- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst

After a period of high growth, rising home prices and record-high employment, cooler winds are now blowing over the Danish economy. Households feel the impact of falling purchasing power and businesses are hurting from the slowdown in the global economy. However, the Danish economy is well braced for a period of headwind. That is why we only expect a moderate decline.

2021 saw the largest GDP growth in Denmark on record since 1994. According to preliminary national accounts data, the high activity level was maintained in H1 2022. Despite the prospect of a technical recession in H2, GDP growth for the full year is expected to reach 2.5%. However, the anticipated setback for the remainder of the year will affect the outlook for 2023 and we therefore lower our growth forecasts from 1.0% to 0.5%. For the first time, we also include 2024 in our forecast. In 2024, the Danish economy is estimated to expand by 1.8%.

The risks associated with this forecast are generally considered to be balanced, but also extraordinarily high. This uncertainty is mainly caused by two factors. First, the development of Russia’s invasion of Ukraine is crucial for the growth outlook. Particularly in terms of the energy supply over the winter when historically high prices and potential natural gas restraints could lead to a harder-than-expected downturn in economic activity. Conversely, easing of the geopolitical tensions could pave the way for a more optimistic outlook than the baseline scenario.

The second key uncertainty is the trend in the Danish housing market. The baseline scenario is a price decline of 5-10% from the current level. But there is a wide range of possible outcomes, and deviations in either direction could significantly affect household spending and activity in the construction industry.

Danish consumers are really feeling the effects of sharp price increases, higher interest rates and growing uncertainty about the economic outlook. In recent months, this toxic cocktail has caused consumer confidence to slump to an all-time low since the first sentiment survey in 1974. This pessimistic view is not an isolated Danish phenomenon and is in line with the sentiment in many other countries.

We generally do not expect the slowdown in consumer spending to be as pronounced as the historically low consumer confidence readings would imply. Firstly, households have large savings buffers and, secondly, recent years’ solid labour market improvements have lifted employment to record-high levels. That said, the very high inflation makes large inroads into disposable income and overheads such as energy eat up more and more of the budget. Subsequently, a natural shift in goods consumption towards stronger demand for services must be expected.

