Key measures of the Simplification Omnibus package

Below we lay out the main proposed changes in the Omnibus I “Simplification” package:

Corporate Sustainability Reporting Directive (CSRD): One of the main measures in the proposal is an 80% reduction of the companies in the scope of the CSRD. Under the new proposal, companies with over 1,000 employees – up from 250 originally – would be in scope. The proposal also postpones reporting by two years, commits to revise the European Sustainability Reporting Standards (ESRS) to substantially reduce the number of data points, and stops the development of sector-specific standards.

Corporate Sustainability Due Diligence Directive (CSDDD): The CSDDD, approved in 2024, is subject to relatively large changes. For example, its application is delayed by a year to 2028, and a due diligence is required every five years instead of annually. The due diligence requirements are restricted to direct suppliers only, as opposed to the entire supply chain, and will not be required from suppliers with fewer than 500 employees. SMEs receive protection against excessive information requests from companies in scope of the CSDDD, and transition plan requirements are aligned with the CSRD.

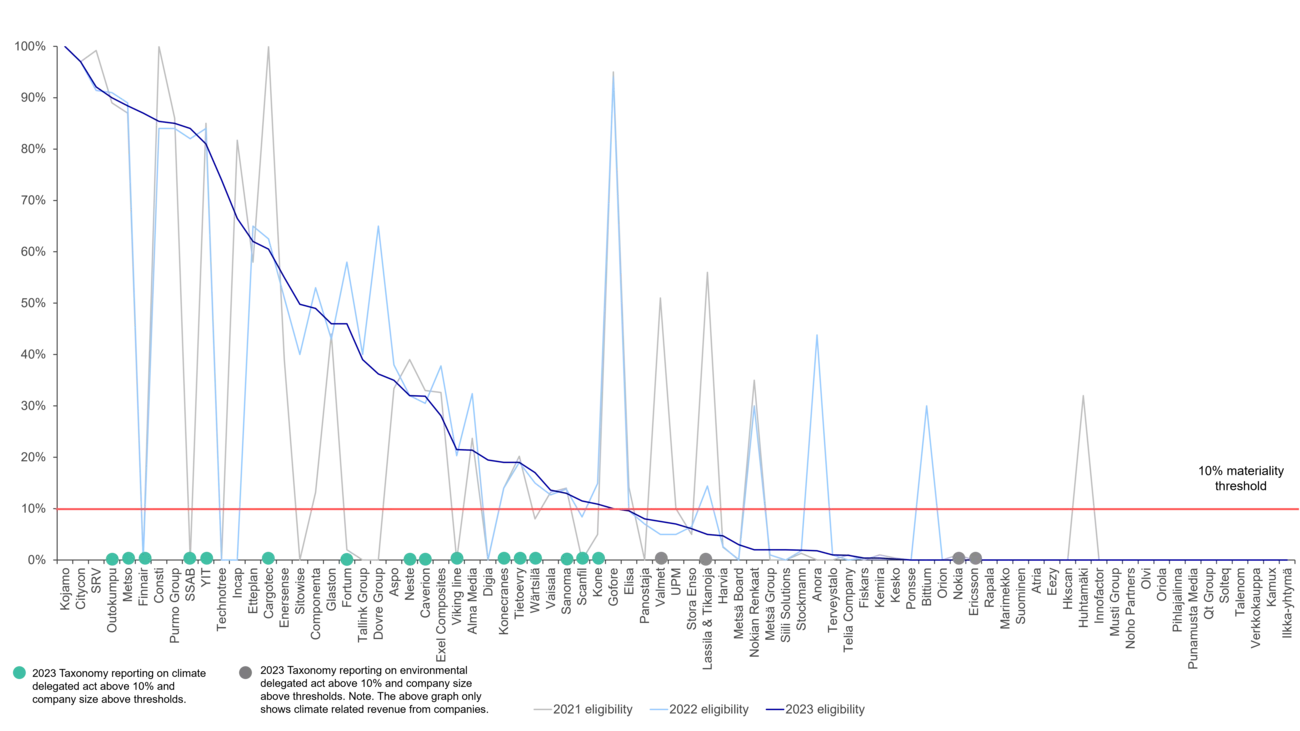

EU Taxonomy: Taxonomy reporting will be mandatory for companies with more than 1,000 employees and above EUR 450m in revenues, with a new 10% materiality threshold introduced. In addition, proposed amendments to delegated acts are estimated to reduce data points by 70%.

Carbon Border Adjustment Mechanism (CBAM): The proposal would exclude around 90% of the importers currently covered (accounting for 1% of emissions in the scheme) by excluding importers of eligible goods with a weight less than 50 metric tonnes per year.