In today's world, it is probably no understatement to say that sustainability has become the new normal. This certainly holds true in the financial markets, where the European Commission’s Action Plan on Sustainable Finance from 2018 has set off an avalanche of change. Much of this has been driven by policy and regulation. However, if we look to the private markets, arguably the most notable and strongest driver of sustainable finance, outside of the sustainable bond market perhaps, is the developments seen within ESG data services, including ESG ratings.

To get you properly caught up on these developments, let me take you through some of the key reflections to bear in mind when discussing these services and ratings. Let us start off with some obvious points:

- A lot of money is being thrown at ESG data/services: So much so that MSCI's ESG-focused business grew by +40% y/y in Q1 (versus 5-11% for its other businesses). Opimas has estimated 24% growth per annum since 2014 for ESG content and indices. With this much money chasing products, it is no surprise that companies are investing heavily in expanding their offerings.

- It is about more than just 'ESG ratings': In a world full of complexities and ambiguity, a simple rating is often the easiest to communicate. Naturally, we therefore see this as a cornerstone product of most ESG service providers – but it far from tells the full story. Most investors we speak to only use ESG ratings as a screening tool but rely on the fundamental ESG data for investment decisions.

- We need harmonisation of concepts but nuance in methodologies: To ensure that we are all on the same page, it is crucial that we harmonise our thinking around the nature of discussed concepts. One such example is regarding CO2 emissions, where the concept of "scope emissions" has taken hold and where the Science-Based Targets initiative has been driving the scientific agenda in aligning company targets. However, we still need to leave scope for different methodologies for how to apply such data, as sustainability discussions are inherently context-dependent, which is why it is often futile to compare ESG ratings across providers.

- Availability and quality of ESG data need to improve: Often these are raised as the primary concerns for the usage of ESG data and ratings – and to a certain extent, this holds true. However, we have seen significant progress in the last three to five years, especially for climate-related data, and we expect this development to drastically improve over the next three to five years, as both regulation and investor demand will drive companies to invest more time and effort into increasing and streamlining the reporting on non-financial data.

If we look more closely at the developments shaping the ESG service provider space, the first thing to recognise is the obvious structural driver, sustainability, as the new normal, as stated above. As a consequence of these strong tailwinds, we have seen a proliferation of service providers, but also industry consolidation. Indeed, we expect consolidation to be one of the main supporters of growth in the coming years as services become more harmonised. Interestingly, in the current market, we see three primary yet different providers/owners of ESG services, namely stock exchanges, credit rating agencies and research providers

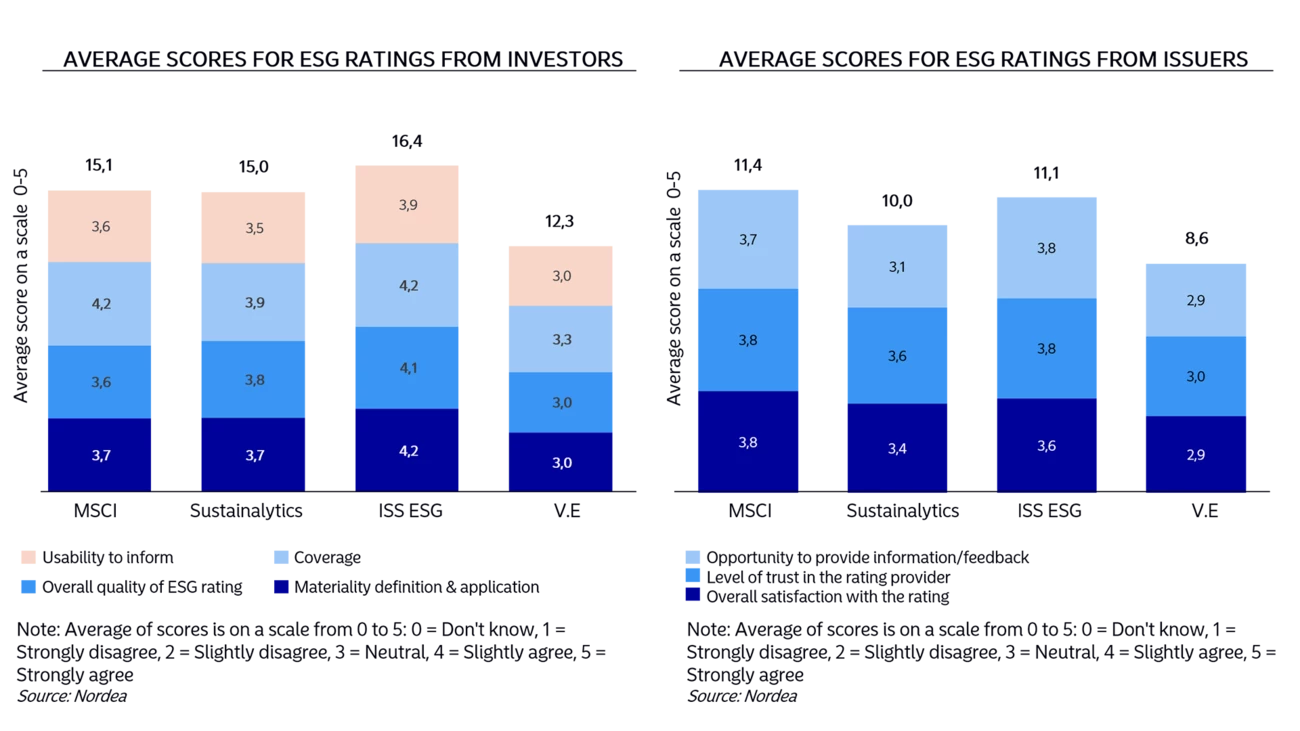

Within the ESG service provider space, "ESG ratings" often represent the flagship product, probably because of their intuitive use and interpretation. However, it is important to recognise that the term "ESG ratings" is used quite ambiguously in the market today. Some providers refer to these as scores, others as assessments or evaluations, and some specifically as risk ratings. Inherent in these differences are different methodological assumptions and approaches. As an example, both MSCI and Sustainalytics base their ratings on an exposure risk and the company's ability to manage such risk. ISS ESG's approach is based on an overall ESG performance that is subsequently adjusted for the impact (positive or negative) of its products and services on the UN Sustainable Development Goals.