1 / DENMARK: MACROECONOMIC INDICATORS, BASELINE SCENARIO

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP, % y/y |

-2.0 |

4.9 |

2.5 |

0.5 |

1.8 |

|

Consumer prices, % y/y |

0.4 |

1.9 |

7.5 |

4.5 |

1.9 |

|

Unemployment rate, % |

4.6 |

3.6 |

2.6 |

3.3 |

3.0 |

|

Current account balance, % of GDP |

8.2 |

8.6 |

8.2 |

6.8 |

4.2 |

|

General gov. budget balance, % of GDP |

0.2 |

2.6 |

0.9 |

0.3 |

0.7 |

|

General gov. gross debt, % of GDP |

42.2 |

36.6 |

32.5 |

31.8 |

31.6 |

|

Monetary policy rate (end of period) |

-0.60 |

-0.60 |

1.90 |

2.15 |

1.65 |

|

USD/DKK (end of period) |

6.08 |

6.54 |

7.79 |

7.10 |

6.77 |

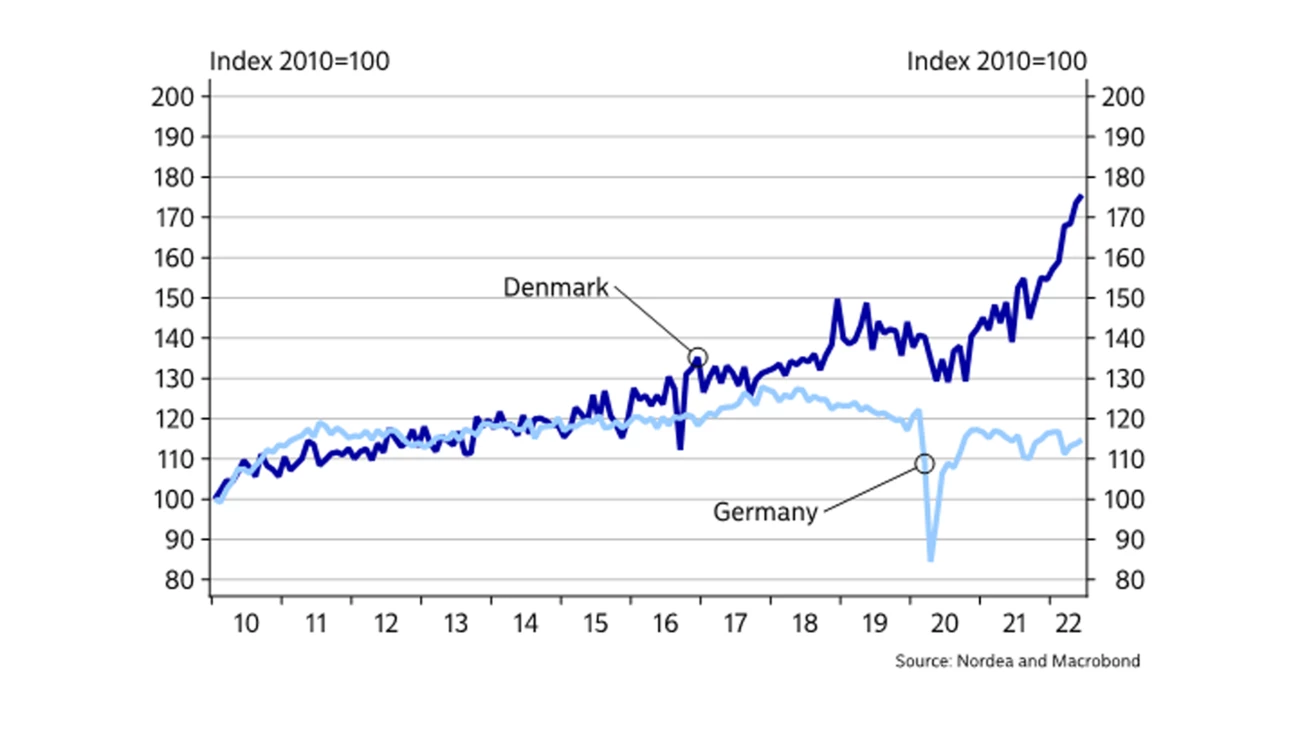

Danish industrial production has surged in recent years. Over the past year alone, total production has risen more than 20% – even more remarkable in light of the largely stagnant German industrial production over the same period.

The main growth driver is the pharmaceutical industry, which accounts for just over 20% of overall production. The mechanical engineering sector, which produces a large part of the products used in the green transition, has also seen solid progress.

The upturn in industrial production has led to strong growth in goods exports. Coupled with a large surplus from sea transport, this has boosted the current account surplus to an all-time high in the first six months of the year.

However, over the coming six months, much indicates that the increase in industrial production will level off. The business survey for industry shows declining production expectations, and stocks of finished goods have risen. In addition, employment expectations in the manufacturing industry have fallen to a low since end-2020.

