- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst

After a period at full steam, the Danish economy is preparing for a soft landing. Household spending has been limited by high inflation and the construction industry especially is being affected by high interest rates. However, particularly strong growth in the pharmaceutical industry has helped to maintain a high industrial production level. Towards year-end, activity is expected to accelerate as real wage growth turns positive again. That will also pave the way for a renewed pickup in the general Danish economy into 2024.

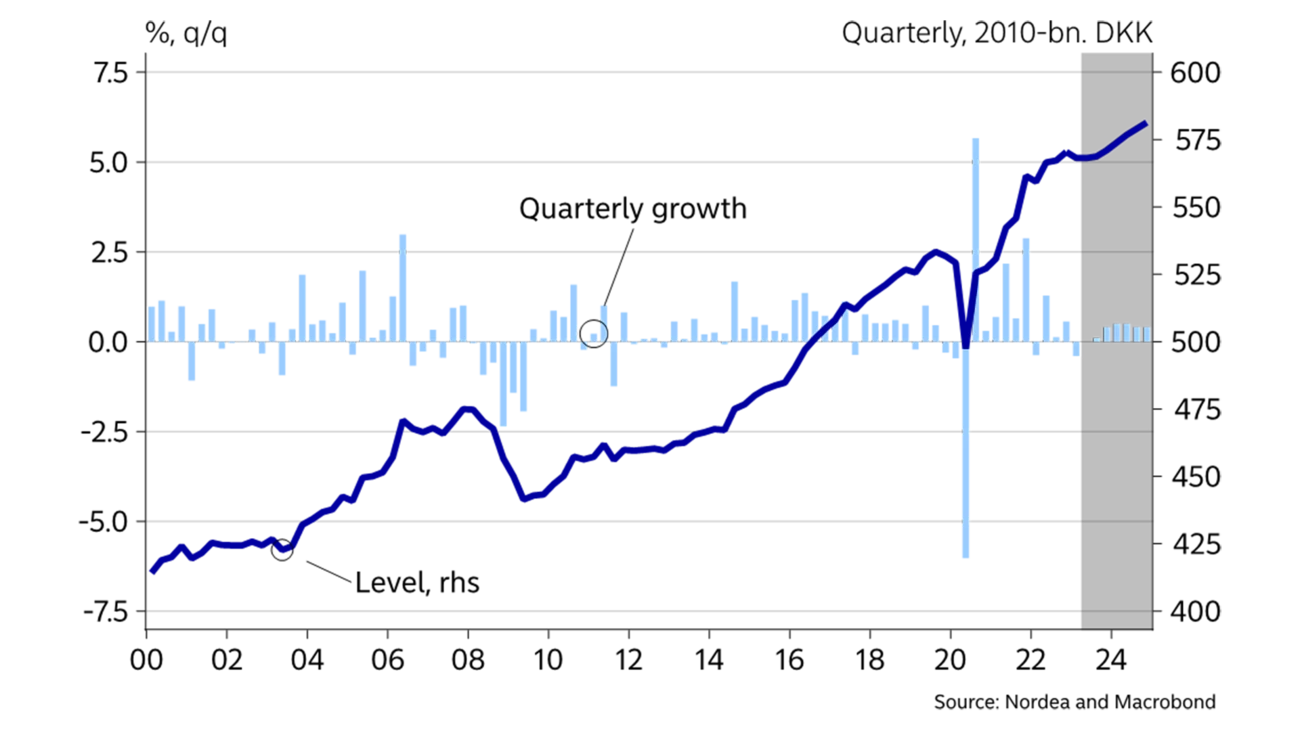

According to the preliminary statement, the Danish economy grew by 3.8% in GDP terms in 2022. This is significantly more than previously expected. The high growth rate is even more impressive as it was preceded by even higher growth in 2021. Overall, this means that by end-2022 GDP was 7% higher than three years ago. Over the past year, growth has been driven especially by strong growth in net exports and investment activity. On the other hand, household spending has fallen in the wake of rising interest rates, lower housing prices and erosion of purchasing power.

Thanks to recent years’ strong growth, the activity level was very high in early 2023. The surprisingly strong basis is the key reason why we have revised up our GDP growth expectations to +0.5% in 2023 in our new forecast. However, compared to the forecast from January, the underlying growth profile is basically unchanged. This means that a weak development at the beginning of the year is expected to be followed by a combination of positive real wage growth and stabilisation of interest rates, which will result in a renewed surge in household spending. It will also pave the way for an expected uptick in activity of 1.5% in 2024.

