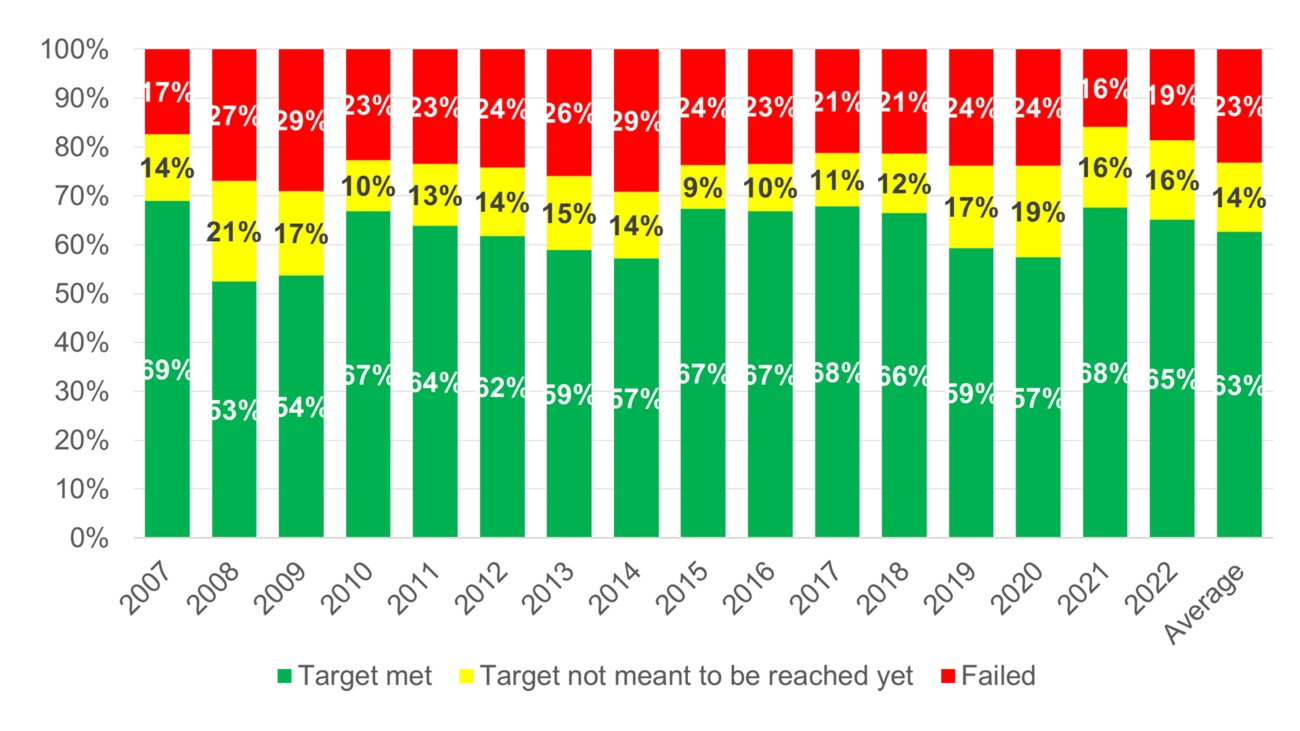

Target achievement is lacklustre

The overall success rate for all targets of all companies in 2007-22 is 77% (or 63% if you exclude those defined as 'over-a-cycle' for the years they are not reached). This is not bad, but it is artificially boosted by strategic targets (leverage and payout) being designed to virtually always be reachable. The strategic target achievement of 80% is contrasted by only 47% for operational targets. And, worryingly, achievement is a mere 37% for margin targets, and it has deteriorated since 2017. The problem seems to be the ambition level for the margin targets, rather than the economic environment.

