More information

Nordea has launched its own ESG ratings for Nordic companies. Find out more in this interview with Marco Kisic, Head of ESG Research at Nordea.

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaESG ratings have grown in popularity as a way for investors and other financial stakeholders to assess companies’ environmental, social and governance performance. What goes into these ratings, and why do they matter?

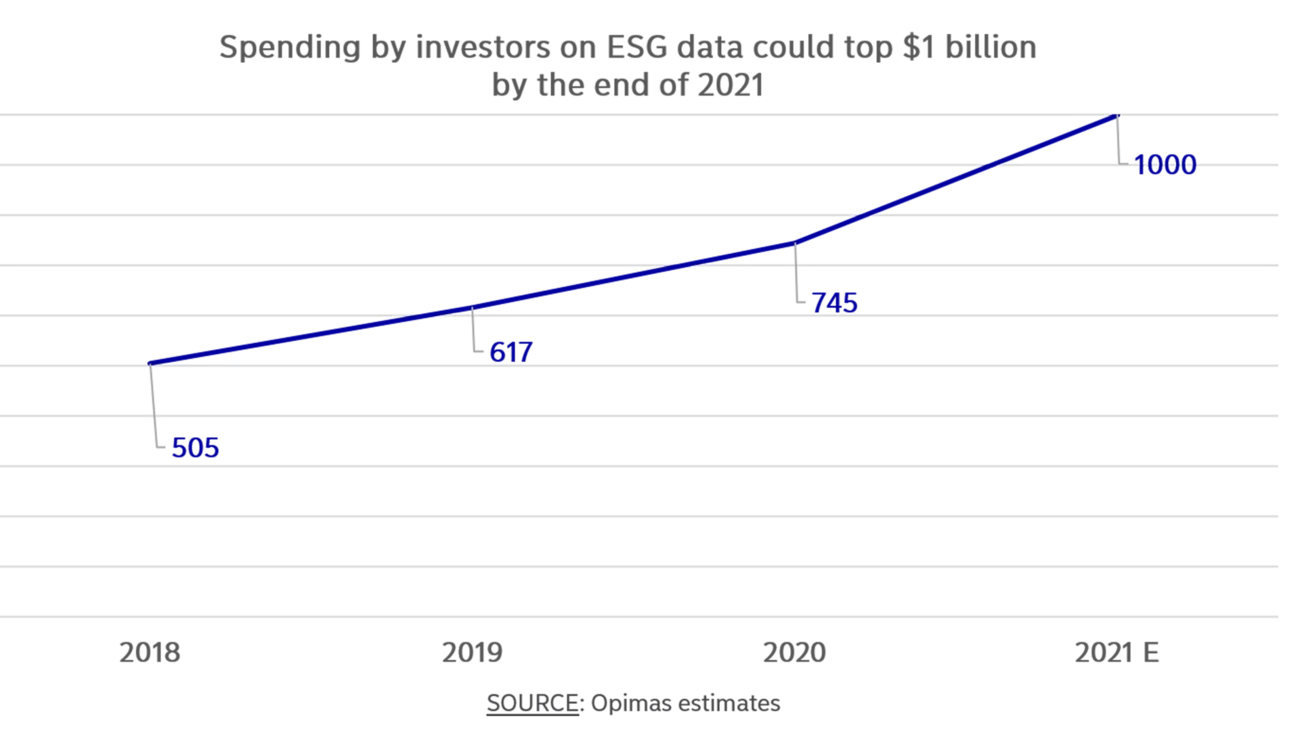

In an era dominated by increasing demand for ESG disclosures from both investors and regulators, ESG ratings have risen in popularity among all stakeholders in the ESG market.

Stock exchanges, credit rating agencies as well as ESG data and research providers all coalesce around a common vision for these ratings as a product to inform and improve investment decision-making.

