- Name:

- Kjetil Olsen

- Title:

- Chief Economist, Nordea Norway

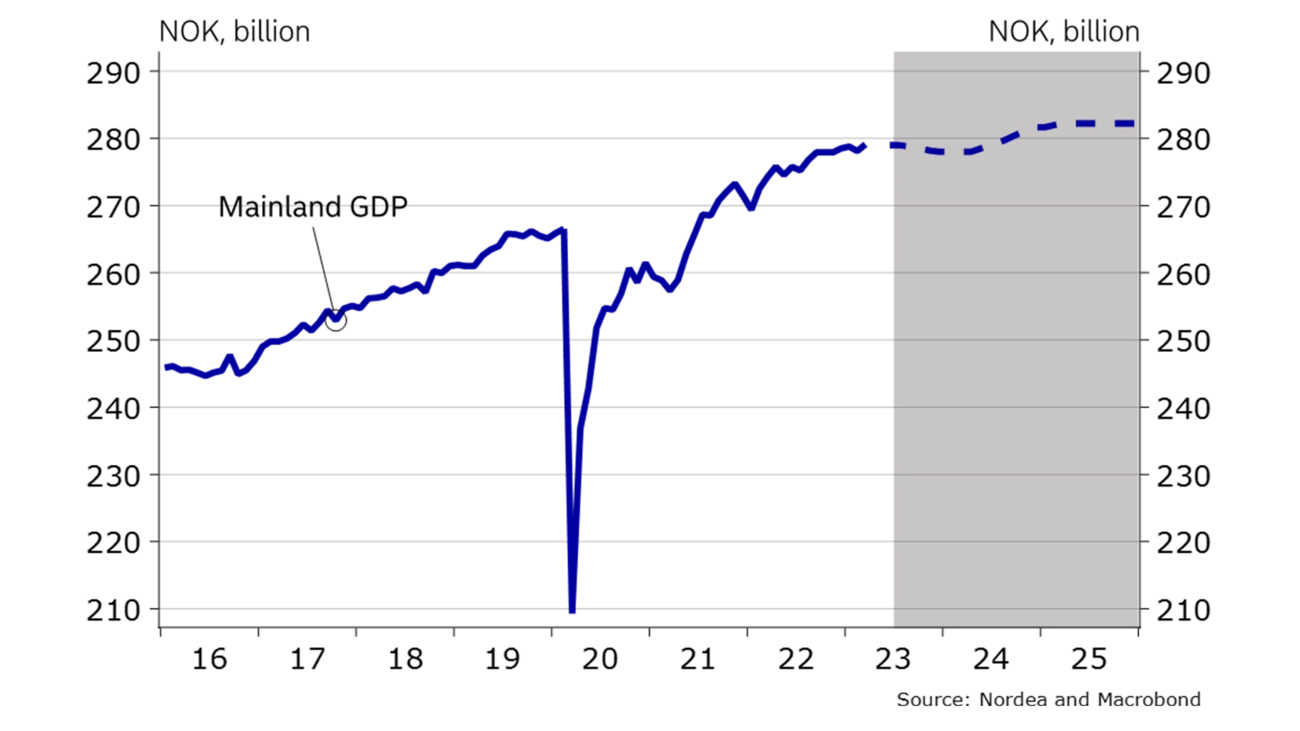

The Norwegian economy has continued to show great resilience to higher rates and price growth than expected.

