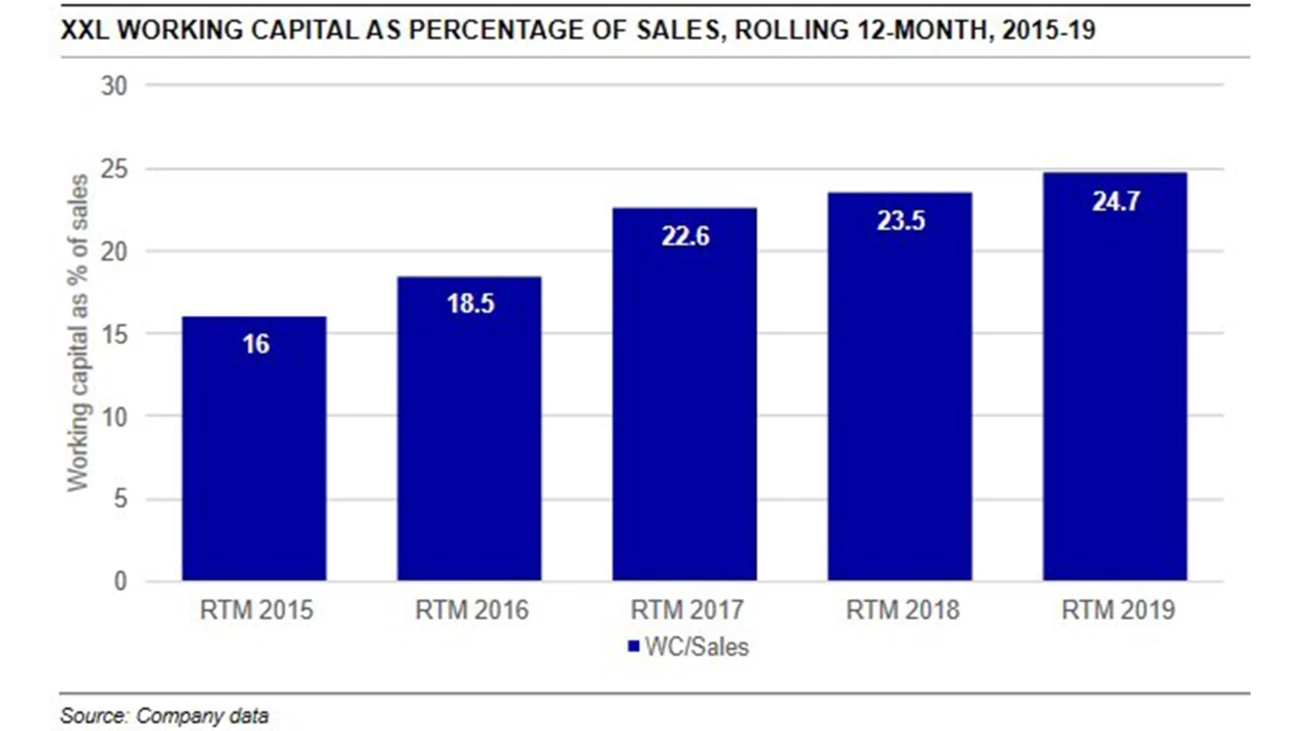

To address these issues, we started a working capital optimisation project in Q2 2019. After a somewhat slow start, I think it is fair to say that we really got it kicking from Q4 2019 and onwards. It has really been an impressive effort by the whole XXL organisation, strongly supported by the owners and the board of directors.

To sum up, the measures we have taken to strengthen our balance sheet are:

