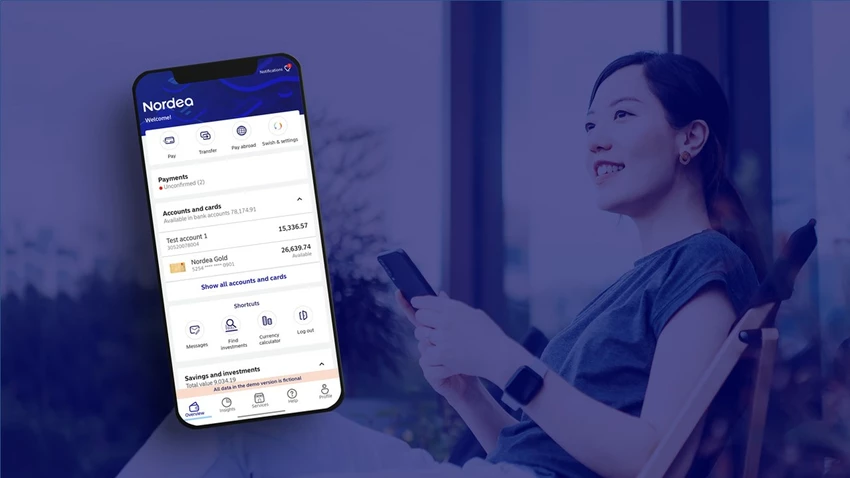

“I was amazed by the seamless experience of digital selfservice and excellent support from my adviser when I needed it. It all started with talking to chatbot Nova and sending in my mortgage application. Along the way, I was contacted by an adviser who picked up where I was in the process and shared valuable insights,” says Maria.

She adds: “Great customer experience and availability are important to me, and I found the whole process really well thought through. It was the perfect blend of digital and personal advice, where the adviser paid attention to my needs and got back to me as promised. Every touchpoint took the customer into consideration. When you really need to talk to someone, the quality of the interaction becomes even more important. I was very pleased with the help I got.”