JT: I think almost everyone has a negative experience from a home delivery, and it is easy to see how incumbent logistics players are struggling to scale up and meet growing demand and to overcome issues with legacy systems and models. How would you describe Budbee’s business model, and how does the way you operate differ from that of postal services and traditional forwarders?

FH: Budbee is focusing exclusively on B2C deliveries, to retail consumers, in contrast to many of the incumbent players who are coming from the B2B side. It is much simpler to deliver to a corporate customer and make them happy with the service, as they typically have staff able to receive deliveries during regular working hours. By addressing the consumer side, we think it is important for us to specialise in this, in order to do it well. There are few synergies between the two sides, as their respective nature is different. Today's consumers were prior to the COVID-19 pandemic typically at work during the day, so we designed our business from the start to make deliveries in the evening and during weekends. This has been the basis for the flows across our value chain, how we ship goods between countries and cities. We saw the lack of transparency, the lack of knowledge of where a parcel is and when delivery of it can be expected, as a big problem. It made consumers sceptical of the quality of home delivery services, and probably helped to create a bias for picking goods up at a service point instead – which is only a partial delivery solution.

I had these insights when I worked as a business developer at Rocket Internet in 2013, and we were launching an online store. The big difference between store-based and online retail is that in physical retail we consumers do all the work ourselves. We travel to the store. We pick the goods, try them out, we pay, and we carry the goods home. When shopping online, it is an entirely digital process until we click the purchase button. Then it is important that a forwarder can provide a good delivery experience, not least because it is the only party having any physical interaction with the customer.

Online still represents a very limited share of overall retail sales, and I expect this split to reverse, at least within my lifetime. To drive this development, I saw a great need to create a good service for B2C e-commerce deliveries.

IT systems are crucial for most businesses, and there is a huge advantage in being able to start with a clean slate, without needing to upgrade or integrate complex legacy systems. Similarly, a new player in logistics does not need to maintain a big existing flow of parcels while at the same time disrupting itself. I think one of the greatest problems for the logistics industry historically has been its poor use of data to make well-informed decisions. For Budbee, making data-driven decisions has been at the core of what we do from day one, understanding our revenue and cost drivers, optimising efficiency and returns, and ensuring the best possible user experience for our customers. From a production point of view, we are not so different from our incumbent competitors. We have similar flows. We have similar hub and spoke systems covering the journey out to the last mile. But the cost of sending a parcel using a typical DHL or UPS service is considerably higher than the typical cost of a Budbee delivery. For those companies it is an express service, often cross-border, which has meant less pressure for cost optimisation compared with a standard e-commerce delivery.

We differ from incumbent competitors both in having a newer technological platform, and in the operational characteristics of our business. If you are expecting a delivery from a traditional operator, you don't know when you will receive it. What it can communicate is essentially the working hours of the driver. We communicate expected delivery times down to minute intervals. How can we do this? Our operating model is different. We schedule the exact route for the driver's deliveries. Using machine learning and our algorithms, we are good at estimating delivery times. Incumbent players leave the responsibility for route planning to the driver. They simply don't know the order of the deliveries along the route in advance, and have no way of effectively or reliably communicating estimated delivery times along the way. And there is no way for them to learn from the data of historical deliveries to be able to make well-informed decisions.

JT: You founded Budbee when you were a student at the Stockholm School of Economics. How did it all start? What made it take off? How has your owner base evolved, from founders and angel investors to today’s backing from Kinnevik, H&M and Stena Sessan as big shareholders? What has got these big players involved?

FH: While working as a business developer at Rocket Internet when I was still a student, I was based in Istanbul, Turkey. We were going to launch an e-commerce operation in Azerbaijan. We were not given visas, so we had to stay and do it from Turkey. This is when it dawned on me how critical deliveries are for an online store. There is a saying that the best conversion for an online retailer is after the first purchase. This is when the customer realises what she or he forgot to order, and makes an additional purchase. And the delivery is the only physical contact with the customer, which convinced me that in the future Budbee would need to become a strong consumer brand. It is about trust, quality and service levels.

