- Name:

- Andreas Zsiga

- Title:

- Director in Investment Banking, Debt Solutions & Structuring

Siden findes desværre ikke på dansk

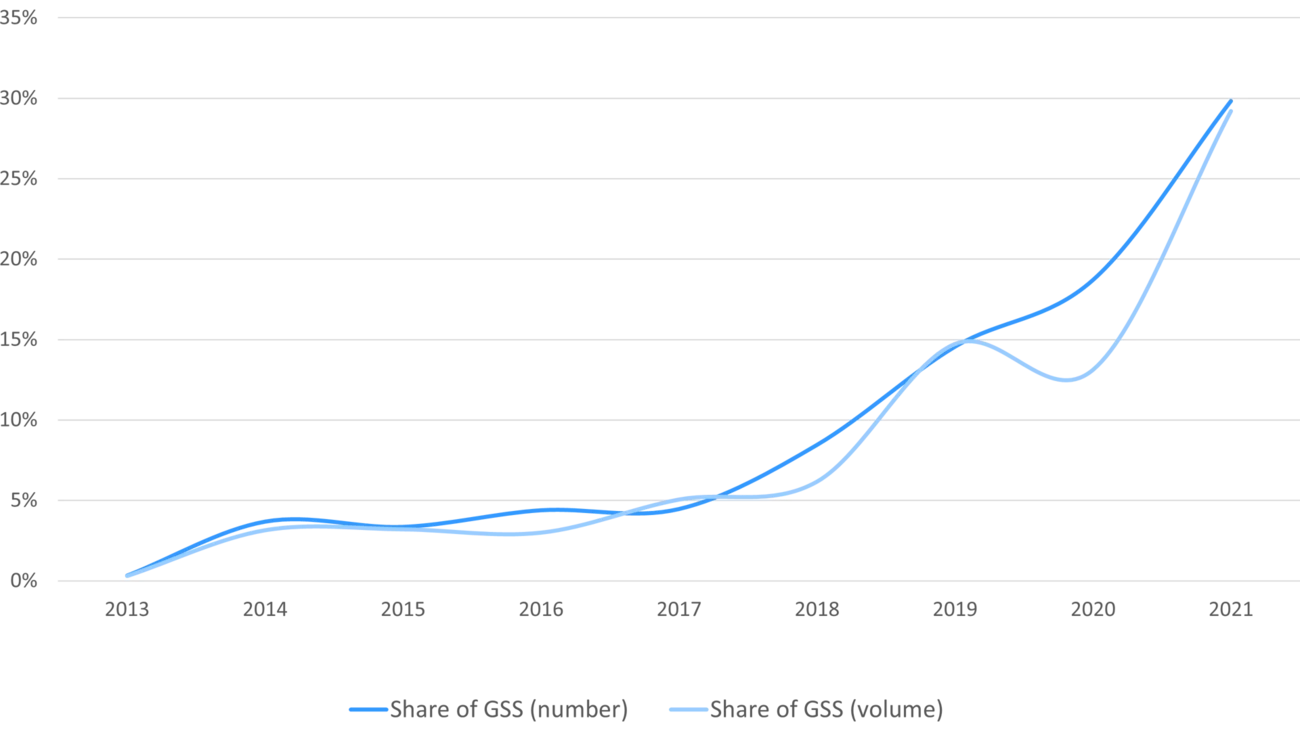

Bliv på siden | Fortsæt til en relateret side på danskNordea in early 2021 launched its first investigation into the performance of green bonds and potential spread differences versus their non-green counterparts. Andreas Zsiga, Chief Analyst at Nordea’s Credit Research, follows up on the previous publication in an updated report.

