Financing still a question

The main EPBD trigger will be the publication of the EU countries’ renovation plans and related measures by December 2025 at the latest. Some countries have already started to make early moves, with France, for example, banning the rental of high energy consumption buildings from January 2025.

A political shift in the EU with the recent parliamentary elections could water down the requirements to some extent, but the broad framework is likely to remain intact, according to Kisic. He expects countries to announce new subsidy plans and sanctions in conjunction with their renovation plans.

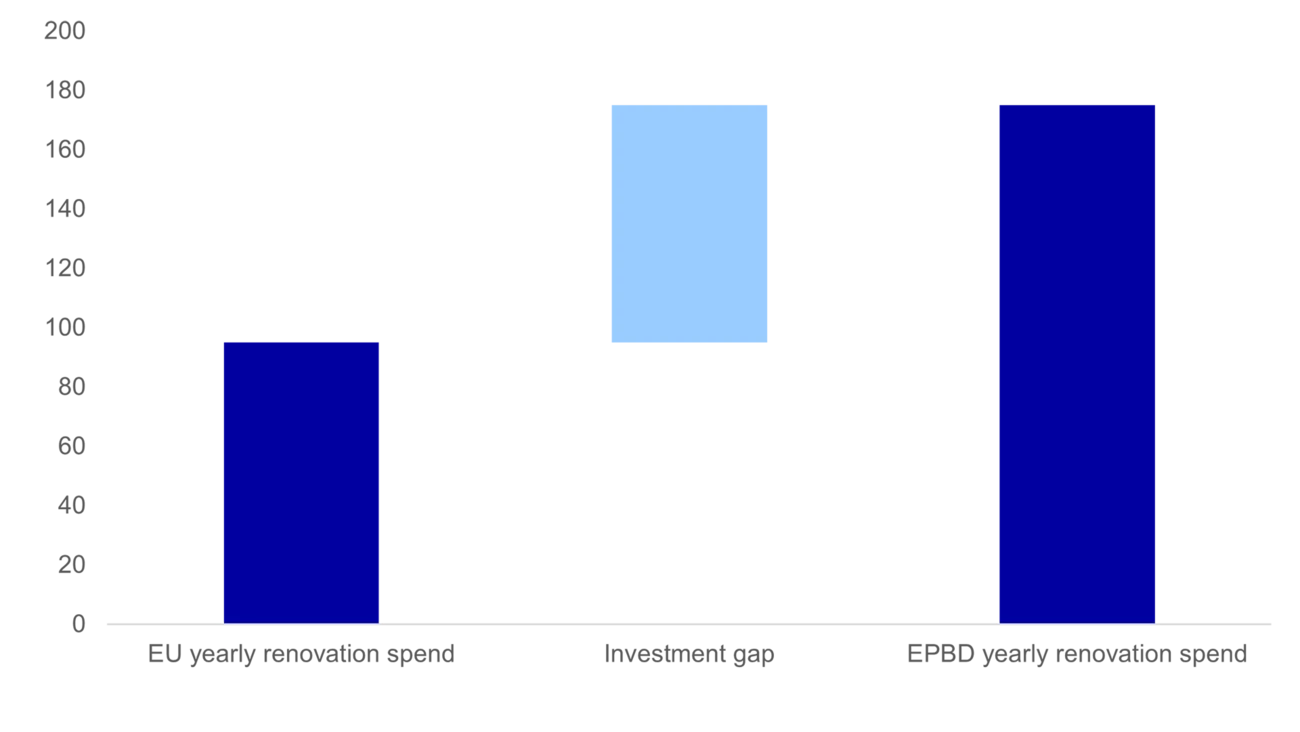

Kisic notes that financing is the main question mark, and a mix of EU facilities, innovative debt financing solutions and equity will be required. Today there is already some EU money on the table, but only a small fraction of the required investment.

Which renovation measures?

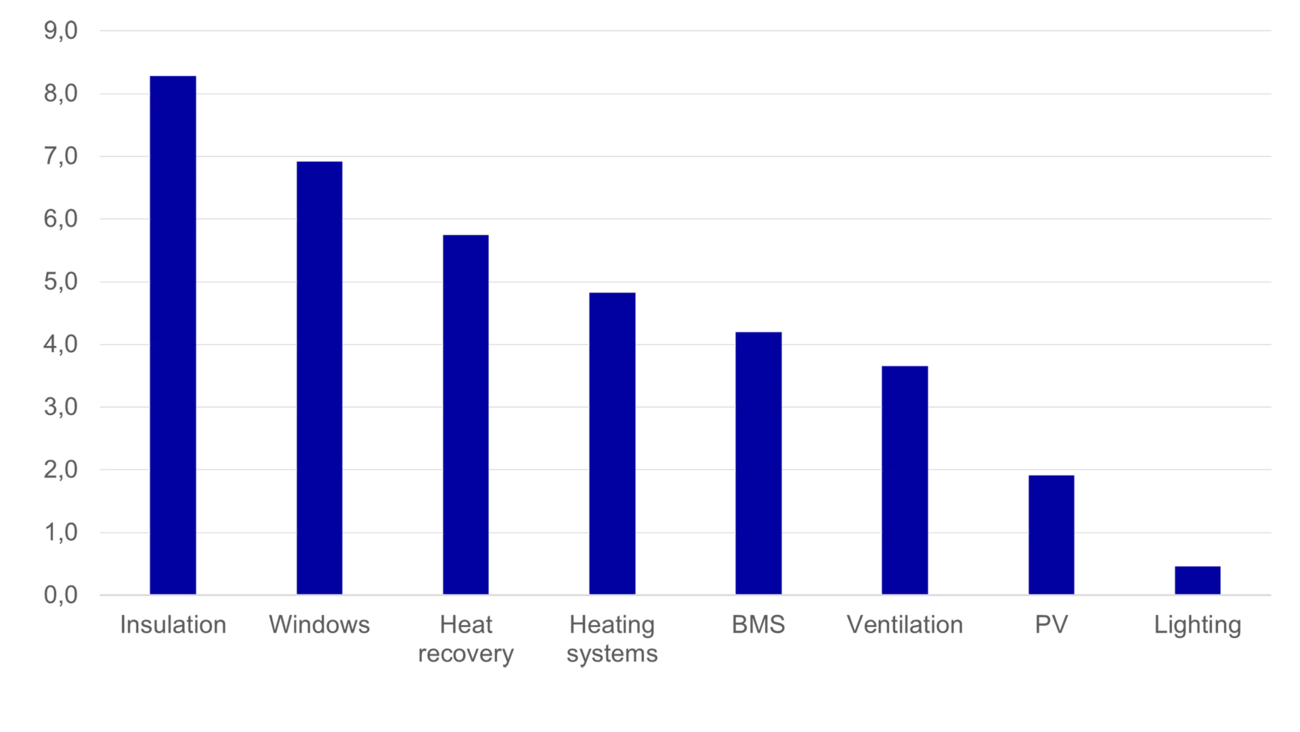

Today, there is little consensus about which renovation measures are likely to be prioritised in the renovation wave. The ESG Research team analysed the Italian Superbonus, a large-scale renovation scheme recently implemented, conducted interviews with Swedish real estate companies and installers and surveyed academic research. Based on that review, the team concludes that insulation, windows, heating systems and heat recovery are likely to be the most popular measures.

Renovation Wave measures: Priority index

(Y-axis is a score based on rankings obtained by combining and weighting the three different criteria)