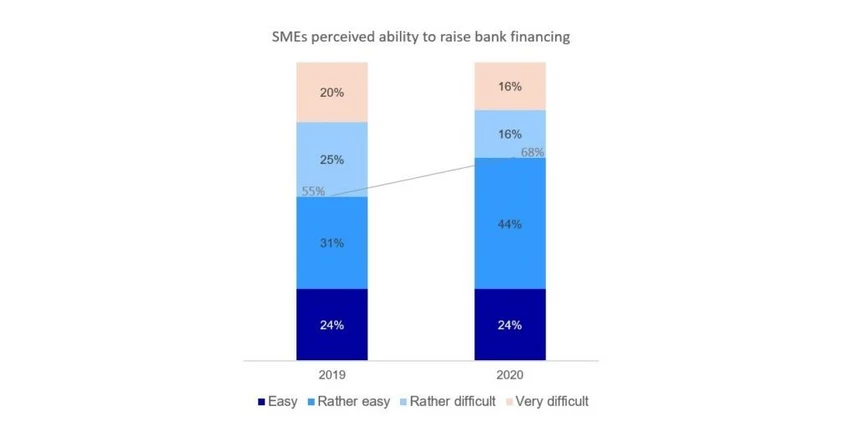

All is not lost! The organisations above propose a couple of solutions in order to make it easier to raise financing for SMEs. Two suggestions that we found the most interesting are “Alternative fintech solutions” and “Shortened payment terms” from customers.

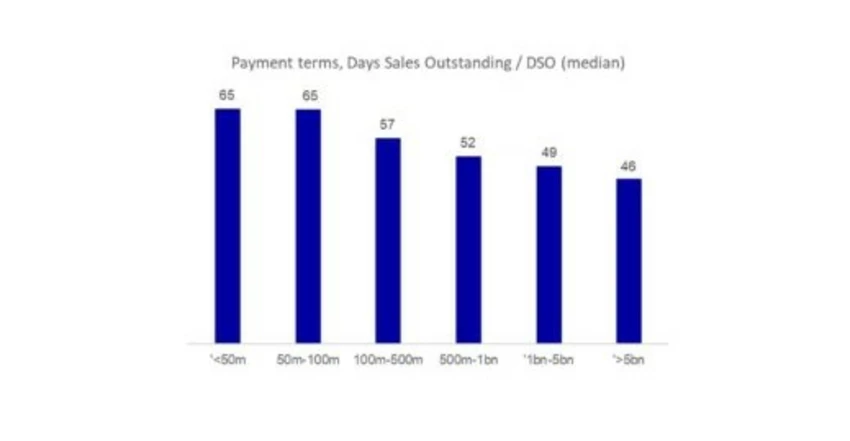

Legislating about shortened payment terms might be a great solution at first sight and especially when looking at the graph to the right which shows that payment terms from customers to smaller companies are longer than for larger companies. But in practice it is more complicated as companies operate in a competitive environment and payment terms is a term and condition up for business negotiation, same as for price and other conditions. It should also be taken into consideration that many companies operate on an international market and that payment terms differ significantly in various parts of the world.

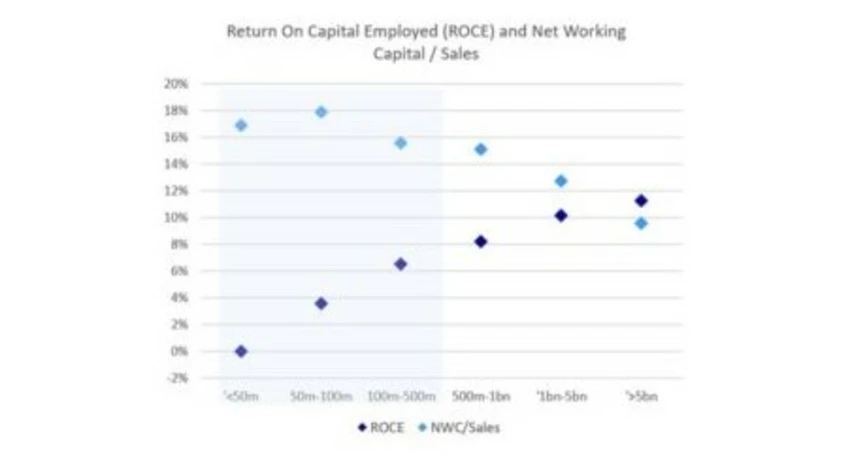

The reason for selecting the suggestions of “Alternative fintech solutions” and “Shortened payment terms” is of the possibility of today to combine the two for a viable and practical solution for companies to run operations in a more capital efficient manner and in order to improve operating cash flow in “Sources and Uses”. By doing this a company can improve its self-financing. This would in turn make the company less dependent on external financing for its daily operations and enable cash release, which can be used for e.g., growth, capex and investments.

A third alternative for SMEs, with an exporting feature in its business, to raise necessary capital is with a credit guarantee, where a bank shares the risk with a domestic state owned Export Credit Agency (ECA) (EKF in Denmark, Finnvera in Finland, GIEK in Norway and EKN in Sweden). The Nordic ECAs can cover a percentage of the risk and thereby making it more attractive for a bank to lend out money to a company. The support and risk coverage the Nordic ECAs can offer differs between the four Nordic ECAs, but all include risk coverage which enables banks to provide companies with the possibility for invoice discounting and / or to set-up an overdraft facility.

Sources

1. ¹Företagarna, Företagarnas finansieringsrapport 2021, Mars 2021, page 6.

2. ²Företagarna: Företagarnas finansieringsrapport 2021, Mars 2021, page 10

3. ³https://www.dst.dk/da/Statistik/emner/erhvervslivet-paa-tvaers/konjunkturbarometre/bygge-og-anlaegsvirksomhed-konjunkturbarometer

4. ⁴Svenskt Näringsliv, Bankregleringen och företagens kreditmöjligheter, November 2019, page 26