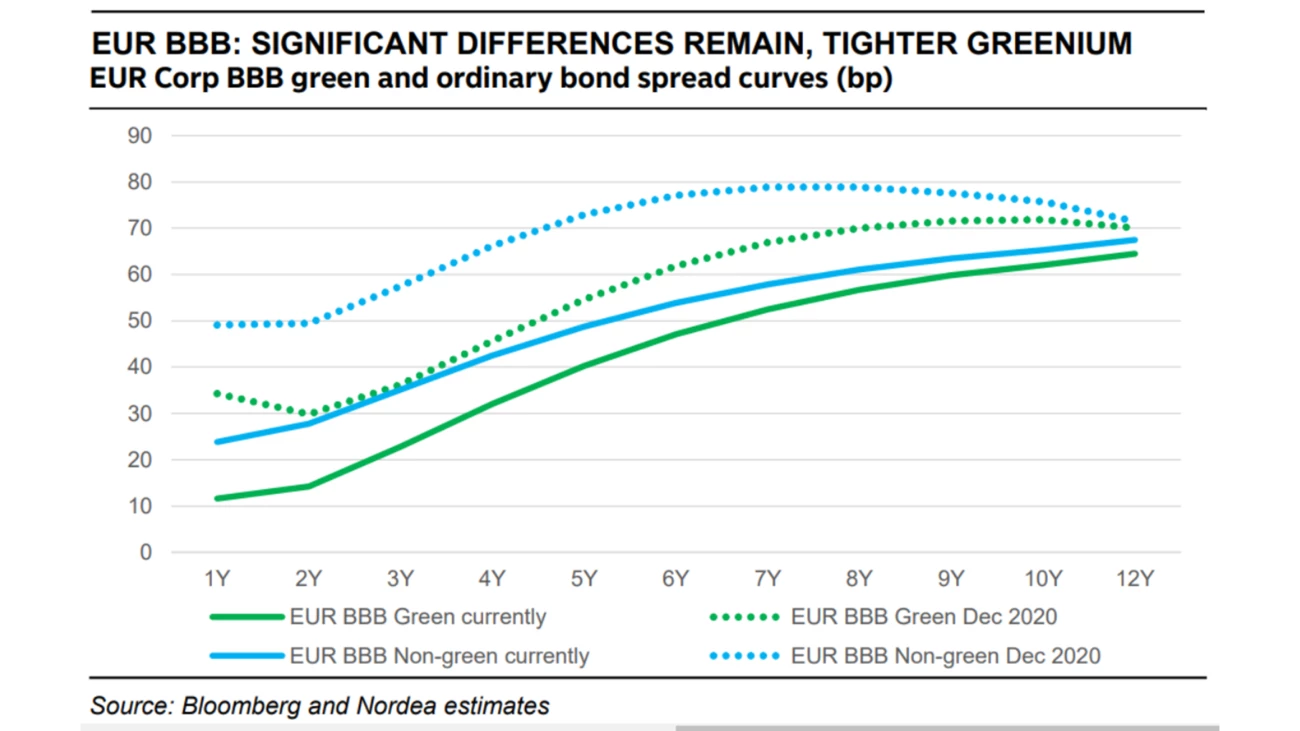

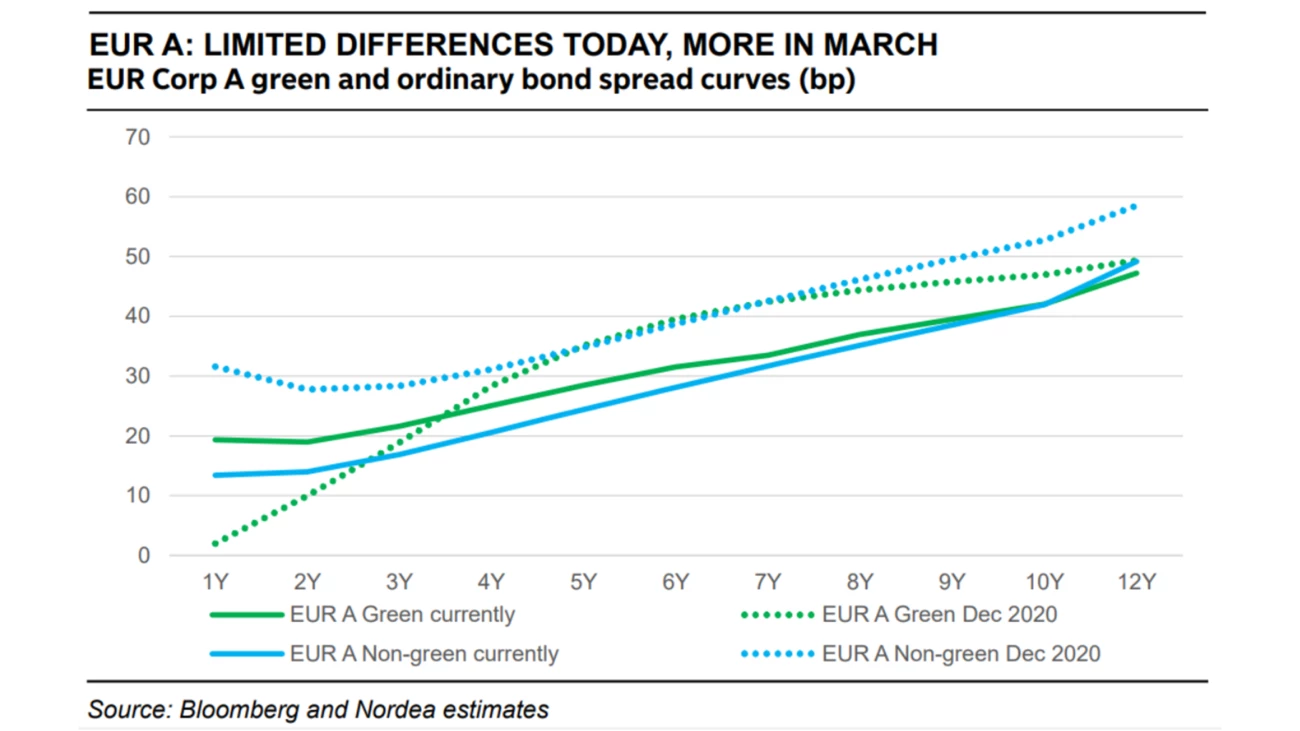

Since the publication of Nordea’s first report on green bond premiums in January, the sustainable debt market has once again exceeded all expectations. As green bonds make up an increasing share of total issuances, there is a keen market interest in the performance of these bonds against both ordinary non-green bonds from the same issuers, and relative to the wider market. January’s report found that there was indeed a tighter spread in the case of investment grade EUR A and EUR BBB bonds but that this outperformance was not found to the same extent in the sample of SEK bonds. The new report provides insight into how the spreads have changed as the economic recovery from COVID-19 has progressed.

The updated report confirms previous findings that EUR A and BBB bonds have a tighter spread compared to ordinary bonds from the same issuer. Nevertheless, the share of issuances which showed a tighter spread has fallen from 60% to 55%. Opposing the development in the EUR market, the SEK IG sample continues to show a tilt towards green bonds trading at a wider spread than ordinary bonds, on a relative basis. Compared to January, the share of SEK green bonds trading at a tighter spread has however increased from 23% to 27%.

The updated report confirms previous findings that EUR A and BBB bonds have a tighter spread compared to ordinary bonds from the same issuer.

Looking at the secondary market, green bonds seem to have weathered the storm with a slightly lower spread widening compared to ordinary bonds from the same issuers during the COVID-19 risk-off session.

”We believe this reflects a broader investor base and higher liquidity potential in green bonds, a feature that will likely increase in importance going forward. The subsequent trend has been more favourable for ordinary and overall bond spreads, resulting in the current situation with something of a premium for non-green bonds,” says Andreas Zsiga.