- A NOK 400m equity issue in Q4 2019

- A subsequent NOK 100m equity issue in Q1 2020

- Inventory reductions since Q4 2019

- Further NOK 400m equity issue in Q2 2020

- NOK 1.45bn new loan facilities in Q2 2020

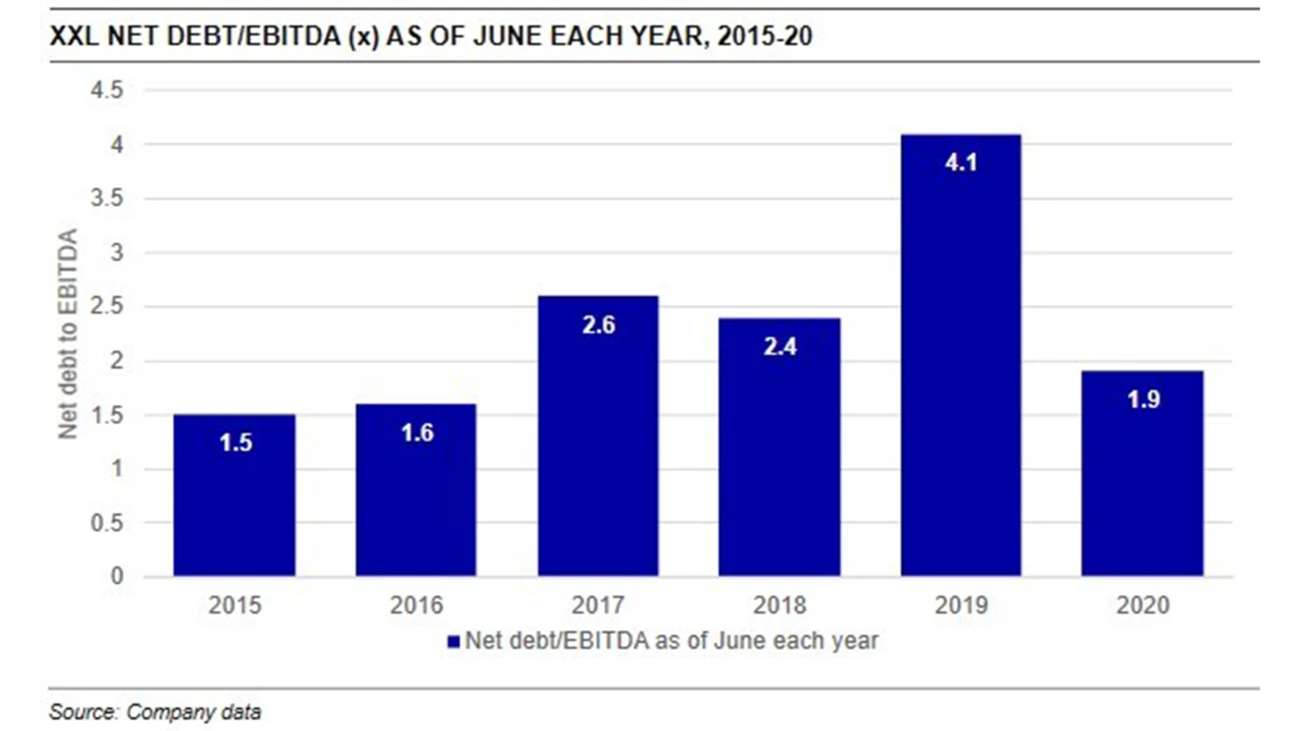

We have reduced our purchasing budgets by NOK 1.8bn and reviewed our assortment, and we ran a big Nordic clearance sale in February and March. This boosted our cash generation after a very weak winter sports season, which was helpful when COVID-19 lockdowns kept customers at home and unable to visit stores from March. In our Q2 report, we showed that we have reduced inventories by NOK 1.1bn, helping drive down our net debt to a mere NOK 300m by the end of Q2, versus NOK 2bn a year earlier.

In March, we realised that the COVID-19 pandemic meant we were facing a 'black swan' event. Our first priority was to establish crisis teams to decide on measures deemed necessary to protect the health of our employees. Our second critical priority was the health of XXL itself. Our revenue declined over 20% during the second half of the month. In Austria, a full shutdown forced us to close our stores, and we did not know what would come next in our Nordic home market. Our cash flow projections at the time showed that if we would have been forced to close our Nordic stores, we would have faced a default within weeks, perhaps surviving for a few months if we froze all spending and investments. We temporarily laid off some 1,000 staff and had plans to do more if we faced a full lockdown in the Nordics. We negotiated payment terms with suppliers and landlords. We cut marketing costs. And we secured additional funding and raised new equity capital.

Was it challenging to align the interests of shareholders and other stakeholders, weighing the costs of diluting shareholders against the benefits of securing financial strength to weather the COVID-19 storm?

Stein: Our shareholders initially wanted to keep a new equity issue as small as possible, of course preferring non-dilutive strengthening of our balance sheet by clearing inventory. But when we found ourselves in the lockdowns of March, it became obvious how quickly the cash burn would drain capital, and we also had to consider the views of our banks, as we had already highlighted a risk of a debt covenant breach in Q4, prior to the COVID-19 outbreak. We had to prioritise ensuring that we had the financial strength to weather whatever pressure COVID-19 would bring to the business. It was a matter of 'safety first'.

It would be a stretch to expect that a proposal to raise another NOK 400m of equity, after having raised NOK 500 the year before, would be popular. But I experienced very strong support from both major shareholders and from our banks. We were in a highly uncertain and challenging situation, and there was general agreement that decisive action was needed. A strong commitment from big shareholders who have been with us for a long time, like Altor, Ferd, Odin Fondene and Arctic, has been very helpful. And our rights issue was oversubscribed.