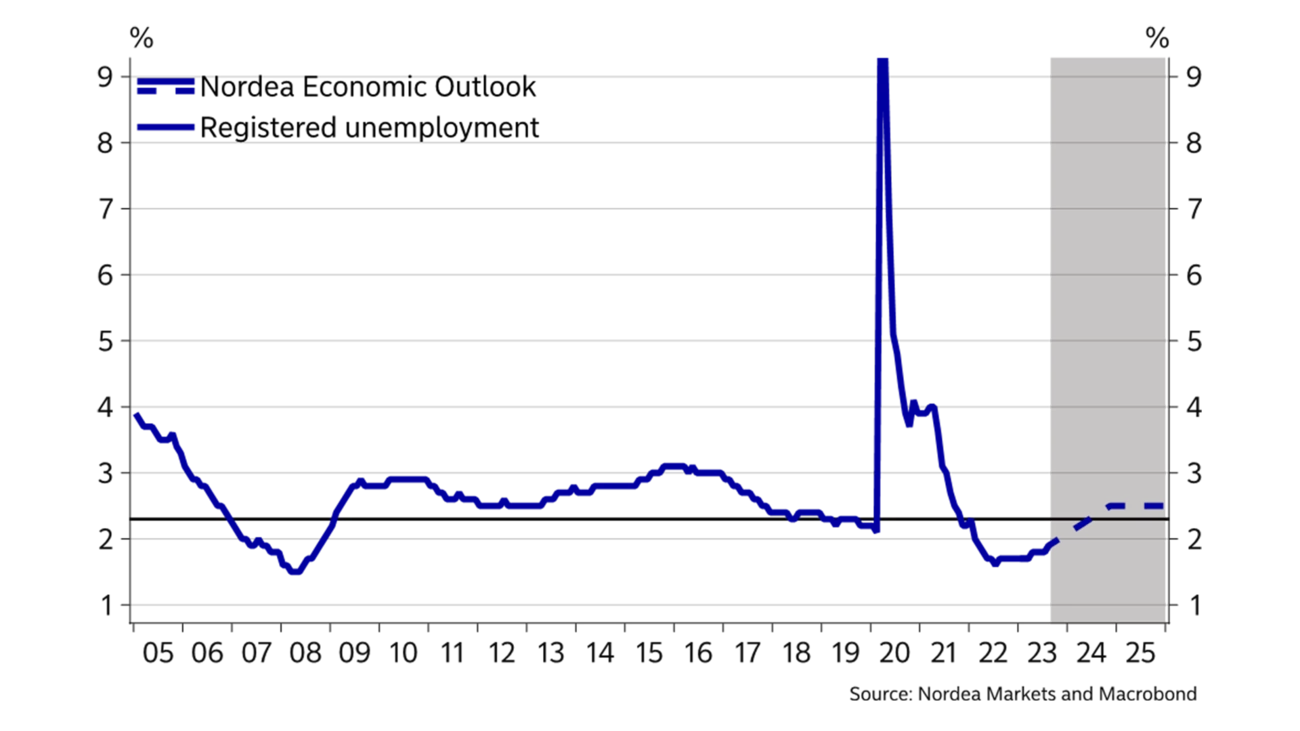

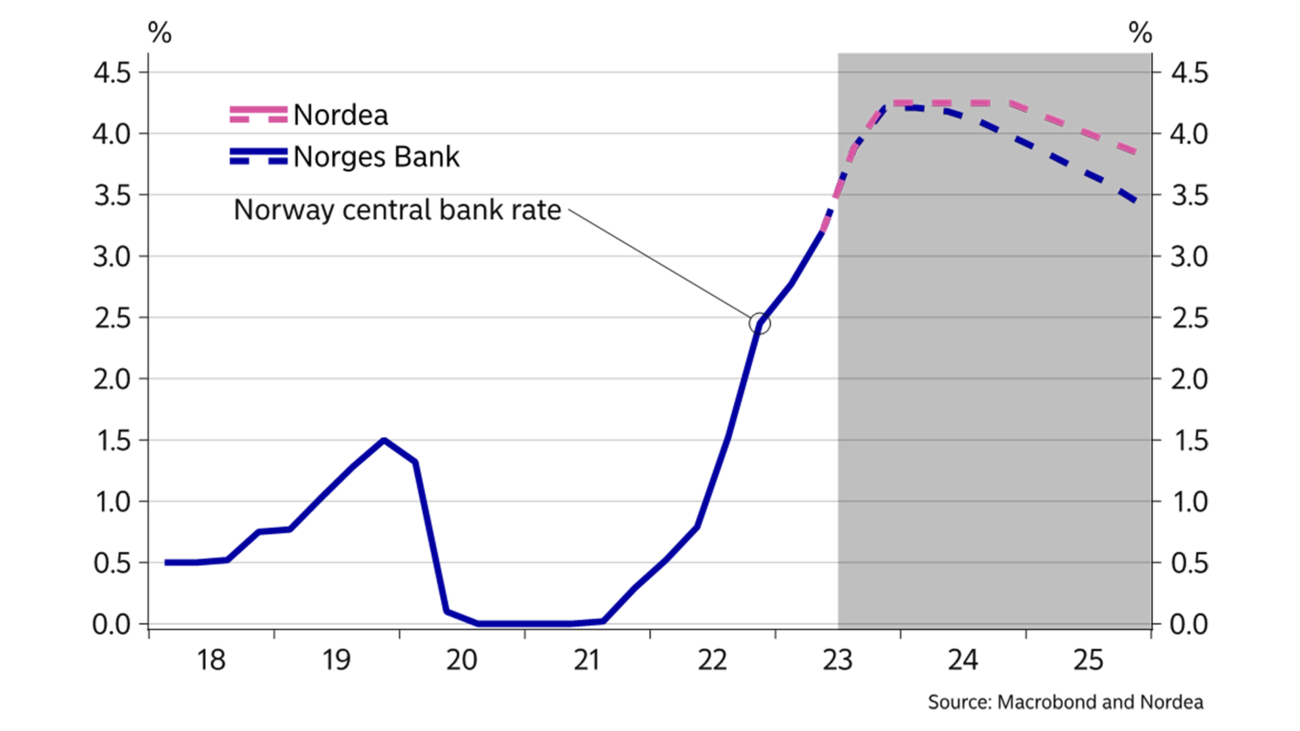

Economic activity in Norway has flattened, and unemployment has risen slightly but is still at a very low level. Higher price and wage growth and a weaker NOK have led to a steeper interest rate increase. Households and the housing market have started to feel the pinch of the rate hikes. Household spending will start to decrease, construction activity will stay at a low level and unemployment will rise somewhat, going forward. The cooling of the economy is, however, slowed by increased oil investments and good profitability in the export sector, thanks to the weak NOK. The policy rate will likely peak at 4.25% in September, but it will take a long time before inflation falls towards the 2% inflation target. Thus, we do not expect rate cuts until 2025. In the near term, the NOK will weaken further, but will probably regain a bit of strength further out.

The Norwegian economy has continued to show great resilience to higher rates and price growth than expected. The Norwegian economy has been surprisingly strong for a long time, and since the start of the year, activity has stabilised at a high level. Registered unemployment has risen slightly from 1.7% to 1.9% this year, but it is still at a very low level. The NOK has remained weak, and underlying inflation reached a new record during the summer. A more resilient economy, weaker NOK, higher wage and price growth are the reasons why Norges Bank has hiked rates at a faster pace and warned of an even higher interest rate peak than previously.

The central bank’s rate hikes may seem to have had a small effect on the economy and inflation. But it takes time before the full effect of rate hikes feeds through, especially in the wake of the pandemic. The rate cuts in 2020 increased disposable incomes for everybody with debt, at the same time as spending was limited by the measures to contain the virus. Consequently, savings skyrocketed. Rate hikes and high price growth have reduced purchasing power, but savings have declined again. Consumption was therefore not as dampened as many had expected. Savings will hardly fall as much going forward, and the effect of the latest rate hikes will thus be more pronounced.

We therefore expect the cooling of the Norwegian economy to be more palpable in the coming period. Autumn and winter will be a bit tough. So far, it is mainly the construction sector and parts of the retail sector that have shown clear signs of weakness. Eventually, a broader part of the Norwegian economy will see a subdued trend. We are sure that eroding purchasing power will prompt households to tighten their belts going forward. Accordingly, the service sector will also experience lower demand in the future. Increased petroleum investments and prospects of moderate wage growth over the coming years will be an important counterweight, though. Thus, we still do not expect any severe downturn for the Norwegian economy.

