About the Nordea Overdues Report 2021

If you are interested in learning more about how to improve your credit and liquidity management and which solutions Nordea has to offer relating to this, please reach out to Henrik Anbelin at henrik.anbelin [at] nordea.com (henrik[dot]anbelin[at]nordea[dot]com) or Vanessa Komorowski at vanessa.komorowski [at] nordea.com (vanessa[dot]komorowski[at]nordea[dot]com).

Scope: Level of overdues for Nordic companies listed on the Nordic Lage cap lists.

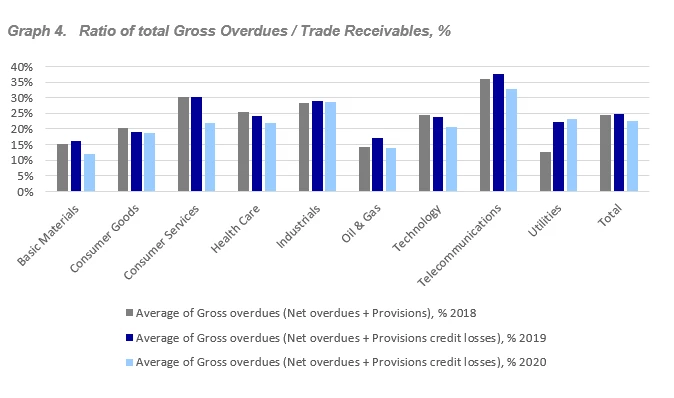

Overdues/ Late payments from customers:

Range: from 1 day and beyond.

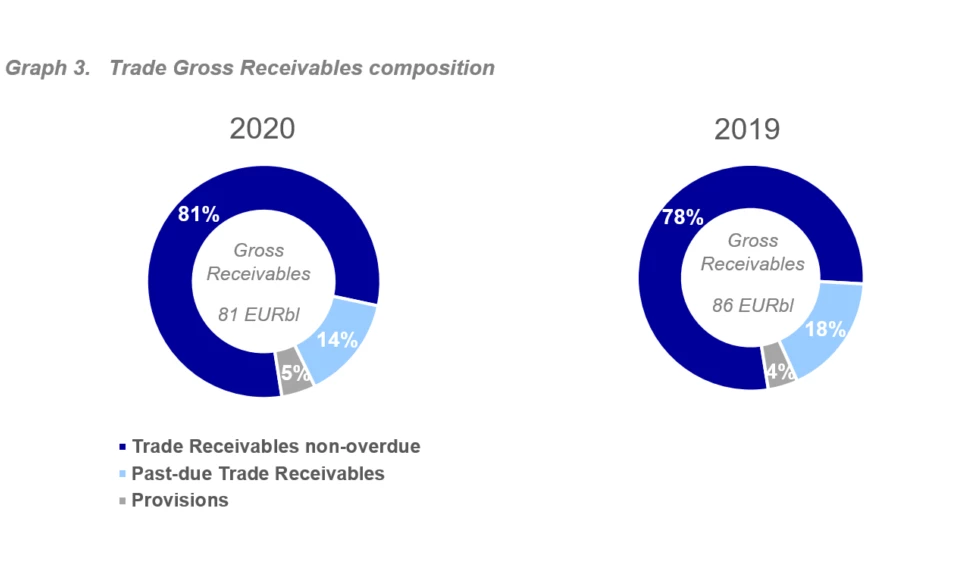

Total Gross Overdues:

On Balance sheet included Overdues in Account receivables+ Provisions for Credit losses

Provisions for Credit losses:

For overdues deemed not to be collected a company shall make Provisions for Credit losses which means that they are not shown as Account receivables in the Balance Sheet but as Provisions for Credit losses. Provisions for credit losses are not the same as realized credit losses and provisions can be redeemed while actual credit losses will not.

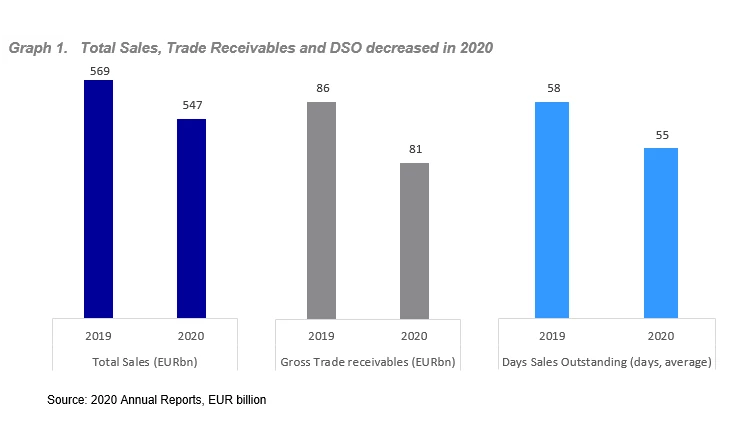

Total Gross Account receivables:

On Balance sheet stated Account receivables+ Provisions for Credit losses

Total Gross Overdues in percentage of total Gross Account receivables:

When calculating Overdues as share of Account receivables, we use the Gross amount in both numerator and denominator.