In conversation with Nordea On Your Mind author Johan Trocmé (JT), SKF CFO Niclas Rosenlew (NR) highlights how targets tie into management's view of the long-term outlook and into the overall strategy. He also stresses the importance of targets having an ambition level that requires a strong effort to reach them.

Targets should not be used dogmatically, he says, but changed when circumstances require it, and potentially with some flexibility, should for example opportunities for major acquisitions arise.

JT: How do you decide what financial targets to use? What are the roles of group management and the board of directors, respectively? And do you have a process for reviewing targets and target levels, for example, at different time intervals?

NR: We are a big user of targets internally, which include financial targets, as well as sustainability targets and human resources targets, such as staff retention and diversity. We also have customer satisfaction targets. All of these have various different time horizons, and tie into our public, external financial targets. Our public financial targets originate in how we in group management, with input and approval from the board of directors, see the future for our business over a ten-year period. We look at prospects for different industries we serve and their growth outlook, and we aggregate this information and use it as a basis for identifying and estimating our business opportunities, which should be reflected in our targets. This is all fairly abstract, with limited visibility for such a long time horizon, but it is important for making our targets well founded and coherent. We last did this exercise just under two years ago, and it laid the foundations for our group strategy.

We have internal medium-term targets with a three-to-four-year time horizon, which we review annually, including to ensure that they are consistent with our ten-year view. They are quite granular, reaching down to the business area level and even business unit level. Every year, we apply these, using the same target matrix, to what we call annual plans, which we use for the calendar year. In December last year, we decided – together with our board – the annual plan for 2023. We then follow up continuously and evaluate our progress with respect to our one-year, three-year and ten-year time horizons. The metrics we monitor, such as revenue growth, operating margin and return on capital employed, are exactly the same for the short-term and medium-term targets. Our targets originate with management, based on the view we have articulated, with the board of directors having an important role in approving the annual plans and being briefed and weighing in on the medium-term plans. When we set them, we want them to be relevant and appropriate for a long time period.

That is our internal world of 13 different targets. Our five external financial targets have been set to be achieved over a cycle, which can be interpreted as three to five years, and are consistent with our internal medium-term plans. Our external and internal target metrics and levels are, of course, the same, but five are external and eight are internal only. It is fair to say that we change our external targets less frequently than our internal goals. In order for us to change our external targets, there must be a clear and relevant reason for it. An investor saying in a meeting, for example, that they happen to like the EBITDA margin better than the operating margin as a measure of profitability would not prompt us to go and immediately change our existing target. Making such changes is a fairly major process, and should be done when a change in circumstance is significant enough that a review is clearly warranted. Constant tweaking would be wasteful and potentially confusing.

JT: What is your thinking around the level of ambition for SKF's financial targets? Are they more "aspirational" or are you "confident in delivering"? Have current ambition levels been affected by some historical difficulties in reaching targets?

NR: You could say that we have a basket of ambition levels for our targets. We aim to double SKF's revenues over a ten-year period. We have faced some criticism for this goal. Doubling our top line by 2030 looks like – and is – a big number. It is a directional marker showing what we are – ambitiously – aiming for. It is not a financial target in the traditional sense. It is a vision.