I started thinking about it, moved back to Sweden and graduated from the Stockholm School of Economics. I am not risk-averse, and I felt strongly that I wanted to start a business. Having lived on student loans, I had not built up any expensive habits, and the jump to becoming an entrepreneur was not as dramatic as if I had been pursuing a career for a number of years prior to doing it. We started testing some logistical models, and the core of what is now Budbee was started in mid-2016.

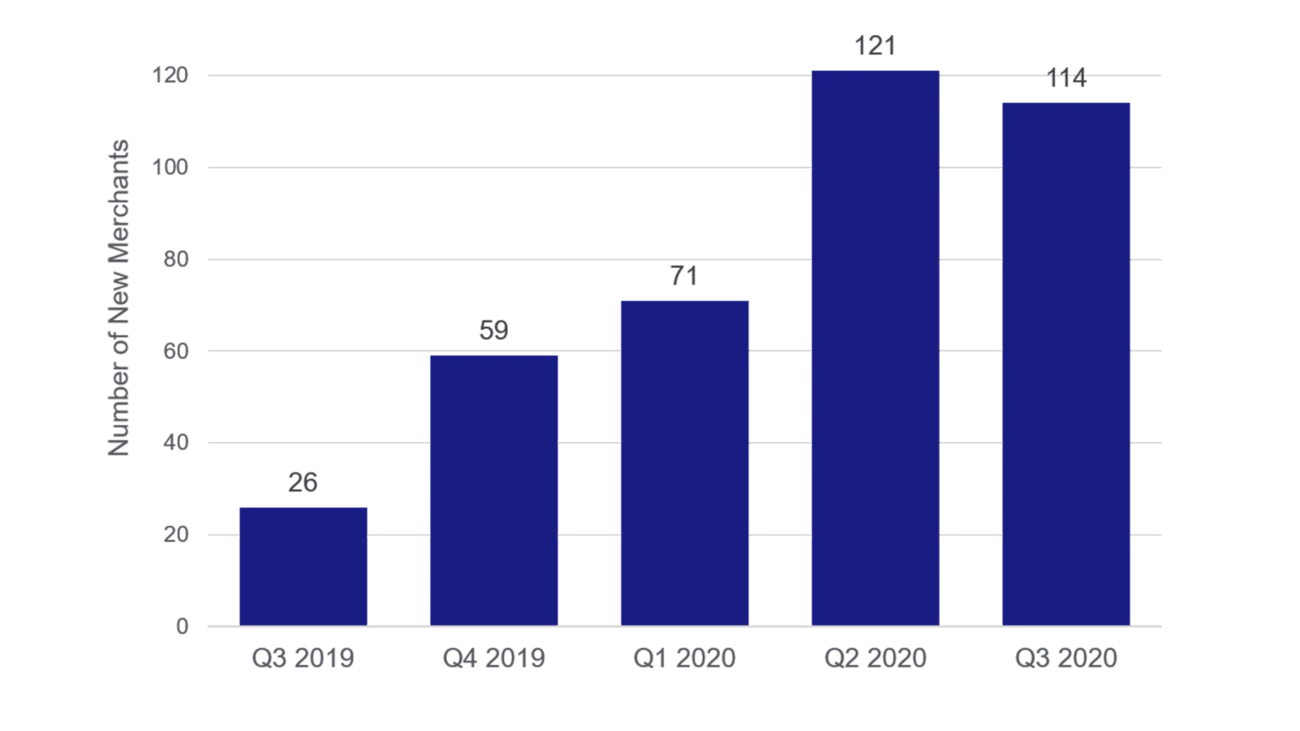

I have an extremely long-term perspective on Budbee. It will take time to build the business. It is a company I will take to my grave. I think many startups focus almost exclusively on the user experience, arguing everything will be fine as long as you have a slick app. I would argue it is equally important to have a solid backbone, the processes, the infrastructure, to be able to scale up and handle the big parcel volumes we have in our system. We feel this view has paid off during the COVID-19 pandemic, when we have seen parcel volumes explode. Many companies have struggled to meet soaring demand, but we achieved around 200% growth in volumes in 2020, similar to our historical growth rates, but from a much higher base. We are forward-leaning in our investments in sorting machines, terminals and processes, so that we can scale up. Without this, we would not have been able to pursue the dramatic volume growth we saw in 2020.