- Name:

- Gustav Helgesson

- Title:

- Nordea Analyst

The volume of money in the Swedish economy has increased much faster than in previous years. At the same time, inflation is higher than it has been for decades. The relationship between money supply and inflation has been questioned for a long time, but now it is seen in a new light.

Monetary policy in Sweden has been expansionary for a long time. From 2015 to the spring of 2022 the Riks-bank’s policy rate never exceeded 0%. However, the historically low policy rate was not enough to increase inflation to the 2% target. The Riksbank thus started to buy bonds in 2015 to loosen monetary policy even further, via so-called quantitative easing. In early 2020 bond holdings had increased to around SEK 350 billion. During the pandemic the Riksbank extended its bond purchase programme, and asset holdings nearly tripled over two years to SEK 900 billion or 16% of GDP.

The combination of a low policy rate and large bond purchases stimulated lending. Since 2015 household debt has increased by 30%, with an average growth rate of nearly SEK 20 billion per month.

The expansionary monetary policy has contributed to a swift increase in the money supply. Half of the money in the Swedish economy today has been generated since 2015. The measures taken during the pandemic further accelerated money supply growth, and 25% of the current money supply has been created over the past two years.

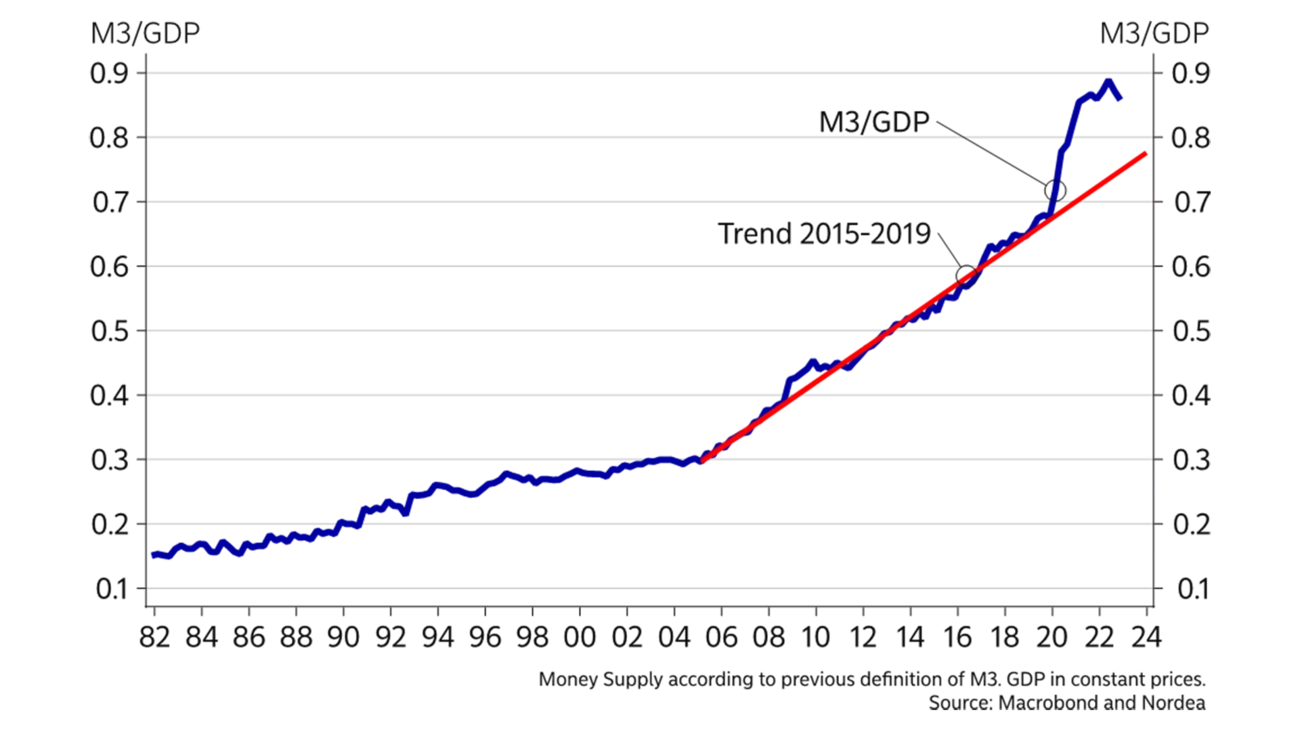

The chart below shows that money supply grew faster than GDP at a relatively steady rate between 2005 and 2020. During the same period inflation was stable at 0-3%. At the beginning of 2022, the money supply as a share of GDP deviated markedly from the previous trend and about a year later inflation soared as well. If this deviation from the trend indicates the amount of “excess money” in the economy, the chart suggests that it will take a while before the supply of money is back at what can be considered more normal levels again.

Several decades ago monetarism – the theory that money supply is a central factor for inflation – was influential in the economic policy debate. Over the past decades, the relationship between money supply and inflation seems to have diminished, and economists thus started to attach more importance to other theories.

However, the question has resurfaced as more and more economists have started to explain part of the sharp global rise in inflation by the enormous economic stim-ulus during and after the pandemic. The Bank for International Settlements (BIS) states in the article “Does money growth help explain the recent inflation surge” (2023) that the link between money supply and inflation is strong in high inflation regimes, but weaker in low inflation regimes. Money supply can also play a very important role in the transition phase between these two regimes. One can speculate on whether we are in such an transition right now. According to BIS, an important reason why many forecasters missed the current inflation spike was that money supply was not incorporated in their models.

One fourth of all money in the Swedish economy has been created since 2020.

The rapid rise in money supply is not unique for Sweden. Many central banks kept key policy rates low and at the same time implemented large scale bond purchases during the pandemic. In addition, fiscal policy was very accommodative. The global economy has probably never seen such a synchronised expansionary economic policy and rapid rise in money supply in such a short time.

It is difficult to determine to what extent the rise in money supply has fuelled inflation. In this article we highlight that the rapid and global surge in inflation was preceded by a similarly rapid rise in money supply. Central banks are now tightening monetary policy forcefully. The money supply has started to decrease and will likely continue to fall. Powerful forces are at play, and if the money supply plays a role for inflation, the direction should be downward going forward. The money supply is nonetheless decreasing from a high level, which means that there still could be more fuel left over for growth, equity markets and inflation than expected, and thus also for higher policy rates.

This article originally appeared in the Nordea Economic Outlook: The Inflation Standoff, published on 9 May 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more