Expect ‘way higher rates than we have today’

Inflation is proving to be “sticky in the way central banks don’t like,” Unell says, noting that it has spilled over from goods to services and also to wages in the US. He expects the same to happen in Sweden and the rest of Europe, with a delay due to labour union frameworks. The US Federal Reserve and other central banks are now responding with a hawkish pivot.

“Until you see central banks’ rate hikes starting to bite and bring inflation under control, rates are going to continue to increase,” says Unell. “We’re surprised the levels aren’t higher than they are. We still have very low rates.”

The market has adopted the narrative that inflation will be dealt within the next 15 to 20 months, as the yield curve shows. Unell disagrees, doubting that such a short time span will be sufficient. He calls the latest developments a “paradigm shift” in inflation and central bank policy.

“The low inflation world we’ve lived in since the financial crisis ended with the pandemic, and it’s not likely to return,” says Unell. He points to the war in Ukraine, efforts to eliminate fossil fuels and reduce energy dependence as well as higher production costs in China as contributing factors.

“Risks are tilted towards way higher rates than we have today,” he says.

Interest rate caps: The best of both worlds

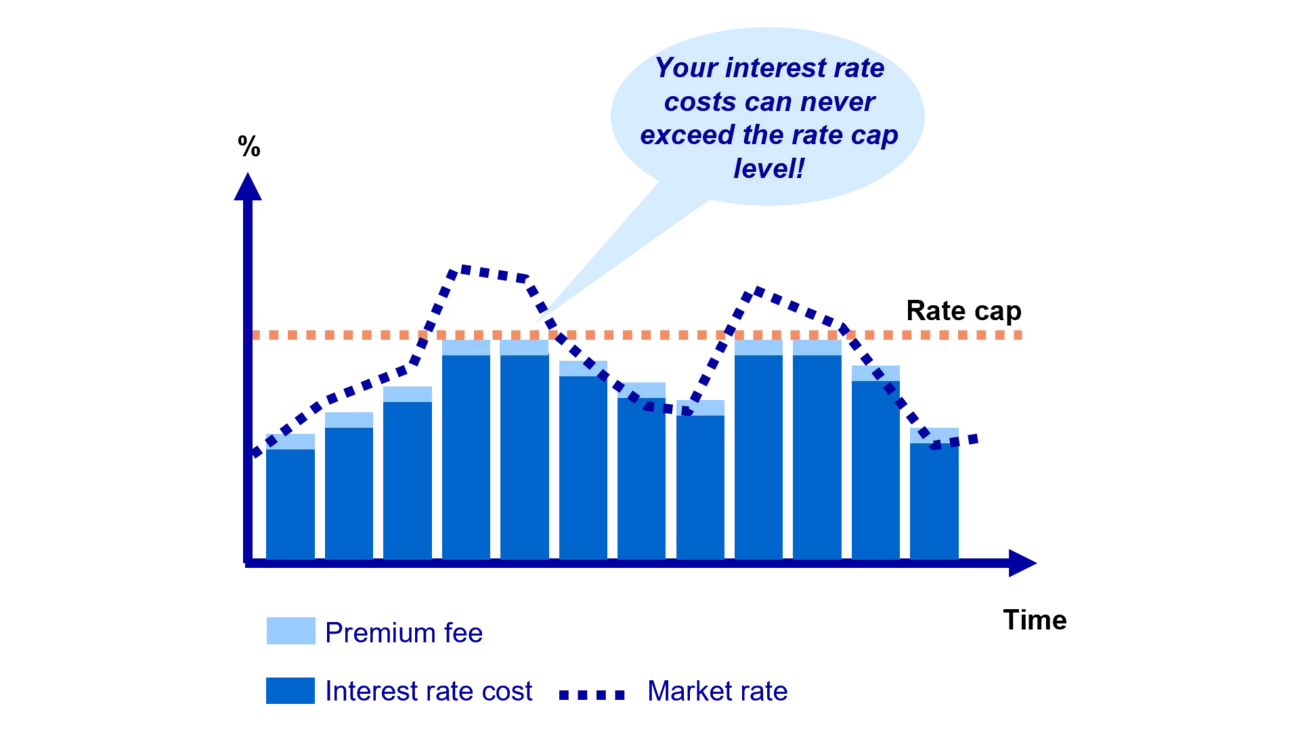

There are ways for companies to take advantage of today’s still historically-low rates, while also protecting against future rate increases. Nordea, for example, offers corporate loans with interest rate caps, that function like a floating-rate loan that’s capped at a certain rate level.

Swedish companies are starting to act and take advantage of interest rate caps, says Hanna Lönnqvist, who works on the Swedish Derivatives Coverage team in Nordea Markets.

“This product has become quite appealing as fixed-rate loans have become more expensive in today’s market environment,” she says. “It’s the best of both worlds as you benefit from paying low floating rates now but also have protection if the rates go up beyond a certain level.”

The client sets the level of the cap and the maturity. In general, the lower the cap, the higher the premium, which is comparable to an insurance policy.