What is our advice?

If a start-up is in the early stage of business operations and does not have a cash flow-producing business and no proven underlying profitability, we do not recommend loan financing. The risk of loan financing in this stage is much higher than equity, as it will mean burning cash in an already costly phase of the life cycle. Loan financing requires that a company is classified as a growth company with a marketable product/service, an existing market and proven underlying profitability.

The company’s business idea and how it makes money need to be clear and comprehensible. Also, we need to have a clear understanding that the team behind the company is competent, that is, has professional ability in core business functions. When you enter the professional funding market (venture capital firms, banks), the success rate will rise if you can point to CFO competencies and a well-argued business plan with professional and transparent financial models.

As a main rule the company needs to be profitable on EBITDA level and produce enough cash flow available to service debt (CASD). However, in most cases companies burn cash for a period and we can accept negative EBITDA if the following three requirements are met:

- Strong existing liquidity so that there is a sufficient buffer to cover the negative cash flow up to the expected breakeven. Commitments from owners/investors to support liquidity will be taken into account when assessing whether liquidity is sufficient.

- Forecasts need to be solid, realistic, partly proven/underpinned by actual sales or order book, and the underlying assumptions must be strong and well documented.

- The company should be profitable on EBITDA level within two years.

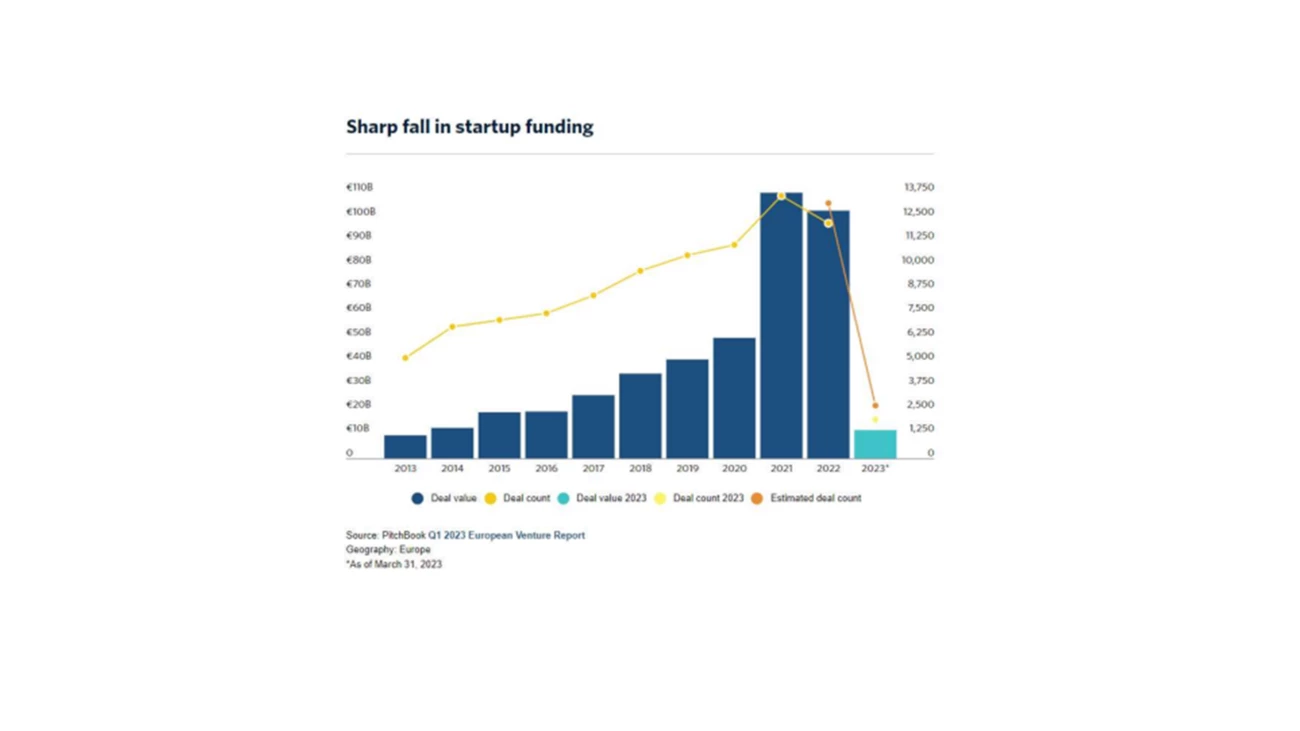

This means that you have to demonstrate the ability to attract more capital in a stress scenario where you run out of cash earlier than planned. If the existing owners do not have the willingness or capacity supplement with additional capital, the risk is very high in today’s market.

You need to show repayment capacity as regards the loan and have a well-documented growth plan. Some will say that this looks like an investor deck or a financial due diligence process. And shouldn’t applying for a loan be a much smoother process? Most companies are surprised at how the bank deep dives into their numbers, so keep in mind that most processes take longer than you expect. And remember that banks have full confidentiality, so be as transparent as you can when it comes to risk elements.