Tino Kam

Head of Transaction Banking Product Management at Nordea

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskTen years ago you’d probably never heard of the 'C-suite', a phrase that refers to a company's key group of senior executives. Now, it’s everywhere. And over that time, the definition has grown more broad. Core roles — like Chief Executive Officer (CEO), Chief Finance Officer (CFO) and Chief Operations Officer (COO) — have been joined by new ones, like Chief Marketing Officer (CMO). As we emerge from a period of intense changes, many businesses are asking if this leadership group needs to evolve further.

According to a survey of CEOs by EY, 72% were planning to make changes to the makeup of their C-suite to cope with changing circumstances. And that survey was carried out in 2019, before COVID-19 hit.

We pulled together a panel of experts from across Nordea to discuss what changes they’re seeing among the enterprises they work with across the Nordics — both domestic and international. We also asked them to look ahead and make their own predictions.

Head of Transaction Banking Product Management at Nordea

Director, Thematics, Investment Banking at Nordea

Head of Emerging Technologies at Nordea

Johan: The simple answer is yes. The COVID-19 pandemic forced many companies to re-evaluate their business models and accelerate digital transformation. It would be foolish to think that the impact of this wouldn’t make its way up to the C-suite.

Katy: I agree, but I think that it’s cultural shifts that are driving the greatest change. Things are improving, but even now there are still businesses where the C-suite consists solely of older, white men. Or, if a woman has made it to the top tier, it’s in HR, marketing or perhaps legal. But change is accelerating and the last few years have seen the C-suite adapt to better reflect the business and its employees, its customers and the communities where it operates.

The COVID-19 pandemic forced many companies to re-evaluate their business models and accelerate digital transformation. It would be foolish to think that the impact of this wouldn’t make its way up to the C-suite.

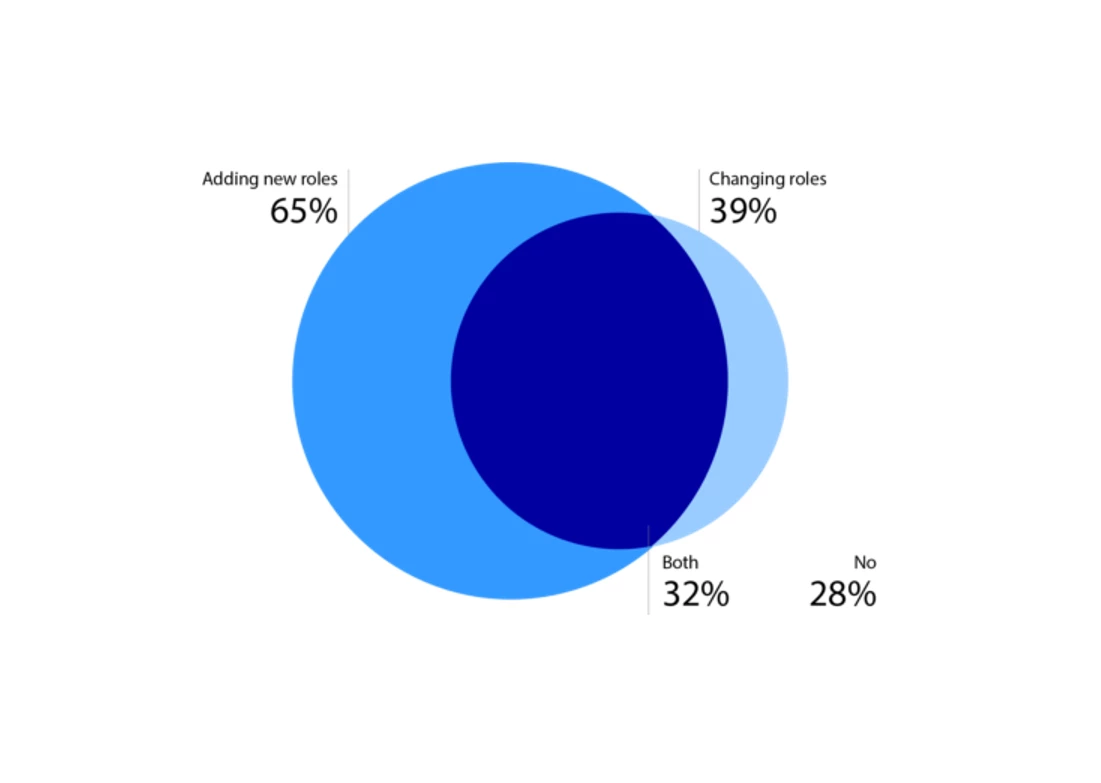

Ville: The C-suite has been growing for years and new roles are always being added — roles like CINO (Chief Innovation Officer) are relatively new. It has even become quite fashionable to add new roles to signify the company’s focus. Facebook has employed a Chief Privacy Officer to demonstrate that it is taking the issue seriously. Likewise, Coca-Cola has added a Chief Sustainability Officer. Some of these new roles, like Chief Impact Officer, feel like a passing fad. Others are more likely to be here to stay.

Johan: That’s true, but the changes aren’t limited to new roles being added.