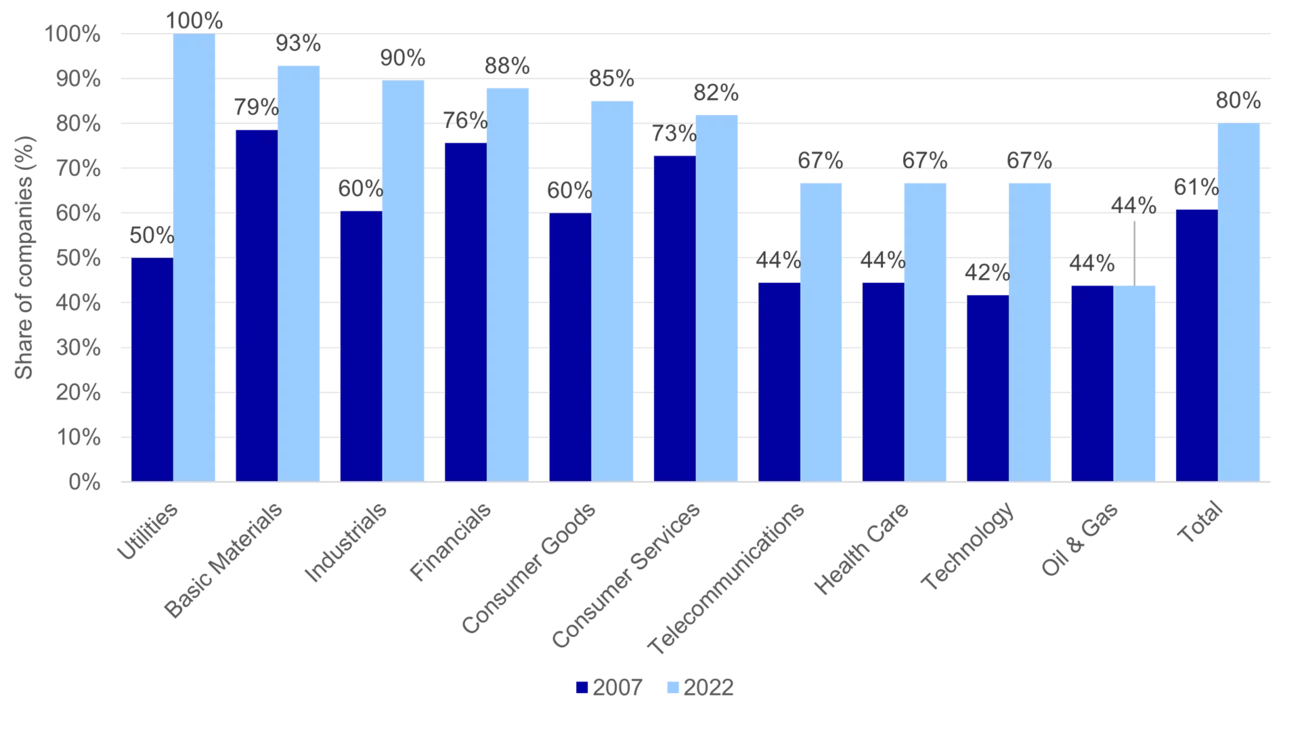

A first look at the use of sustainability targets

We believe sustainability targets will in the long term converge with financial targets, as businesses will need to be sustainable to remain viable. To get an idea of how the corporate focus is evolving, we take an initial look at the 'E' in ESG and find that the share of our studied companies reporting greenhouse gas emissions has risen to 94%, from 75% in 2019. The share that has emission targets is up from 38% to 88%, which is even higher than the 85% that have financial targets. 72% pledge zero emissions, and the rest carbon neutrality (they can buy offsets). 55% have targets for scope 1+2 emissions (from own footprint), 32% for scope 3 (across value chain), and 13% for emission intensity reduction targets.