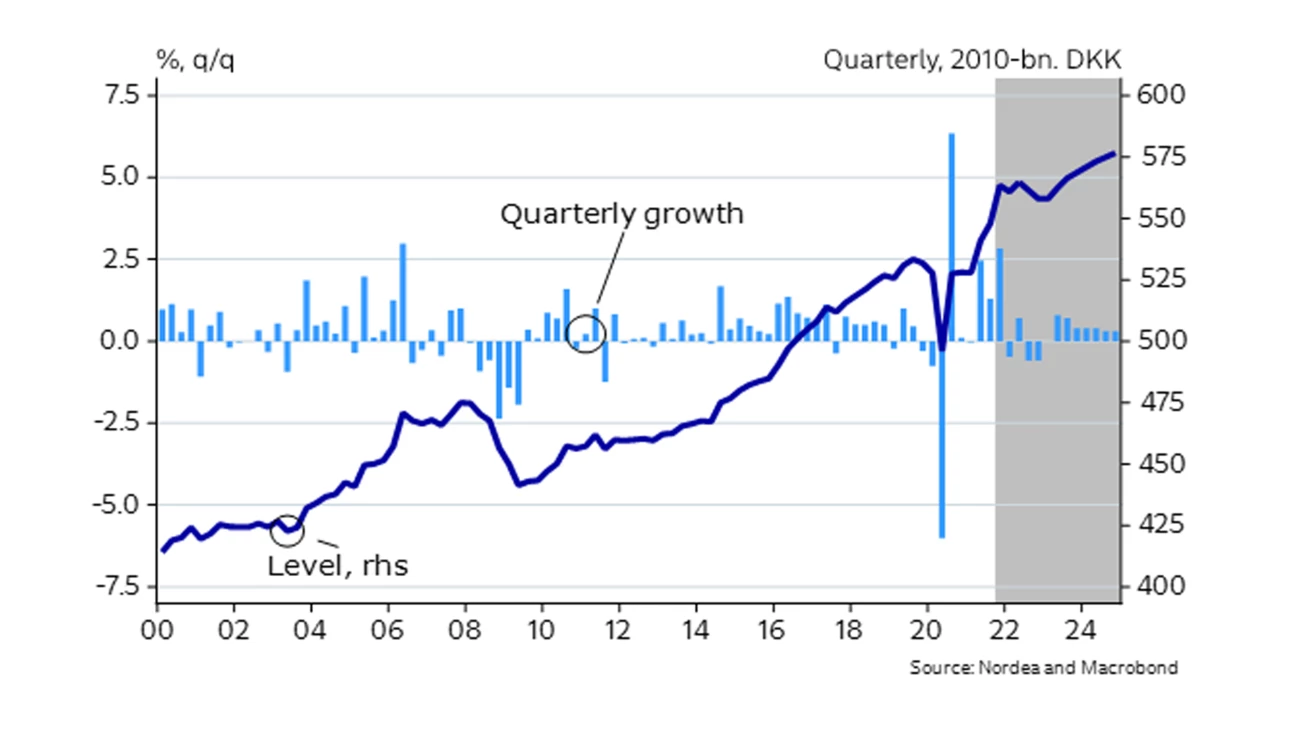

A / Technical recession expected in H2 2022

Quarterly GDP in 2010 prices and forecast

The Danish economy is expected to be hit by negative GDP growth in Q3 and Q4 2022. Positive growth is expected to return in 2023.

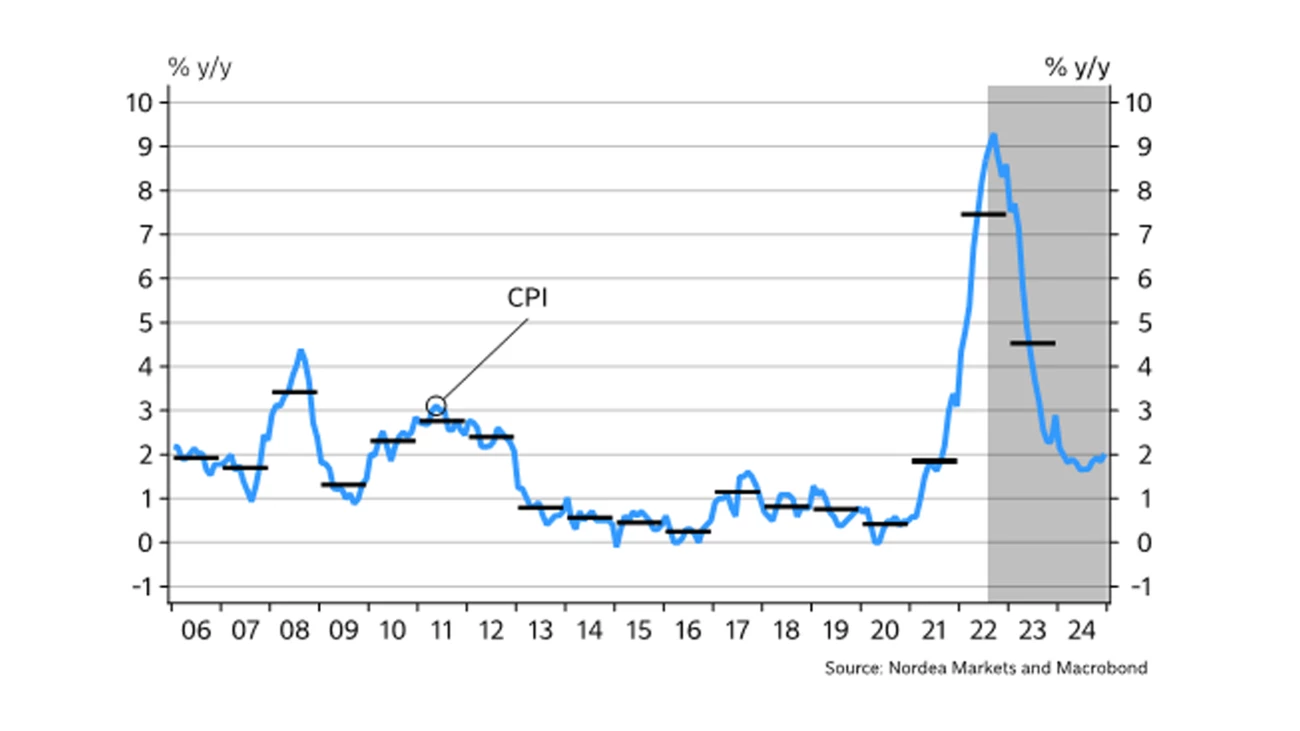

B / High inflation well into 2023

Consumer price index, annual change

In 2022, inflation has risen to an all-time high since the early 1980s. It is not expected to return to 2% until the first months of 2024.