The forecast risk is expected to be fairly balanced. The biggest threat to activity is linked to inflation. If inflation does not decline as expected, central banks will be forced to hike rates more aggressively than in our baseline scenario. Moreover, an extended period of high inflation will delay the recovery of households’ purchasing power.

In 2022, household spending fell by more than 2%, especially goods consumption, which nosedived from a very high level during the coronavirus pandemic. The development also affected retail sales, which have fallen around 10% from the peak when adjusted for price trends. Consumption of services is still at a high level, though.

We expect household spending to be adversely affected by the high inflation for some time yet. In addition, households’ interest expenses have risen sharply, also curtailing household spending.

During 2023, nominal wages are expected to increase more rapidly than consumer prices. This will likely be the starting signal for a renewed increase in household spending, which will accelerate into 2024.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP, % y/y |

-2.0 |

4.9 |

3.8 |

0.5 |

1.5 |

|

Consumer prices, % y/y |

0.4 |

1.9 |

7.7 |

4.7 |

2.4 |

|

Unemployment rate, % |

4.6 |

3.6 |

2.5 |

2.9 |

3.0 |

|

Current account balance, % of GDP |

8.2 |

8.1 |

13.1 |

10.6 |

9.9 |

|

General gov. budget balance, % of GDP |

0.2 |

3.6 |

3.3 |

1.2 |

0.7 |

|

General gov. gross debt, % of GDP |

42.2 |

36.7 |

30.1 |

29.2 |

28.6 |

|

Monetary policy rate (end of period) |

-0.60 |

-0.60 |

1.75 |

3.35 |

2.60 |

|

USD/DKK (end of period) |

6.08 |

6.54 |

6.97 |

6.48 |

6.48 |

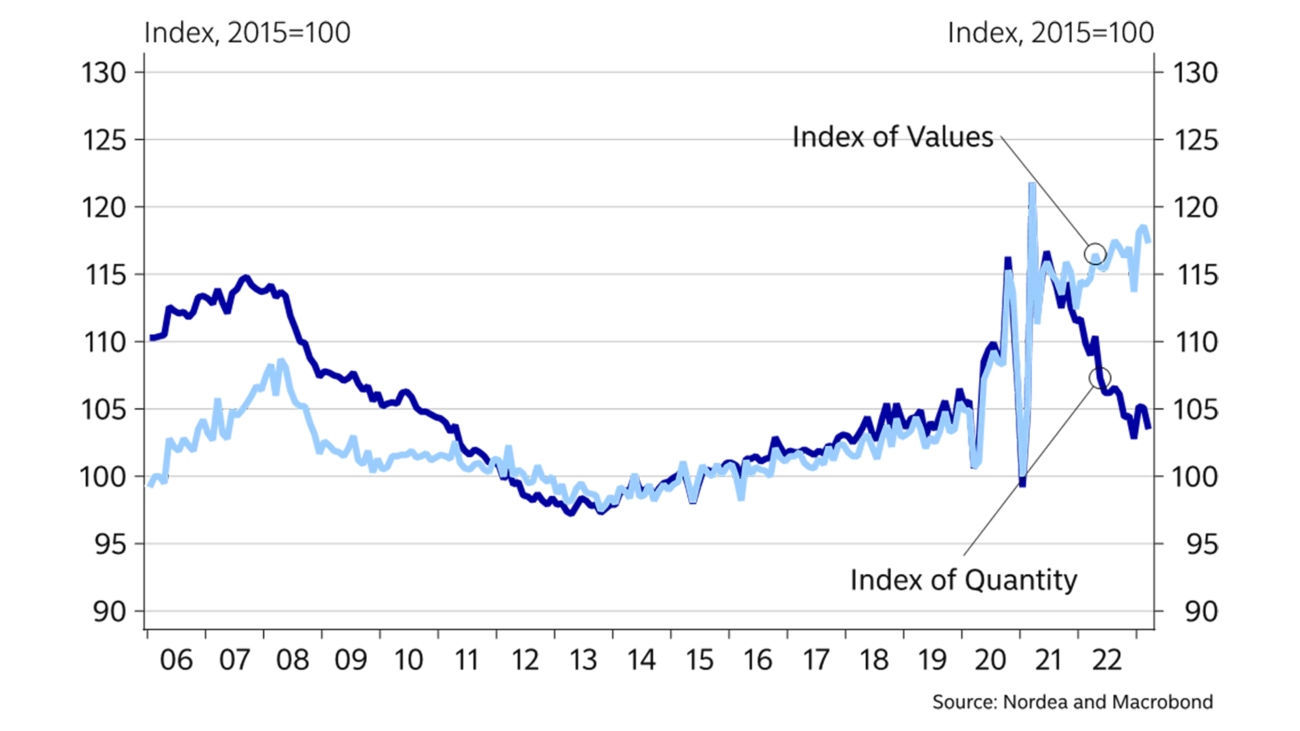

Over the past two years, Danish exports have increased by nearly 20%. The strong growth can be ascribed especially to goods exports; notably, the pharmaceutical industry has experienced strong tailwind. This also means that Danish exports have grown much faster than global trade in recent years.