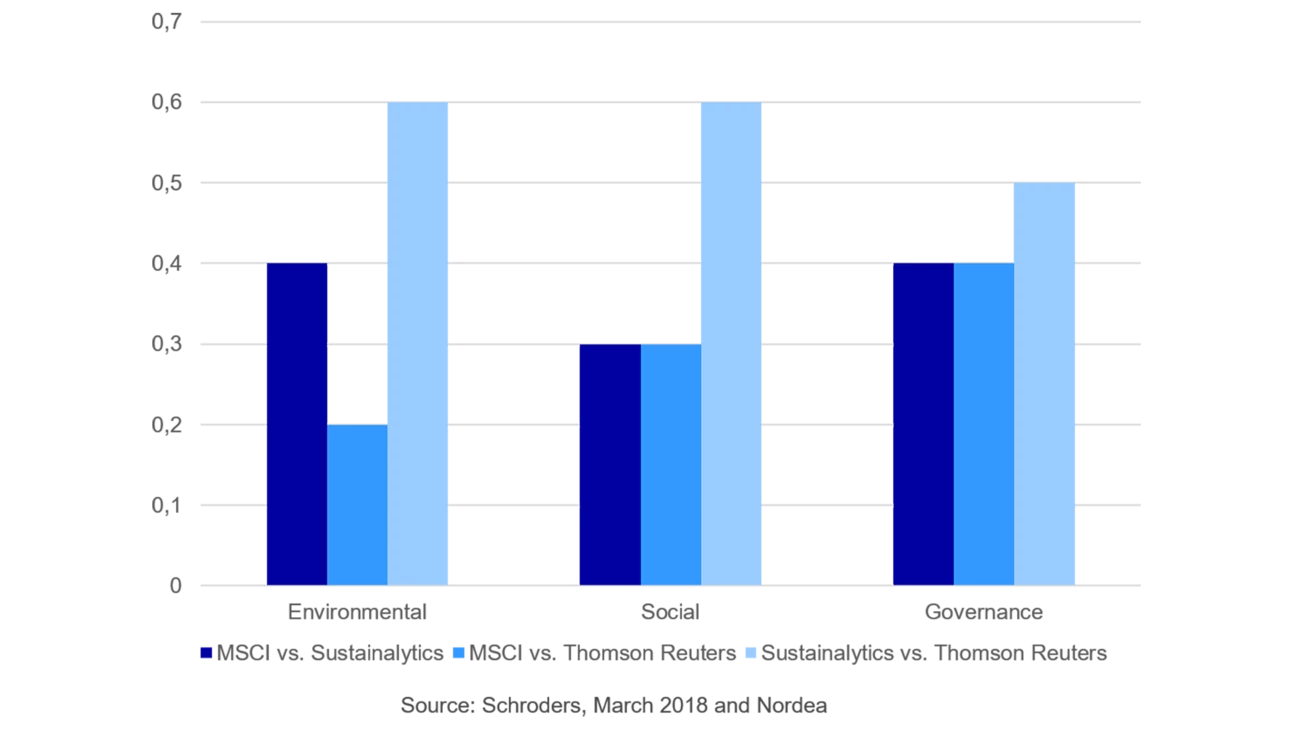

Yet the proliferation of ESG ratings has also added some ambiguity to the concept. In an effort to differentiate themselves from their peers, rating providers tend to approach these ratings in different ways.

Asset managers are looking to ESG data and ratings providers to produce products that inform and improve investment decision making.

– ESG ratings are an ambiguous concept, resulting in diverging approaches.

A look at the product and service offerings in the ESG market reveals a dilution of the “ESG ratings” concept, for example, with “ESG Relevance Scores”, “ESG Evaluation” and “ESG Risk Ratings” (not to be confused with ESG in credit ratings).

Such different names give rise to actual divergences in the methodologies adopted by the providers. These divergences occur at different stages of the rating process and can be grouped into 3 main categories:

These divergences make it difficult to compare ratings from one rating provider to another. This is due to the fact that the measurements of ESG performance are not based on the same underlying components.

