Corporate insights

Managing business risk from the Russia-Ukraine war

How are Nordic corporates handling the risks from their business exposure to Russia, Ukraine and Belarus? We asked them in our Treasury Survey 2022: Re-assessing risk.

Read moreDen här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaGet the latest insights on the economy, industries and emerging trends that can help your business tackle the challenges it faces in today’s market. We share the learnings and perspectives of leading experts and innovators in the Nordics, both from Nordea and beyond.

Corporate insights

How are Nordic corporates handling the risks from their business exposure to Russia, Ukraine and Belarus? We asked them in our Treasury Survey 2022: Re-assessing risk.

Read more

Nordea On Your Mind

To get a glimpse from inside the storm, we talk to experts from Swedish state-owned power utility Vattenfall about the volatile European energy markets and what lies ahead.

Read more

Sustainable finance

The EU Platform on Sustainable Finance's long-awaited Recommendations on Data and Usability of the EU Taxonomy offers valuable insight into emerging best practices.

Read more

Sustainable finance

The integration of ESG factors into credit ratings is an exercise distinct from the ratings and evaluations carried out by ESG service providers, although the two are often compared and confused. We take a look at the differences between the two approaches.

Read more

Markets and investment

Anders Aalund, Head of Trading Strategy in Nordea Markets, shares insights into the current Danish bond market, strategy and golden opportunities.

Read more

Nordea On Your Mind

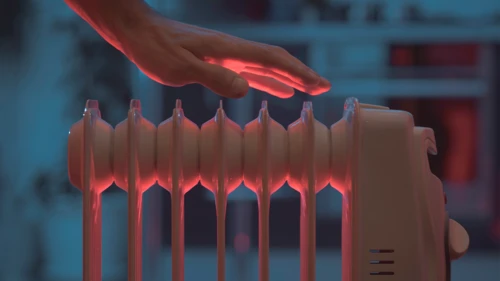

Is there a way out of Europe’s big energy crisis? What will the next steps be for the world-class electricity systems in the Nordics? Energy supply in the European and Nordic markets is front and centre in the latest Nordea On Your Mind.

Read more

Markets and investment

At China’s Party Congress in October, Xi Jinping continued to strengthen his role as China’s leader, and his position is now much stronger than that held by his predecessors. However, it is not clear what this implies for the Chinese economy.

Read more

Podcast

In Nordea Thematics annual treasury study, 160 Nordic large corporates have answered questions about what they consider to be the greatest risks and how they manage them.

Read more

Sustainable finance

The EU Platform on Sustainable Finance on 11 October released one of the last outstanding reports on the usability of the EU Taxonomy. It provides recommendations on interpretation of the existing Taxonomy and guidance for the remaining environmental objectives as well as alignment with other European sustainable finance regulation.

Read more

Sustainable finance

The EU Platform on Sustainable Finance published its final report on the functioning of the Minimum Safeguards laid out in the EU Taxonomy Regulation. The Minimum Safeguards ensure that companies engaging in sustainable activities meet certain standards when it comes to human and labour rights, bribery, taxation and fair competition.

Read more

Corporate insights

Corporate treasury and finance departments are facing a new reality characterised by geopolitical tension, sky-high inflation and rising interest rates. Find out how they are responding in Nordea’s latest annual Treasury Survey: Re-assessing risk.

Read more

Open banking

Open Finance was first mentioned in the Digital Finance Strategy published by the European Commission in 2020. Since then, it has been a “buzz word” in the financial industry, creating both curiosity and concern. But what do we know about Open Finance at the moment?

Read more