However, the development in the pharmaceutical industry also means that an increasingly high share of goods exports take place outside Denmark. As a result, employment is affected less than previously. Still, growth in exports helps to maintain a very high current account surplus. In 2022 alone, the surplus was more than DKK 350bn, corresponding to 13% of GDP. The surplus is expected to be somewhat lower in the forecast period, though.

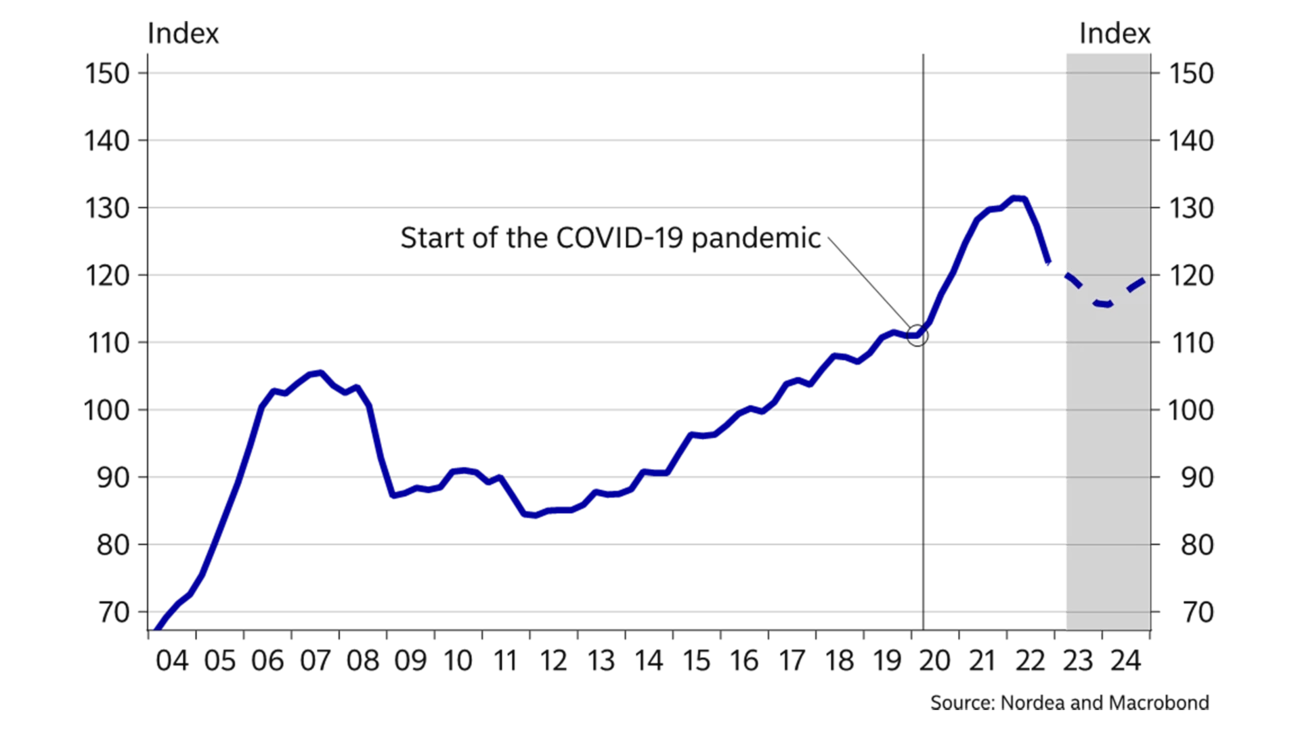

During the coronavirus pandemic, Danish housing prices rose steeply. During that period, low financing costs, robust growth in disposable incomes and greater appreciation of homes were the main drivers of the much stronger housing market demand. In tandem with rising interest rates and high consumer prices, this trend has reversed, though – over the past year, prices of houses as well as flats have fallen by more than 6%, according to the price index from Statistics Denmark.