Household spending has been surprisingly strong for a long time, thanks to a lower propensity to save, but also accumulated savings after the pandemic. At the same time, most people have jobs. However, we are now seeing signs of a reversal. Goods consumption has surprisingly not fallen in step with the normalisation after the pandemic, and it seems to continue to fall, especially large durable goods purchases, such as cars, boats and sports equipment. Now, we also see signs that service consumption, which surged after the pandemic, is slowing down.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (mainland), % y/y |

-2.8 |

4.1 |

3.8 |

1.0 |

1.0 |

|

Household consumption |

-6.2 |

4.5 |

7.5 |

3.0 |

0.5 |

|

Core consumer prices, % y/y |

3.0 |

1.7 |

3.9 |

5.0 |

3.5 |

|

Annual wage growth |

3.1 |

3.5 |

4.2 |

5.0 |

4.5 |

|

Unemployment rate (registered), av. % |

5.0 |

3.1 |

1.8 |

1.8 |

2.1 |

|

Monetary policy rate, deposit (end of period) |

0.00 |

0.50 |

2.75 |

3.25 |

3.25 |

|

EUR/NOK (end of period) |

10.47 |

10.03 |

10.51 |

10.00 |

9.80 |

A / Economic activity will fall going forward.

B / Unemployment set to rise slightly from very low level.

It will take some time before Norges Bank will consider cutting rates.

In the past year, many consumers in Norway have experienced a historic decline in purchasing power. As a result of higher interest rates, lower real income and higher unemployment, households as a whole will need to tighten their belts in the future. Therefore, we expect overall spending to fall this year and towards next summer.

Although unemployment will rise slightly going forward, it will stay at historically low levels. Most people will thus still be employed and many will likely see wages increase more than prices next year and in 2025. At the same time, households still have large savings buffers overall. If consumers use their savings, spending could be less affected in the future than the decline in purchasing power would suggest. This will prevent a sharp drop in spending, going forward. A stabilisation of the interest rate level and real wage growth will improve purchasing power next year and in 2025. This points to increased consumption after next summer and towards the end of 2024, and especially, in 2025, when the policy rate will likely go down somewhat.