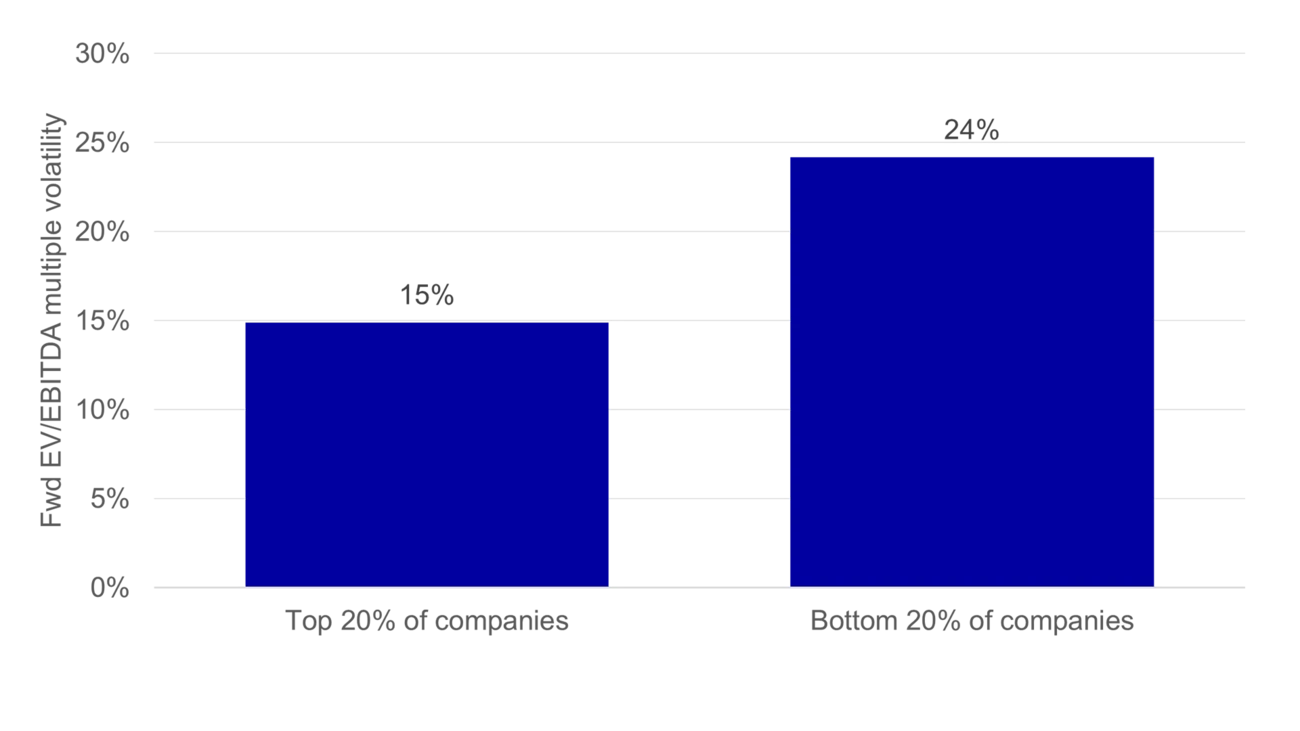

Making good use of financial targets

Our comprehensive quantitative analysis of our sample of companies shows that having more (rather than just one or two) targets and having operational (rather than only strategic) targets, reduces the volatility of forward EV/EBITDA and EV/sales valuation multiple by 20-40%. Interestingly, being among the best at reaching targets also helps, but only slightly. Lower valuation multiple volatility reduces a company's WACC. With some simple assumptions, we estimate that this can increase a company's equity value by some 10%. And this is in addition to substantially reducing the gap between consensus forecasts and actual outcomes for growth and margin.

Views from the top

From the perspective of investors and shareholders on companies' use of financial targets, we interviewed Kjetil Houg, CEO of Norway's Folketrygdfondet, the biggest institutional investor in Norwegian equities.

"When a company does not have any financial targets, we see this as an implicit message of having a low level of ambition. And, this makes it more likely that we choose to put our money into another investment instead. Being willing and able to put into words and numbers what you are aiming to achieve with the business is a very important and positive signal to the outside world," Kjetil Houg says in the interview.

For a corporate perspective and experiences, we turned to leading global bearing-maker SKF's CFO Niclas Rosenlew.

"You could say that we have a basket of ambition levels for our targets. We aim to double SKF's revenues over a ten-year period. We have faced some criticism for this goal. Doubling our top line by 2030 looks like – and is – a big number. It is a directional marker showing what we are – ambitiously – aiming for. It is not a financial target in the traditional sense. It is a vision," says Niclas Rosenlew.