EUR Corp A and BBB-rated bonds continue to show a clear tendency towards tighter spreads, with 14 out of 22 issuers in the EUR Corp A sample and 28 out of 35 issuers in the EUR Corp BBB sample with a spread of at least 5 pp. However, spread differences are generally modest with up to 10bp in the A-rated bond sample and between 5bp and 15bp in the BBB-rated sample. For both samples, differences in maturity suggest a shift towards sustainable finance as non-green bonds generally have shorter maturities than their green counterparts. Despite this, there are fewer differences in both spread and maturity of green bonds versus non-green bonds from the same issuers in the SEK A and BBB categories.

When looking at the aggregate spread differences for the same sample, there is clear outperformance in the case of EUR BBB bonds and, to a lesser extent, for EUR A bonds.

Comparing green bond issuers to non-green bond issuers, the report shows that while there is no “greenium” at this point in time for EUR A bonds, there was a marked difference during the risk-off session in March 2021. The report further suggests a clear “greenium” for EUR BBB corporates that was particularly pronounced in Q1 and remains, to a lesser extent, now.

As previously, we hold that the existence of green bond premiums could be due to combination of long-term and stable issuers of green bonds, the automatic exclusion of non-green companies hit hardest in past crises, as well as the characteristics of green bond investors and the growth in the number of dedicated green bond funds. However, as the supply of green bonds increases rapidly, the wider availability may reduce the incentive for investors to get hold of green bonds at a premium.

While the increasing supply of green bonds could diminish premiums, higher premiums might still be found in the near future in social and sustainability markets where issuances are still more scarce.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more