How can we build financial confidence among younger generations? A key question at Nordic Fintech Week 2025, where Søren Rode Jain Andreasen, Head of Digital Customer Engagement Hub in Retail Digital, appeared alongside Philip Haglund, founder and CEO of Gimi, in a joint fireside chat.

”In a customer study, we found that 80% of adults have experienced financial stress and 32% named money as their main source of stress,” says Søren Rode Jain Andreasen. ”What if we change that by starting earlier and giving the right tools to young people.”

That’s what sparked Nordea’s partnership with Gimi.

Empowering younger generations

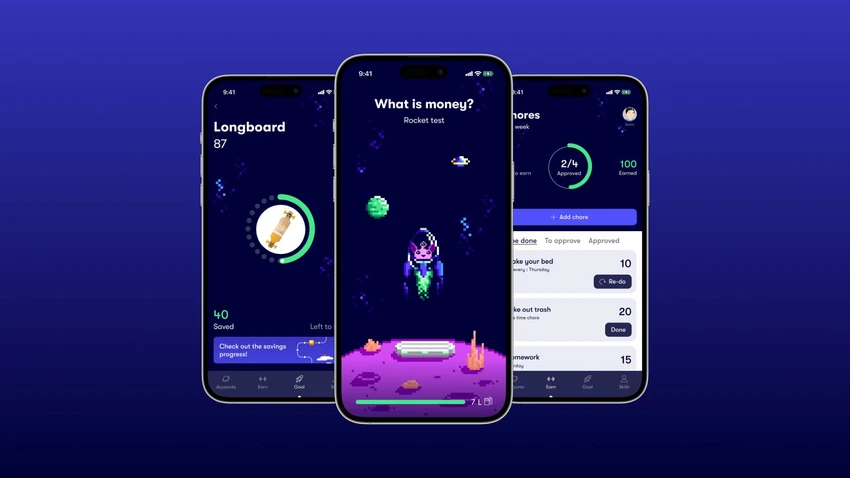

Gimi is a pocket money app that teaches children and young people about finances through interactive learning. The app connects to the child’s bank account using secure open banking technology and offers several practical features such as setting up allowance, handing out chores and reaching savings goals. Through these features and over 40 interactive lessons and quizzes, Gimi helps young people learn essential financial concepts like savings, budgeting, interest, loans and spending.

“Financial education shouldn’t be complicated, boring or hard to get. Our goal is to make money matters engaging and accessible for children and young people at the age when lifelong habits are formed”, says Philip Haglund.

Customers in Norway and Sweden were the first to get their hands on the solution, with promising results. Children using the app engage with it more than twice a week, with 84% actively using features beyond checking account balances, such as setting savings goals and exploring educational content.