Tino: Exactly. I work with CFOs regularly and I’ve seen their role change dramatically. The core function may have stayed the same, but new tools — like increased automation and real-time data insights — are helping them work in new ways. They haven’t needed to design a new role to enable innovation and improve liquidity management. But the definition of roles has changed.

Katy: I think that the pecking order has changed. Even within the C-suite there’s a hierarchy, and roles like the CFO have traditionally been seen to be more powerful than ones like CMO. I think that partly explains some of the name changes. For example, we’ve seen roles like Chief Revenue Officer and Chief Growth Officer emerge, often encompassing the CMO role but showing the additional responsibility.

I work with CFOs regularly and I’ve seen their role change dramatically. The core function may have stayed the same, but new tools — like increased automation and real-time data insights — are helping them work in new ways

Johan: Digital transformation hasn’t really reached the C-level yet — not properly. Although we could argue a strong case that it should have.

Tino: The problem is, digital transformation means different things for different companies, so finding the right skillset is a challenge. But ultimately, every company is going to have a digital representation one way or the other in the foreseeable future — COVID-19 has highlighted the importance of that.

Ville: Innovation and transformation aren’t just buzzwords anymore, they’re key drivers that inform where and how money is spent, and how businesses attract and serve future customers. This isn’t a project, companies need to change how they do business permanently. And ultimately, that change comes from the C-suite.

Johan: COVID-19 has created a new urgency in corporates. We consumers have changed our habits dramatically — because we’ve simply had no choice. Enterprises had to come up with new solutions to meet these changing demands. And as a result we’ve seen a very notable step up in the level of ambition from companies, and the level of priority given to coming up with new ideas, new capabilities, and new ways to serve customers.

Katy: Companies that didn’t have a CINO before COVID-19 are likely to be looking into one now. It may be that they don’t have that title, but businesses across the world are now likely to be investing in people and skills that can help drive future innovation.

Tino: Before, the C-suite may have held back disruptive change, fearing the impact on established revenue streams and sources of profit. What the C-suite needs now is some fresh blood that can come in and open its eyes to the possibilities of the future. A Chief Disruption Officer, if you will, someone who can play devil’s advocate and support the next big idea, and the next one.

Innovation and transformation aren’t just buzzwords anymore, they’re key drivers that inform where and how money is spent, and how businesses attract and serve future customers. This isn’t a project, companies need to change how they do business permanently.

Tino: Liquidity is an important consideration for all businesses. Regardless of how many assets a company has, it must be prepared to use them in the best way and manage money appropriately. But could that translate into a C-level role in the future? No, not really. I think that function still very much belongs within the treasury, but the treasury itself will need to evolve.

Ville: I disagree, I think there is scope for a CLO — but I do agree that treasuries need to evolve in the first place to facilitate it. As everything becomes digital, companies will no longer be able to isolate cash movement and liquidity from the rest of the business. Everything will be available in real-time — that means the question of payments, cash and liquidity will become part of each and every facet of the company. That’s creating a completely new and unique challenge for treasuries and finance departments. Suddenly, they need to be involved in the day to day running of the business, and have an eye on everything, rather than simply focusing on managing and optimising liquidity and cash pools around the world. A CLO could help bridge that gap.

Johan: This all comes down to the digitisation of the treasury and the bank-to-customer relationship. It’s a monumental challenge, but one that could have tremendous efficiency gains and bring more transparency into the overall economy.

Katy: We’re still a way off a treasurer being able to click his or her way to a new €5 billion revolving credit facility. It’s in the nature of business that this process is complex and unique. But banks are looking at ways to automate and improve the process. Having dedicated roles to act on behalf of the treasury function could propel this forward. There’s no reason why that role couldn’t be a CLO.

There have been huge advances in measuring customer satisfaction and turning transactional relationships into long-term loyalty. A Chief Customer Experience Officer would help ensure that the company’s values extend beyond the annual report into every interaction with its customers.

Katy: Yes, a Chief Customer Experience Officer (CCXO). Lots of the things that we’ve talked about today revolve around increasing customer-centricity. That’s what digitalisation is all about: delivering better, more personalised products and services. There have been huge advances in measuring customer satisfaction and turning transactional relationships into long-term loyalty. A CCXO would help ensure that the company’s values extend beyond the annual report into every interaction with its customers.

Tino: A Chief Sustainability Officer (CSO). I’m really proud that Nordea has been a leader in green initiatives, but a CSO would be responsible for so much more than that. Their mandate would be to align the organisation’s business model and operations with its sustainability strategy. That is easier said than done, it requires wide cross-company collaboration and excellent communication to all stakeholders. High-level ownership is critical to making that happen, and that’s why I think it deserves a place in the C-suite.

Ville: One of the hot topics right now is purpose and I would love to see all companies have a Chief Purpose Officer (CPO). A company’s purpose is a statement of why the company exists. Nordea’s talks about how we help individuals and businesses realise their ambitions. That drives what we do, how we interact with customers and how we treat our employees. The role of CPO would, by its nature, be disruptive. By representing what customers and employees want, the holder would always have an eye on the future.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more