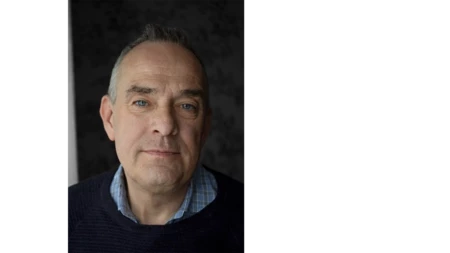

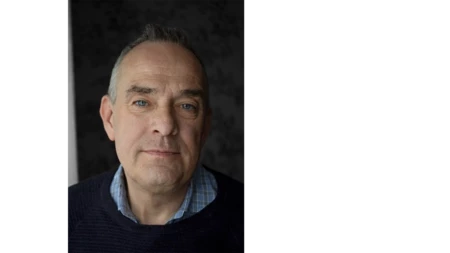

- Name:

- Gunnar Berger

- Title:

- Head of Nordea Open Banking

With PSD3 right around the corner, Gunnar Berger, Head of Open Banking at Nordea, reflects on its possible consequences for innovation. Are regulatory requirements enough to drive innovation, or do all involved parties need to have something to gain to ensure new technology is adapted to improve service offerings?

The purpose of the Payment Service Directive is to improve payment service offerings for consumers by stimulating innovation and increasing competition among providers of end-user solutions. Knowing that two directives have already been implemented (PSD from 2007 and PSD2 from 2016) and that a third is on its way (PSD3), you might think that the regulator is pushing for a radical and dramatic change of the payment service industry. The truth is, that the change has already taken place in many areas, and the EU Commission is only trying to formalise it.

In Nordea, we have seen a steep increase in the use of our PSD2 APIs since the beginning of 2020, but most of those transactions ran through our systems already before PSD2 when third parties were using screen-scraping, a.k.a. reverse engineering or direct access. The regulation did not trigger a massive move of business from banks to non-banks. Rather, the payment traffic is now more controlled from a supervisory perspective and safer for the consumers. The exception to this is in countries where screen-scraping has been illegal and where the introduction of PSD2 has more significantly strengthened the competitiveness of third parties.

“The truth is that the change has already taken place in many areas and the EU Commission is only trying to formalise it.”

Many see PSD2 as a half-measure, where much of the payment functionality still requires the bank’s online interfaces and where liability for fraud still resides with the banks, although payments are initiated by other parties. There are many other shortcomings listed in the responses to the PSD2 review, and it shouldn’t come as a surprise if the PSD3 draft that comes in June 2023 includes significant changes for banks and third-parties.

I believe the direction of these changes will be that the third parties will be able to build and operate their end-user solutions on top of the banks’ core systems, without having to involve or rely on any parts of the banks’ online systems. It will aim at a transformation similar to what happened to the railroad system when the responsibility for running the trains was separated from the responsibility for maintaining the rails.

It shouldn’t come as a surprise if the PSD3 draft that comes in June 2023 includes significant changes for banks and third parties.

So, will this direction of changes help fulfil the ambition to improve payment service offerings for consumers by stimulating innovation and increasing competition? I believe that competition will indeed increase, maybe not so much between third parties and banks, but definitely between the new third parties and the incumbent middlemen, and also between the third parties themselves.

When it comes to the innovation part, I’m more concerned, and I see a risk that we might face a setback. The payment service directive is built on the idea that third parties get access not only to the bank’s core systems but also to the layer of services the banks have built for their online interfaces, on top of the core systems. My concern is that banks will lose the incentive to develop those services if the customer interaction happens elsewhere than in their own interfaces. I’m specifically concerned about the timing of these changes, since we have just started the movement towards real-time payments in all channels, for all segments, and since it will require a lot of new, innovative developments in the banks to make the benefits available to all customers.

To avoid PSD3 and Open Finance throwing a wet blanket on innovation, there must be incentives for banks to keep developing their services. Regulatory requirements will not make innovation happen unless they are combined with the possibility for banks to create revenue by adapting new technology to deliver improved end-user functionality.

To avoid PSD3 and Open Finance throwing a wet blanket on innovation, there must be incentives for banks to keep developing their services.

Gunnar is heading a Nordic unit responsible for ensuring PSD2 compliance and proactively embracing the opportunities for innovative development and third-party collaboration based on Open Banking. Gunnar’s goal is to make Nordea’s Open Banking platform the go-to hub for financial APIs in the Nordics, where customers, third parties, and banks can meet to exchange data and co-create comprehensive and value-adding solutions. Gunnar is the main person responsible for Nordea’s API interaction with licensed third-party providers, and he is now looking into what additional regulatory requirements will come with PSD3 and Open Finance. Gunnar has a long history working in the banking industry, especially with complex customer cases and development initiatives.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more