Community engagement

Community engagement is about creating positive change through our employees. Through well over 20 programmes and partnerships, we focus on building financial skills and fostering entrepreneurship. In that way, making our banking and financial expertise have a positive impact on the societies.

Read more

Nordea in society

For us, social responsibility means caring – about individuals, businesses and society. We believe that financial skills is a cornerstone of a good life and supporting people in their financial skills and encouraging them to start businesses, are two ways of promoting wellbeing in society.

Read more

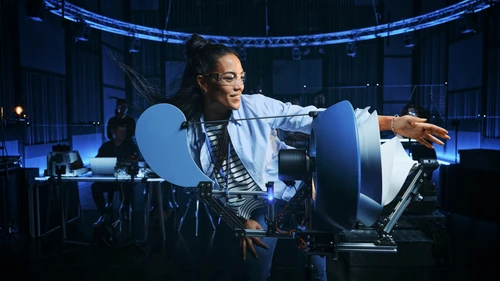

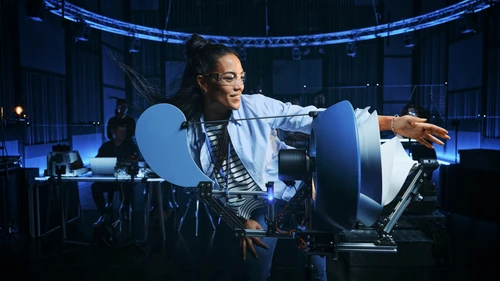

Security for your money

Developing our systems, that is, our payment systems, apps and online bank that our customers use every day is our top priority. We develop the systems to constantly meet our customers’ needs and changed behavior. Also, we protect against cyber attacks, detect fraud and generally safeguard our customers from financial crime.

Read more