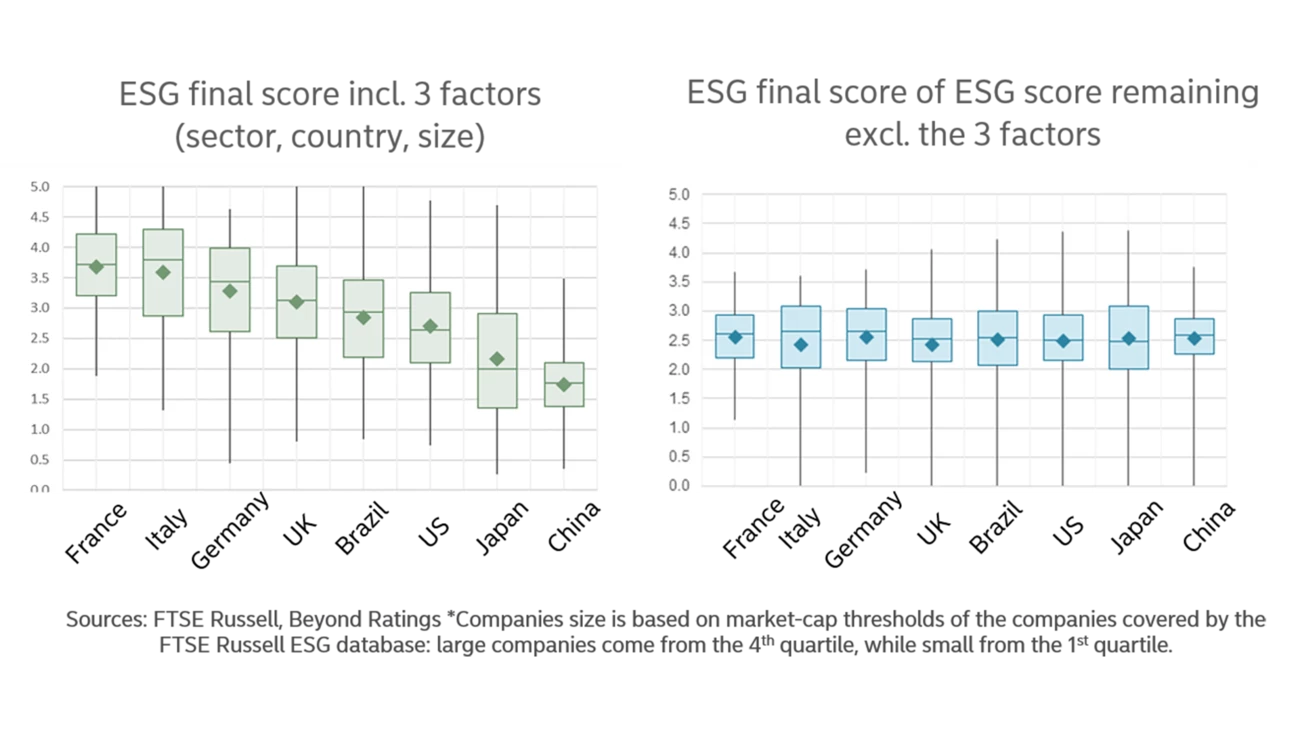

– ESG ratings are subject to market biases.

What’s more, ESG ratings are based upon various sources of data which can, themselves, be biased by macro characteristics.

The size, sector and geographical location of the issuer, for example, can all influence the final rating:

To neutralize the potential effect of these factors, most of the rating providers factor local regulations/conventions into their scoring methodology by adjusting its main components (usually exposure or management/performance score). However, others do not necessarily adjust their ratings for these factors. Rating provider V.E (Vigeo Eiris), for example, voluntarily excludes local regulations from its ratings.

The existence of such biases, alongside the diverging approaches, underscores the importance of understanding the actual methodology behind these ratings.