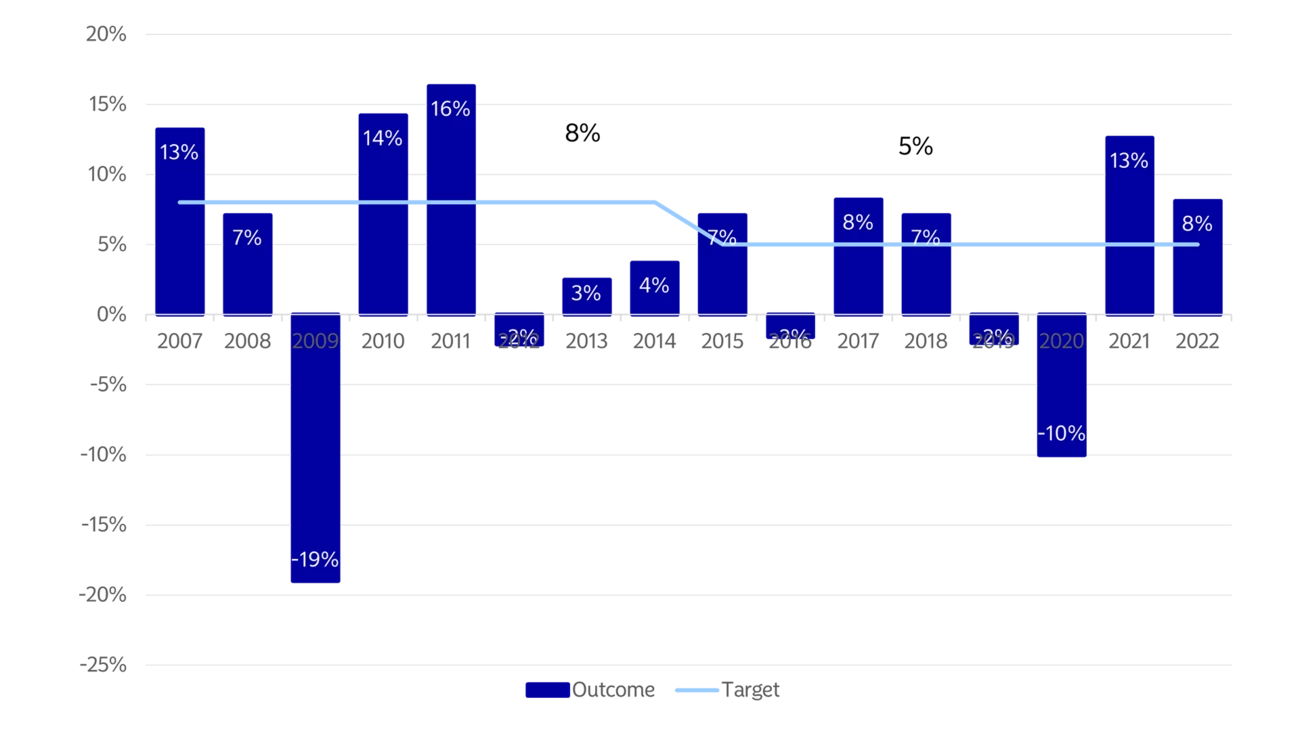

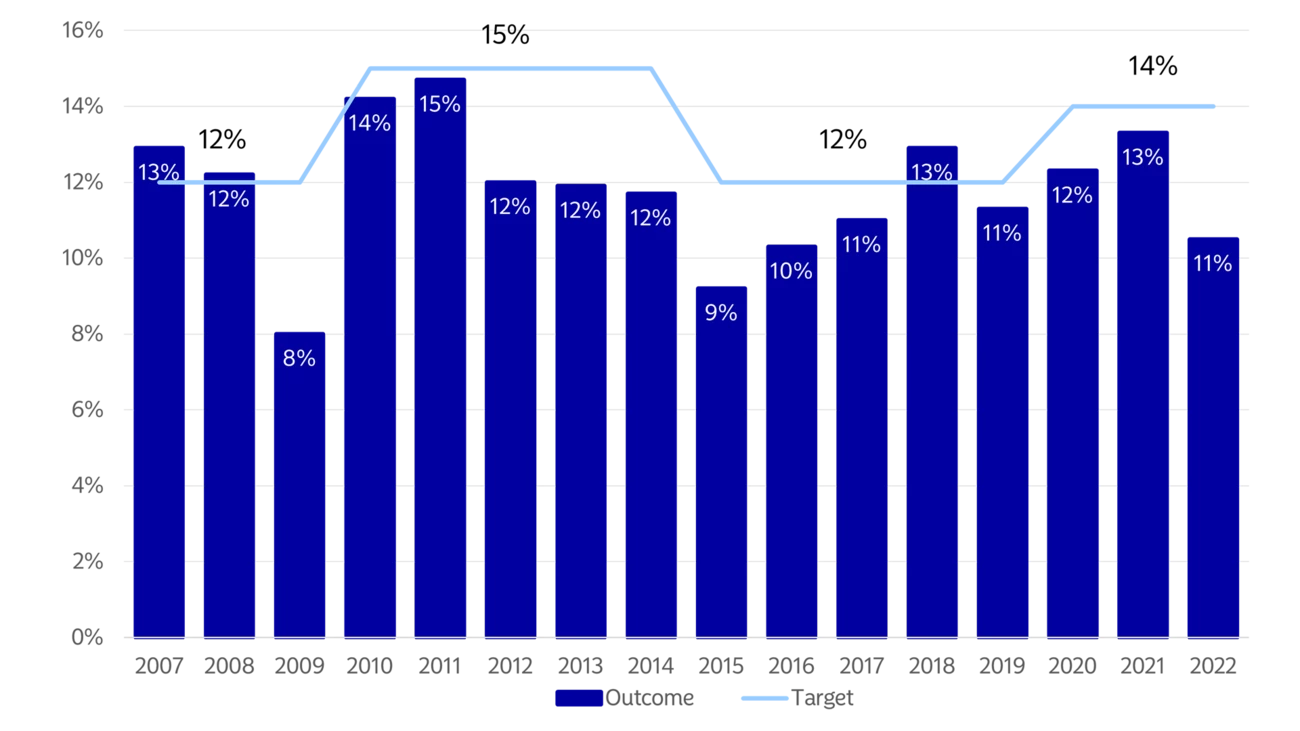

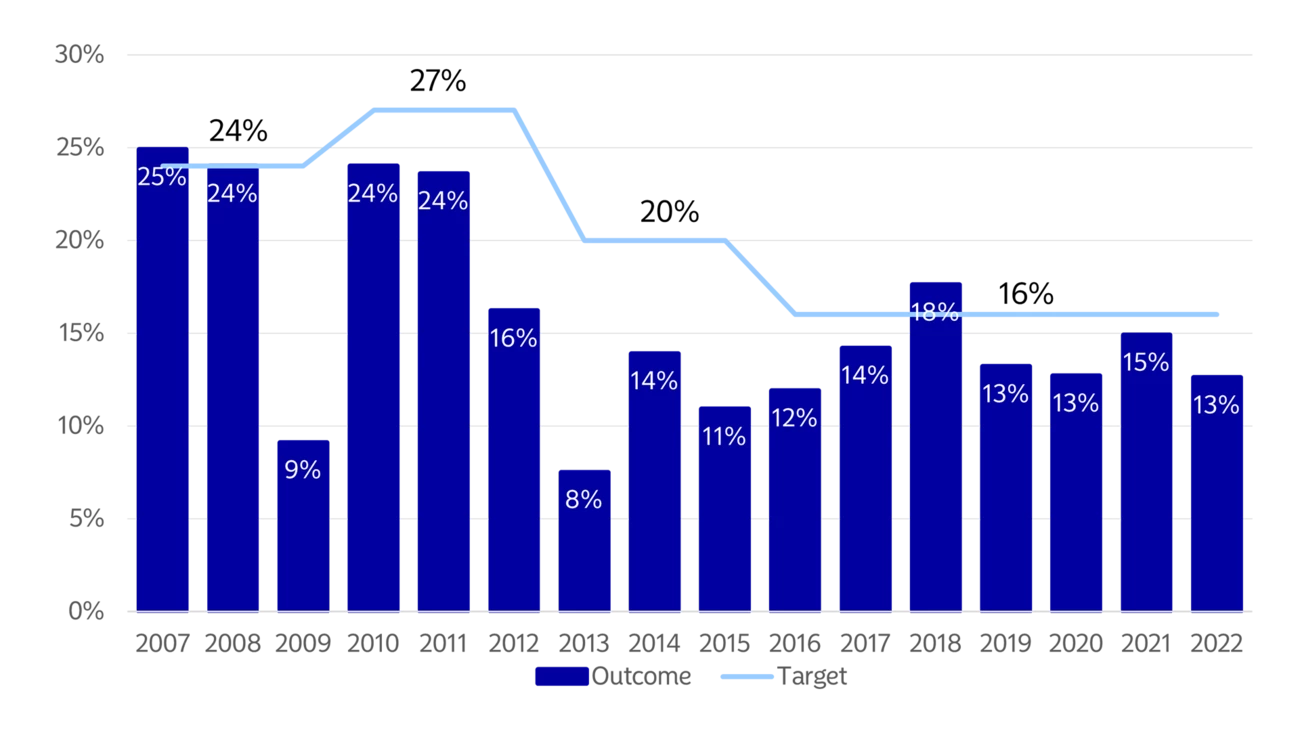

Our specific public financial targets are meant to be balanced, just as consultants talk about balanced scorecards. Owing to climate issues, the economic environment and business conditions, some of the targets are more ambitious than others. And how challenging each target is to reach can vary from year to year. We think this is natural, and it aligns well with our choice to define our financial targets as to be reached over time, over a cycle.

We have chosen a level for our targets which requires us to a good job in order to reach them. The targets do not represent any form of utopia. With hard work, they should be achievable. This is arguably the essence of having targets. They are a way of telling ourselves and the outside world what "good" looks like. We are sometimes asked about our 14% operating margin target – could we not do better than that? A quick answer could be "yes". Is 14% the highest operating margin SKF could ever achieve? We don't believe so. But our perspective is that if we start at a level of 12-13%, let us target 14%, and if we succeed in reaching our target, we can review it and get back with an updated view of what should be achievable in the long term. And this could be said of any of our financial targets. There is no point in having targets which you can easily beat. We are here to push and ensure that the business performs at its full potential. Equally, having targets that are so ambitious that they are almost unattainable as soon as they are introduced would be demotivating and counterproductive. Looking at our margin, growth and ROCE targets, we have been able to reach our target levels in some historical years. We know that the business can achieve those levels, but we have not yet delivered it consistently over a three-to-five-year cycle. And this is where we think we should be in order for our performance to be "good". I should add that our payout ratio and leverage targets do not require any significant stretch, but should be seen more as policy parameters. They reflect what we see as suitable and healthy levels for dividend payouts and indebtedness over time. One year, we might pay out 40% of our profit in dividends, and another year, we may pay 60%. But our board of directors considers that 50% is the sort of level you should expect over time. In recent years, we have had lower net debt to equity than our target. We have "tolerated" this, as the target is mainly intended to show roughly the level we feel sustainably comfortable with. It could, for example, give investors an idea of how much we would be prepared to stretch our balance sheet in order to make and absorb an acquisition.