Annual wage growth will likely be around 5.5-5.75%, clearly above the 5.2% collectively agreed in the wage-leading sectors. If so, this will be the highest annual wage growth in 15 years. There is a clear tendency for the final wage growth rate to be higher than that negotiated for the wage-leading sectors when labour market conditions are tight and profitability generally is good, as in the current situation. Likewise, inflation will also be higher than the level assumed in the wage negotiations. Most of us will thus likely experience a year when inflation is higher than wage growth. This may affect wage negotiations next year, despite somewhat higher unemployment at that time. The employee side again has clear expectations of positive real wage growth next year, but employers also expect wage growth to be higher than inflation. Over the next couple of years, we project slightly lower nominal wage growth as inflation slows, but positive real wage growth. With estimated CPI growth of 4% next year, we expect wage growth to be around 5%.

The fall in energy prices from a high level last year will curb headline inflation now that energy prices have come down and base effects start to kick in. After inflation of around 6% last year and this year, CPI growth will decrease much more next year.

While overall inflation will decline, there is reason to believe that core inflation (adjusted for energy prices) will remain high. Core inflation has been and will likely continue to be broad-based. Increased import costs, wage costs and rents will contribute to core inflation well above 6% this year. Core inflation will fall next year, but with continued high wage growth and the effects of a weak NOK, it will take a long time before core inflation is close to Norges Bank’s inflation target of 2%. We may have to wait until 2026 before core inflation is below 3%.

Norges Bank hiked its policy rate to 4.0% in August and signalled a new hike in September. We think the policy rate will peak in September at 4.25%, but we cannot rule out that it will be slightly higher. The bank still worries that inflation and wage growth could take hold at an elevated level, although growth and economic pressures should abate going forward. A possible NOK weakening will add to price pressures and could also trigger stronger wage growth. In our view, a much weaker NOK is the biggest risk factor for an even higher interest rate peak than we estimate at present.

Although the interest rate peak is close, Norges Bank is not about to consider a rate cut. Unemployment will rise, and although inflation will fall somewhat in future, it will stay well above 2% in the next few years. We do not expect the bank to reduce its policy rate until 2025, and then cuts will not be significant.

C / Wage growth has risen in line with tighter labour market conditions and higher price growth. Real wages will increase in 2024 and 2025.

D / The interest rate peak is close in Norway, but no rate cuts until 2025.

A stock market correction will weigh on the NOK.

Given Norges Bank’s rate hikes, the trend in housing prices has been surprisingly strong this year, increasing 5.2% so far. Seasonally adjusted, housing prices have thus basically been unchanged from the peak last summer. The changes in housing loan regulations, which took effect from the new year, have probably contributed to better price performance for existing houses than would otherwise have been the case. Borrowers must now be able to sustain a rate increase of 3 percentage points instead of 5 percentage points (but in any case a rate of 7%). This means that banks can lend more to borrowers than under the old rules.

At the same time, housing market sentiment has reached a turning point. Prices have fallen a good deal over the summer, and we expect housing prices to continue to fall towards year-end. The current level of housing prices does not reflect Norges Bank’s latest rate hikes, and interest rates will increase further. At the same time, slightly higher unemployment also points to a slower housing market. On the other hand, there is little new construction of housing. We therefore project a moderate decline in housing prices of some 5% (seasonally adjusted). In the long term, housing prices could increase thanks to increased income when the policy rate is lowered.

The NOK has fluctuated widely this year. The currency is still close to the crisis levels at the time when the coronavirus pandemic broke out. The interest rate differential between Norway and its trading partners is clearly narrower, which has been a very important driver of the NOK weakening. The interest rate differential between the NOK and the EUR has not been this low since before the financial crisis. The NOK also has a lower interest rate compared to other major currencies, such as the USD and the GBP. The NOK has gone from being a high-rate currency to a low-rate currency. At the same time, the NOK is also more exposed to risk than most other currencies. That is why it should come as no surprise that the NOK is one of the currencies that has weakened the most this year and which fluctuates the most when interest rates and stock markets are volatile.

We expect the NOK to remain weak over the coming period in spite of relatively high energy prices. For the NOK to strengthen, interest rates abroad must come down. However, it will take some time before global inflation declines sufficiently for central banks to cut rates.

We do not expect rate cuts among the large western economies until next summer, but they will likely occur sooner than in Norway. Coupled with increased oil investments, which lead to increased demand for the NOK, and continued relatively high energy prices, an improved interest rate differential could result in a slightly stronger NOK in the long term. However, in the short term, there is a clear risk of an even weaker NOK. It may be a turbulent autumn for financial markets, as inflation, especially in the US, seems to be more resilient than markets anticipate. A stock market correction will weigh on the NOK. We expect EUR/NOK to trade around 11.50 at end-2023, 11 towards end-2024 and down towards 10.5 by end-2025.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more