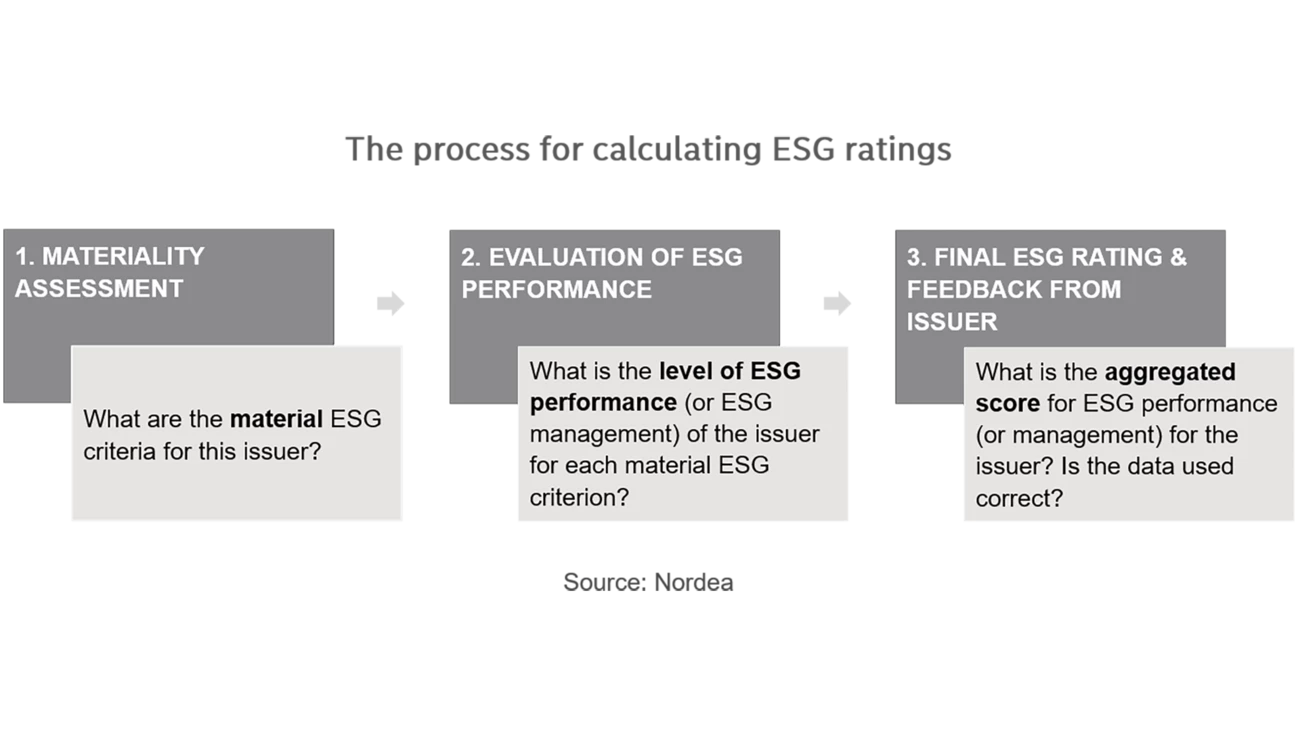

Overall, rating providers follow similar processes for calculating their ratings.

Each rating provider starts off the rating process by focusing on material environmental, social and governance factors.

ESG ratings are based on very different scales, depending on the rating provider. For example, MSCI rates an issuer on a scale from AAA (“leader”) to CCC (“laggard”), while Sustainalytics uses a 0 (best, “negligible”) to 100 (worse, “severe”) scale.

At the end of the process, issuers have the opportunity to engage with the rating provider in order to give feedback on the rating and, more specifically, the accuracy and completeness of the data used.

For the past few years, we have observed an encouraging tendency for rating providers to make their ratings public, for example MSCI and Sustainalytics, recently followed by S&P Global in February 2021.

ESG ratings are not the only indicators of ESG performance or the sole drivers for investment decisions. Rather, they are usually part of a larger suite of offerings where investors or issuers can find additional products and services for their purposes.

The ESG market is constantly evolving, and we see shifts in how investors use these ratings. While some would rather use one service provider due to cost, partnership or convenience, others prefer to complement one provider’s ratings with other products or services. Other investors will simply use the raw ESG data gathered by rating providers as input for their in-house assessment models for investment decision-making.

About the authors:

Jacob Michaelsen, Head of Sustainable Finance Advisory, Nordea

oskar.hagman [at] nordea.com (Anaïs Gilbert), Data & Analytics, Nordea

Nordea has launched its own ESG ratings for Nordic companies. Find out more in this interview with Marco Kisic, Head of ESG Research at Nordea.

Sustainable banking

Morningstar Sustainalytics has recently published a new report identifying companies that are taking steps to reduce emissions, set actionable targets and implement good governance practices. Nordea is highlighted for its significant progress in reducing emissions and its comprehensive climate targets.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more