- Name:

- Jan Størup Nielsen

- Title:

- Nordea, Chief Analyst Denmark

Lower prices and stagnating turnover are dominating the Danish housing market. The decline is especially caused by rapidly rising interest rates, and it is expected to continue until 2024. However, the starting point is strong, and that is why the situation after the financial crisis will not likely be repeated.

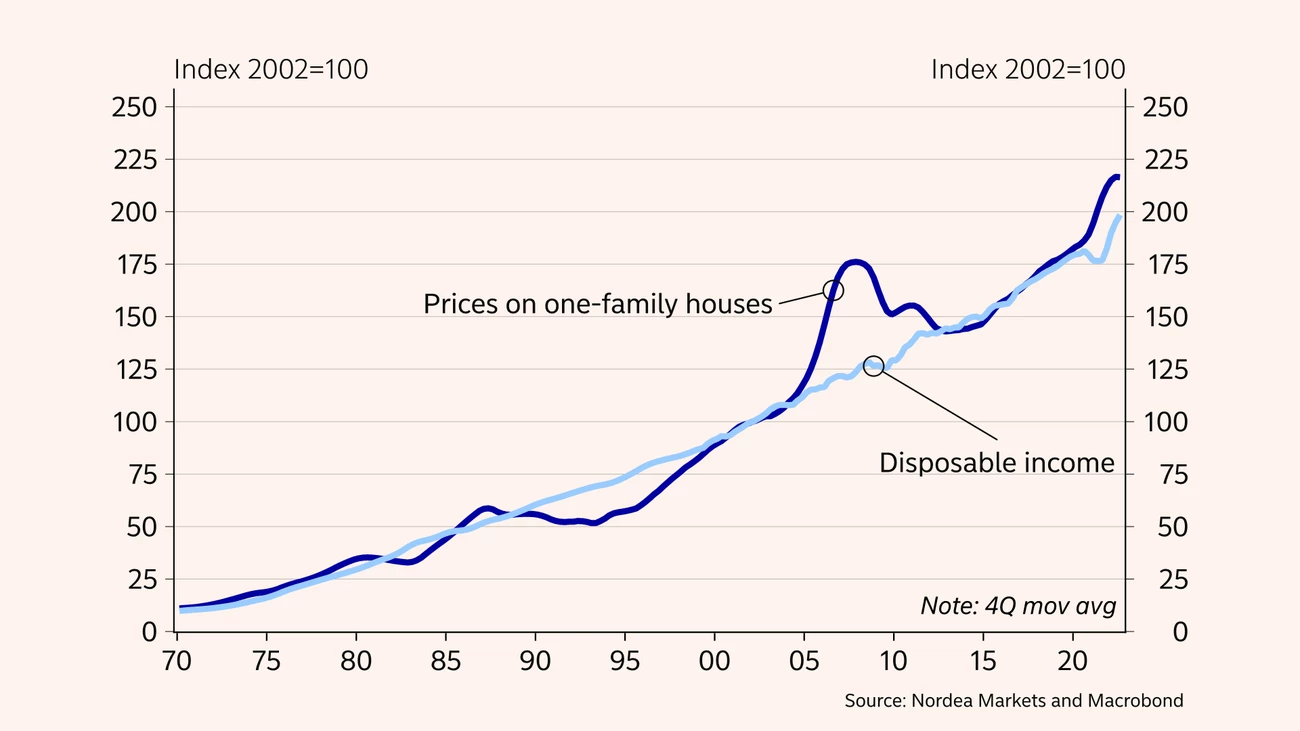

The development in the Danish housing market has been remarkable in recent years. Starting in the spring of 2020 and two years on, prices rose steeply with large turnover. In this period the increase was primarily driven by very low financing costs coupled with a significant rise in disposable incomes. Add to this an element of market euphoria, which strengthened the underlying upward price pressure.

Since the spring of 2022, the situation has changed considerably, though. Prices of houses and owner-occupied flats have started to go down, making a dent in the large value gains seen over the past few years. At the same time, turnover has stagnated and the number of homes for sale has risen – although still at a low level. Measured from the peak in the spring of 2022, this means that home prices have now fallen by around 10% nationwide. The market for owner-occupied flats in the largest cities, which is traditionally the most price-sensitive part of the housing market, has especially been affected by falling prices.

We see two main reasons for the ongoing correction. Firstly, prices were driven up to an ”artificially” high level during the COVID-19 pandemic. This is the case for home prices measured both relative to income and in terms of rent developments.

Secondly, the large interest rate increases have significantly changed the price dynamics of the housing market. Throughout 2022 the average fixed mortgage rate rose by more than 3 pp, to the highest level in more than 10 years. At the same time, many variable-rate home loans have seen a corresponding increase. The sharply higher interest rates mean higher costs for existing homeowners and also affect the disposable income of new potential homebuyers. This adverse effect has been reinforced by surging energy prices, which have eroded homeowners’ finances even more.

The situation with falling prices, longer sales times and lower construction activity may seem like a repetition of the events during the financial crisis. Back then prices fell by more than 20% and the decline in the housing market was a significant reason why it was harder for the Danish economy to emerge from the crisis than for neighbouring countries.

However, the current situation differs considerably on several factors – and the events of 2009 will not likely be repeated. The main difference is that regulation has been tightened significantly, making the housing market far more resilient to withstand a period with low economic activity. Therefore, the level of household debt today is considerably lower. Moreover, the situation is also buoyed by the record-high employment rate, which will help support the housing market.

After a period with high price increases, the housing market is making a natural adjustment.

We expect prices in the Danish housing market to continue to fall throughout 2023, as the effect of the new and higher interest rate level has not fully fed through yet. At the same time, prices will be driven lower by the general economic slowdown in Denmark. In that light, we expect prices of single-family houses to fall by nearly 8% this year. In 2024 prices are expected to stabilise as, for example, the effects of the tax reform should contribute to support home prices, which are thus expected to bottom by mid-year. At that time, prices are expected to have dropped by close to 15% from the peak in early 2022.

On the other hand, the tax reform is expected to add further negative price pressure on the market for owner-occupied flats in the biggest cities. Here we do not expect prices to bottom until after end-2024. At that time they are expected to have fallen by around 17% from the peak, which corresponds to the price level of owner-occupied flats at the beginning of 2019.

This article first appeared in the Nordea Economic Outlook: The balancing act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more