Insights from experts

In this report's interviews, leading electronics retailer Elkjøp Nordic's CEO Erik Sønsterud shares how the COVID-19 pandemic required a major step-up in the company's online offering, and how this has brought lasting changes to the business model.

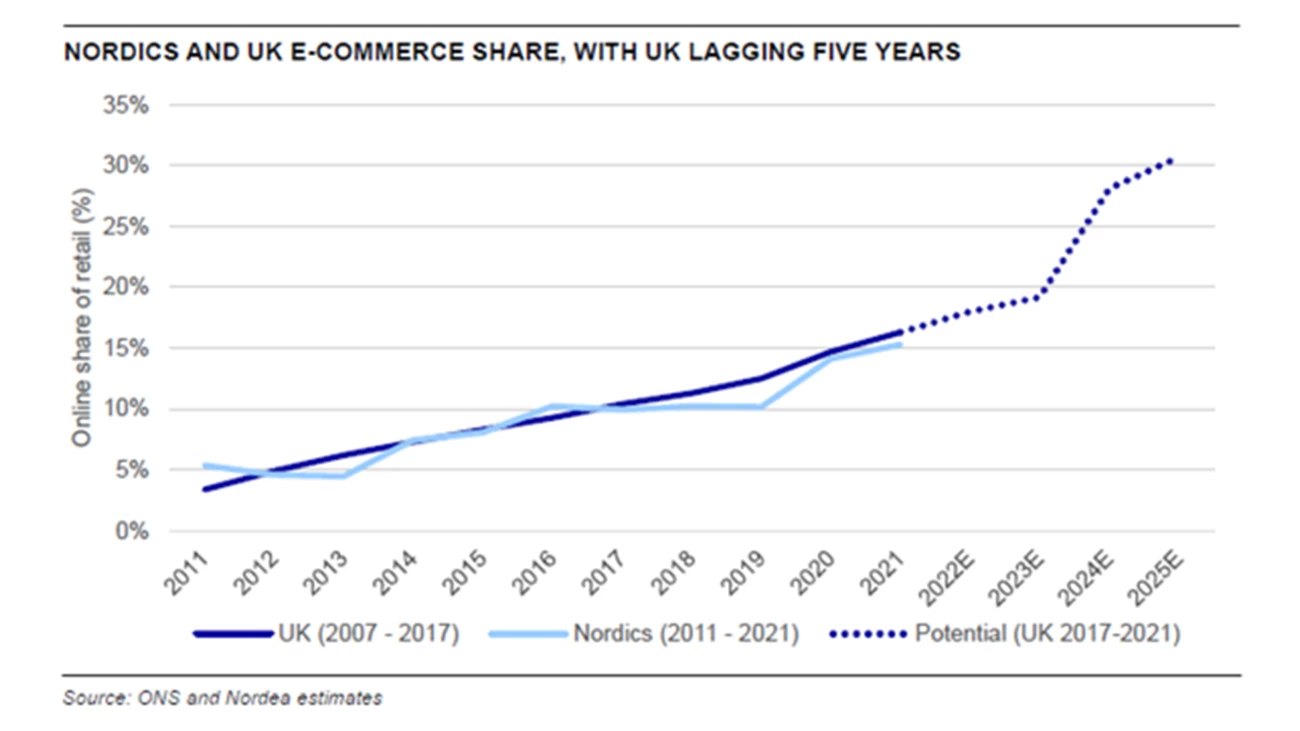

“There is a pretty strong case, both from the South Korean experience during SARS as well as early post-COVID evidence, which suggests that we can expect a short-term bounce-back favouring physical retail, followed by continued medium- and long-term online migration to a new saturation level,” Sønsterud says.

PostNord's CEO Annemarie Gardshol gives an e-commerce fulfilment perspective from the point of view of a logistics provider.

“We are constantly becoming more flexible, and today we are even more capable than before COVID-19,” she says.

From Nordea, Harald Ström draws on his long and international experience as a corporate finance adviser to retailers, and Daniel Ovin from Equity Research elaborates on investors' views on online retail over time.

Orvin notes that, at the moment, investors are generally avoiding e-commerce companies, as rising interest rates hamper growth-driven companies and high inflation dampens consumer confidence. While he expects the trend to continue into 2023, inflation will likely fade and interest rates stabilise in the not-too-distant future, he says, adding:

“We believe this is likely to turn investors' attention back to high-growth online retail companies.”