“The problem of fossil emissions is not entirely black and white, either. We know that modern societies need an increasing amount of energy. In the Nordics, our need for heating during winter will not go away. Even with large improvements in energy efficiency, we know that the global demand for energy will increase by at least 20% in the next 20 years. At the same time, the amount of green energy produced today still only covers roughly 20% of the global energy need. So, we simply need to give companies some transition time to adopt and invest in modern, and sometimes quite costly, green business models and technologies. At the same time, we need to send a clear message to companies that aren’t making these investments,” says Eric Pedersen and adds:

“If we were to just exclude companies based on their present emission levels or use of fossil fuels, we would ignore their transition efforts completely and wouldn’t be able to make this distinction.”

Why invest in companies that need to change?

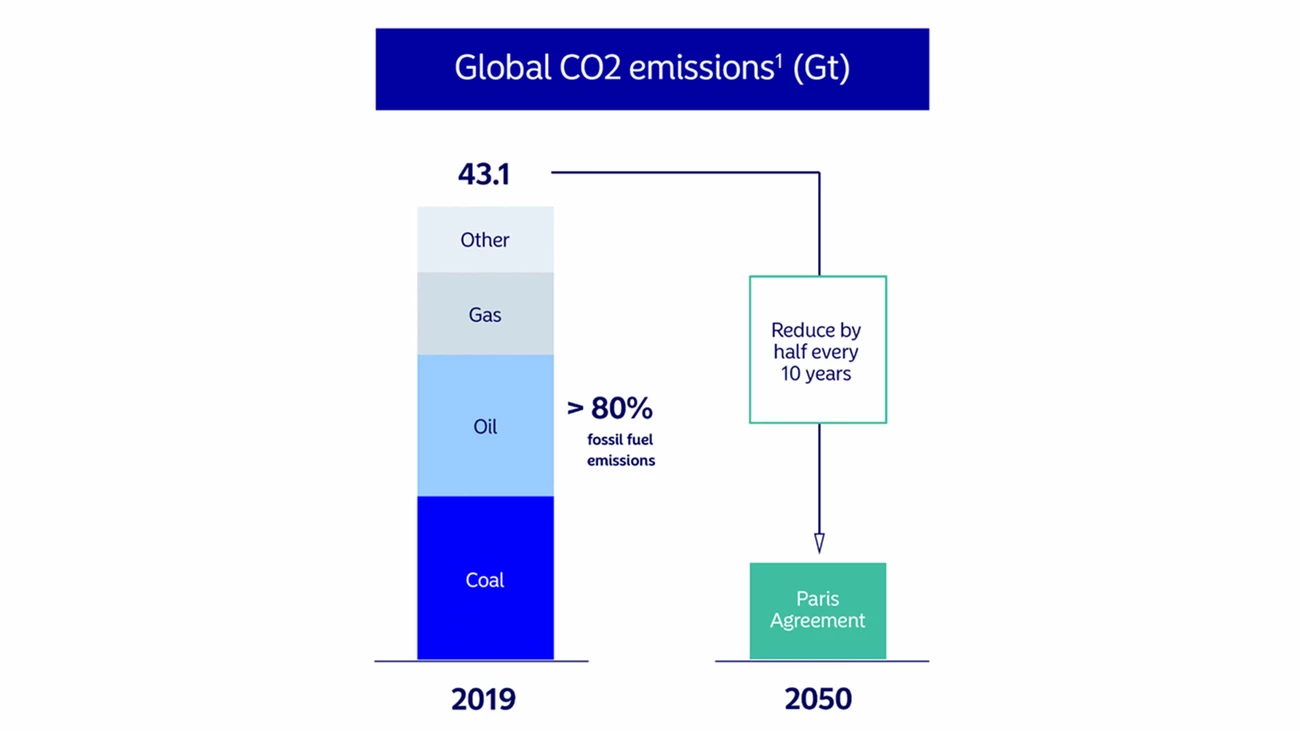

“As we all know, climate change is a problem we simply need to address as soon as possible. Therefore, as an investor, it makes sense to take whatever measures you can to achieve the most with the shortest possible delay. At Nordea, we believe that the most important measure we can take to limit global warming is to bring down emissions from fossil fuels. This can only be done if we recognise that the complete elimination of fossil fuels in most countries is a decade or more away. Many of the key energy providers of tomorrow are currently in a phase-out period where they are reducing the use of fossil fuels,” Eric Pedersen emphasises.

“Another upside in aligning investments to goals of the Paris Agreement is the fact that it is widely supported globally and signed by 197 countries. With our approach to fossil fuels, we also make sure that the assets in our funds with a sustainability focus are working for this same target,” he says.

How can this be done in practice in a trustworthy way?

“We think it is important that the assessment is done as transparently as possible, based on carefully developed tools and indicators, and in line with independent industry standards. We use the research from the Transition Pathway Initiative (TPI) to understand if a company’s strategy helps or hinders the Paris Agreement goals. TPI is rapidly becoming the go-to corporate climate action benchmark, and their focus on future rather than past climate efforts makes their analysis a powerful tool for investors to help drive climate action,” says Eric Pedersen.

“In addition to TPI, there is a variety of climate-related analyses in the market, and understanding them requires competence, experience and time. I am very pleased to work as part of a team of award-winning professionals that have been exploring climate issues for more than a decade – that has made my work much easier.”

“Even if climate data is growing enormously, we are still lacking adequate assessment tools and processes for many industries. We continue to contribute to their development with our long experience, and hopefully the financial industry will soon have even better tools to make good climate investment decisions. Two thirds of global emissions come from fossil fuels, so it really is companies in the fossil fuel-dependent sectors that need to change the most.”