JT: Does the Norwegian State being your biggest shareholder with 50% of the company influence your view on what is an appropriate capital structure?

GSI: The State’s ownership stake does not affect our choice of capital structure for the company. But as a shareholder, it expects us to take a stance on a capital structure, communicate it, and argue for it. It is as demanding as any institutional shareholder.

The speed of decision-making can be an issue, as the State answers to the Norwegian parliament. When we proposed our rights issue in conjunction with the acquisition of Rolls Royce Commercial Marine, the State was expected to contribute NOK 2.5bn in new equity. This decision was subject to parliamentary approval, which was not given until October 2020, after the parliamentary summer break. It was also very apparent that the perceived uncertainty regarding the State’s participation in the rights issue was a wet blanket over the share price for several months.

As a shareholder, the State also pays extra attention and needs additional information on specific areas such as sustainability. One specific example is management remuneration, for which the State wants more detailed information than is mandatory under Norwegian corporate law and stock exchange regulations.

The State’s ownership stake does benefit the view of our credit risk profile among banks and Norwegian bond investors. This perception has probably strengthened among other investors as well, after the State committed to its full NOK 2.5bn share of our NOK 5bn rights issue in 2020.

JT: Is capital structure a theme in your ongoing dialogue with investors and shareholders? Are there big differences in views between equity and bond investors? Or between different equity investors?

GSI: In short, yes! Capital structure is a theme brought up in virtually all of our investor meetings, typically towards the end of the conversation. This applies to all types of investors – equity, bond, domestic, and international. It is also a topic discussed at most of our board meetings.

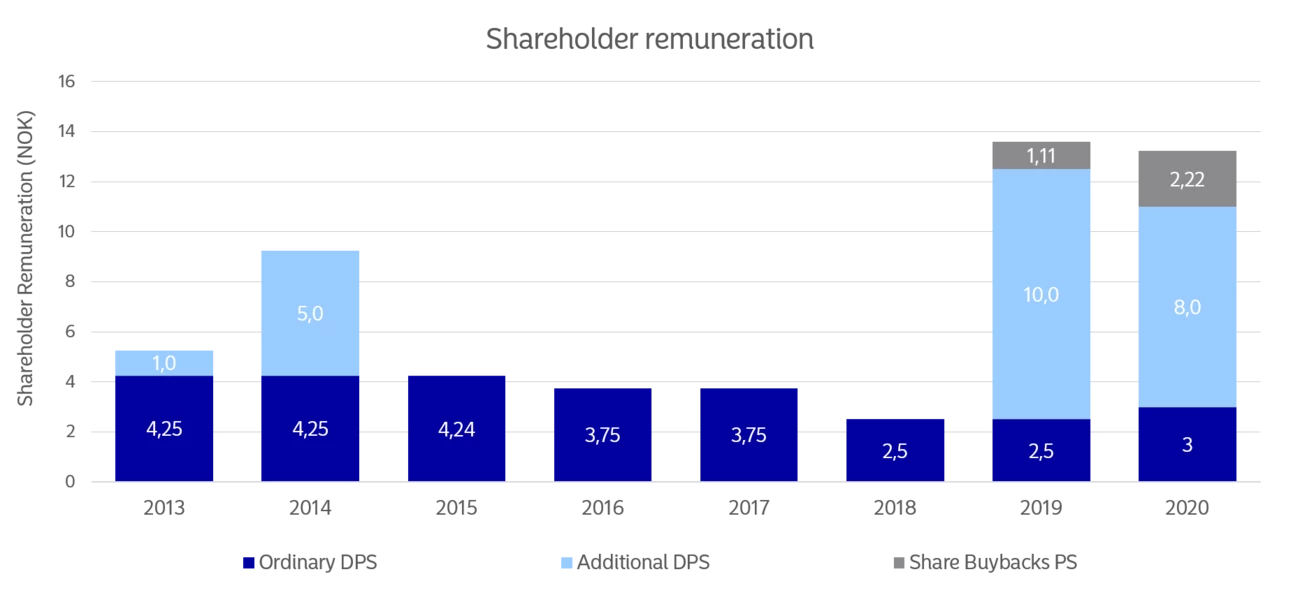

Bond investors focus on changes to risks. Among equity investors, international investors are typically keen on replacing dividends with share buybacks, particularly to avoid withholding tax.

Investors all seem to agree that they prefer we put money in the company to use, rather than sit on idle, low-yielding cash. We will accordingly pay out some NOK 4bn to shareholders in the coming 12 months, which should be seen in relation to our annual profits of NOK 500-700m in 2018-19. We want to send a strong signal that we listen to and agree with our shareholders, will pay out funds that we do not need, and use buybacks as a complementary tool in a way that is attractive for investors.