We expect the downward pressure on sales prices to continue throughout 2023 as higher interest rates increase financing costs for potential home buyers. At the same time, a normalisation of the number of homes for sale will also put pressure on sales prices. Overall, the average sales price of single-family homes is expected to fall by 7.5% this year. However, in early 2024, sales prices are expected to bottom out and subsequently increase moderately towards the end of the forecast period. The expected reversal is due to prospects of slightly lower interest rates during 2024 and renewed growth in disposable income resulting from higher wages, among other things.

The Danish economy got through 2022 in surprisingly strong shape, which also lifts expectations for 2023.

Prices of owner-occupied flats are also falling. But prices are not expected to bottom until H2 2024, when the implementation of the tax reform will impact this part of the housing market in particular. There are also many first-time buyers in the market for owner-occupied flats, who often need large loans and may be more sensitive to rising interest rates.

The higher interest rates have more than doubled households’ interest expenses over the past year. Compared to previously, the interest payment level is still very moderate, as households took advantage of the period with historically low interest rates to reduce debts. Moreover, many homeowners have been able to reduce their debts by performing buybacks of the fixed-rate mortgage bonds. Lower debts mean that households are currently much less sensitive to interest rate changes than in the period ahead of the financial crisis. This has also helped to maintain a low level of forced sales.

Despite a sharp fall in both consumer and business confidence since mid-2022, the labour market has continued to surprise positively. In the first two months of 2023, about 10,000 more wage-earners joined the labour market. Excluding July 2022, employment has risen consistently for more than two consecutive years. Compared to the beginning of 2020, this equals an increase of 6.5% in the total number of wage-earners. The increase has been broadly based across both the public and private sectors.

In spite of this, the number of registered jobless has increased moderately over the past year. This is because the inflow to the workforce has been higher than the increase in employment. From a historical perspective, an unemployment rate below 3% is still very low. We expect unemployment to rise slightly in 2023, as the number of vacancies is declining and companies’ own hiring plans are also negative.

In 2022 average inflation reached 7.7%, which is the highest level since 1982. The peak so far was reached in October last year with an annual inflation rate of 10.1%. Annual inflation rate has subsequently gone down, not least driven by a lower contribution from energy components. Coupled with lower commodity prices and transport costs, this has prompted a sharp decline in goods inflation, which has been halved over the past six months. We expect the downward pressure on goods inflation to continue throughout the forecast period. This applies to for example food, which has a weight of more than 10% in the overall CPI index. Since mid-2022, global commodity prices for agricultural goods have declined. Furthermore, several supermarket chains have announced that prices of several goods will be lowered over the coming period.

On the other hand, services inflation has continued the upward trend which started in mid-2021. This sector is more affected by wage growth, as labour traditionally accounts for a large part of service companies’ costs. With a view to general wage increases of around 10% over the coming two years, much suggests that services inflation will remain high as many companies will probably try to pass on increasing wage costs to the consumers.

Overall, we expect average inflation this year to fall to 4.8% against 7.7% in 2022. In 2024 it is expected to decrease to 2.2%.

According to the preliminary statement, the public budget surplus was DKK 93bn in 2022 or more than 3% of GDP. This was the sixth year running with a public budget surplus – in stark contrast to many other countries where public finances are under massive pressure due to the high costs of fighting the pandemic and facilitating the green transition. Government gross debt has thus fallen below 30% of GDP thanks to the current surplus. This is a historically low level except for a short period up to the financial crisis in 2007-2008.

Public finances are expected to continue to record a surplus this year and the next. However, it will most likely be smaller compared to previous years as, for example, pension return tax receipts will likely be significantly reduced. Moreover, in 2023 and 2024, public budgets will be affected by the payment of more than DKK 13bn to homeowners, who paid too much in housing taxes from 2011 to 2020.

Since mid-2022, monetary policy has been tightened rapidly. The ECB’s repeated interest rate hikes have only been partly mirrored by the Danish central bank. One of the reasons is the historically large current account surplus, which has increased Danish companies’ demand for Danish kroner. To counter the pressure on the DKK, the Danish central bank has several times had to widen the interest rate differential, so the policy rate is now 0.4% points lower than in the Euro area.

In our baseline scenario, we expect the Danish central bank to hike rates at the same pace as the ECB. If so, interest rates will peak at 3.35% by mid-year, corresponding to the highest level since the beginning of 2009. The first rate cuts are expected to be sanctioned at the beginning of H2 2024.

Also longer Danish bond yields are expected to increase further from the current level, peaking over the coming six months and then subsequently falling moderately.

This article originally appeared in the Nordea Economic Outlook: The Inflation Standoff, released on 9 May 2023. Get the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more