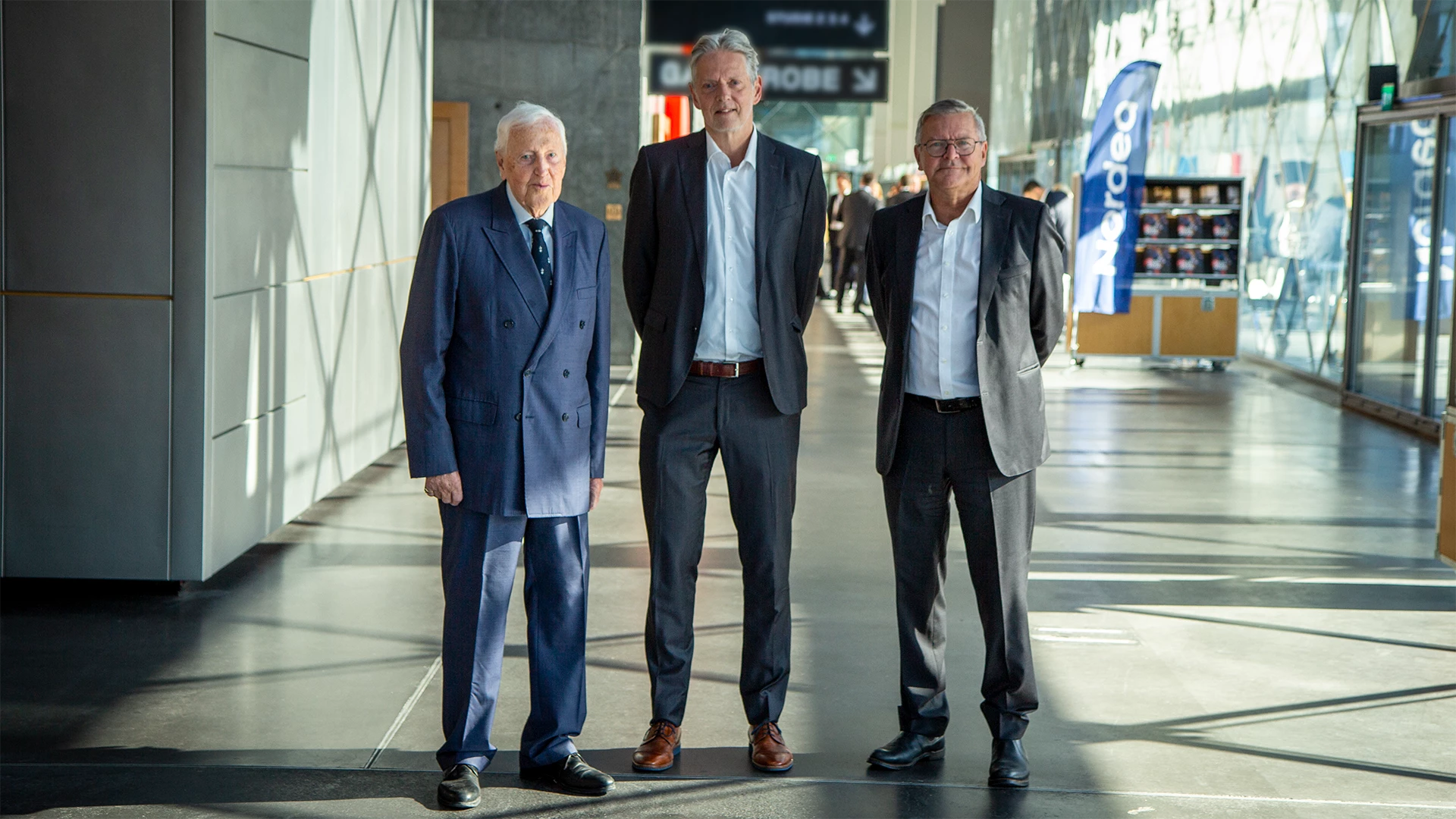

Thygesen, who was one of the original architects of the economic and monetary union in the EU, shared his views on the reform (which he noted were not necessarily the views of the European Fiscal Board). He said the increased “national ownership” should raise the legitimacy of the new rules and increase compliance, as well as the willingness by the Council to enforce countries’ fiscal plans.

He did point to some “major omissions” in the new reforms, including leaving out any element of joint EU initiatives to supplement national efforts at stabilisation. He also highlighted that the fiscal rules face significant challenges, including the need for spending on defense as well as energy infrastructure to advance the green transition.

Denmark’s success story

Dovetailing with Thygesen’s presentation, Lars Rohde, former Chairman of the Board of Governors of Danmarks Nationalbank, zoomed in on Denmark as a success story. He reflected on the Danish economy’s 40-year journey from being “at the edge of the abyss” to having solid fundamentals.

Denmark has had a current account surplus since 1990, and it went from being a net debtor nation to a creditor nation around 2008. “So how did Denmark go from Northern Europe’s Italy to Northern Europe’s Switzerland or Germany?” Rohde asked.

He highlighted a range of factors, including an increasing understanding among politicians of how small, open economies work, as well as a willingness to find compromises on tough issues, such as labour market reform and increased retirement age. He also emphasised the importance of Denmark’s fixed exchange rate policy against the euro, in place since 1982.