This year, historically high prices of natural gas, electricity and food have lifted annual growth in the Danish consumer price index (CPI) to the highest level since the early 1980s. Food and beverages make up more than 10% of total CPI and are thus a key contributor to the high inflation.

The forecast assumes that Danish inflation will remain at very high levels until the end of the year, lifting the average for FY 2022 to a 40-year high of 7.5%. Inflation is also expected to be very high in 2023 when major rent increases is one of the factors that will maintain high a inflation level. On the other hand, the effects of energy and food price increases are likely to gradually abate. Next year, average inflation is thus expected to decline to 4.5% and to 1.9% in 2024.

The Danish economy faces headwind on several fronts.

Public finances have fared much better than expected over the past couple of years. An important explanation for recent years’ very strong development is the pension return tax. Over the past two years alone, pension return tax receipts contributed more than DKK 110bn in revenues. Moreover, the government also received large one-off revenues from the frozen holiday pay in both 2020 and 2021.

In addition, public finances have benefited from strong economic trends, which have resulted in higher tax receipts and lower unemployment benefit payouts.

This year, public finances are expected to worsen compared to last year. The reasons are that expenditure will be affected by a number of one-off payments and that revenues from the pension return tax are expected to be markedly lower. Against this background, the surplus is likely to contract to some 0.5% of GDP this year.

C / Industrial production in Denmark has outpaced Germany

Industrial production in Denmark and Germany, index 2010=100

Since early 2018 Danish industrial production has fared markedly better than Germany’s, chiefly driven by strong growth in the Danish pharmaceutical industry.

D / Housing prices likely to fall in the period ahead

Price index for single-family houses, Nordea’s forecast

In recent years housing prices have risen much faster than disposable incomes. This may contribute to the downward pressure on prices now that interest rates have risen.

The Danish housing market has seen some turbulence in recent years. Contrary to most predictions, prices as well as trading volumes rose sharply during the pandemic. However, after the aggressive rate hikes the housing market has gradually lost steam. The number of homes for sale has risen and time on market is longer, which reflects that potential buyers have gained bargaining power. In continuation of this trend, the first sporadic signs of falling prices have started to emerge.

We expect the lower prices to spread like rings in the water in the Danish housing market in the years ahead. At first, the decline will affect mainly the most price-sensitive areas of the market such as owner-occupied flats in the major cities. Here, prices will be pushed down by a sharp rise in financing costs; the effect of the coming property tax reform and heightened uncertainty about the economic outlook. The market for single-family houses is also likely to face a period of lower prices. Next year, sales prices are expected to drop by 5% on average. If so, this will be the sharpest price decline for more than a decade – and in real terms, the steepest drop since the financial crisis.

Price declines of single-family houses are not expected to level off until the end of next year. Prices of owner-occupied flats are expected to continue to decline throughout 2024, mainly as a consequence of the implementation of the tax reform. From their peak, prices of owner-occupied flats are projected to plummet by more than 10% – back to the levels seen in mid-2020.

On 21 July, the Danish central bank announced a rate hike of 0.5% point, tracking the decision of the European Central Bank (ECB) earlier that day. We expect the Danish central bank to hike interest rates by a total of 2.0% point before the year-end. If so, this will lift the policy rate to the highest levels since 2019 and mark the end of a long period with negative interest rates in Denmark.

After a large sell-off of DKK towards the end of the year to defend the fixed exchange rate regime, the Danish central bank has seen no need to intervene so far this year. However, the DKK is still strong against the EUR, so a further need to sell DKK cannot be ruled out. In our baseline scenario, we expect the spread between the deposit rates of the ECB and the Danish central bank to remain at the current level until the end of 2024.

After a temporary decline over the summer, Danish long-term yields have again risen sharply – rapidly approaching the highest level since 2011. Danish long-term yields have risen on the prospect of significant monetary policy tightening, higher US rates and persistently high inflation in the Euro area. We anticipate a further increase in Danish long-term yields towards mid-2023 – although most of the expected increase has already happened.

This article originally appeared in the Nordea Economic Outlook: Feeling the squeeze, published on 7 September 2022.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more