- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Den här sidan finns tyvärr inte på svenska.

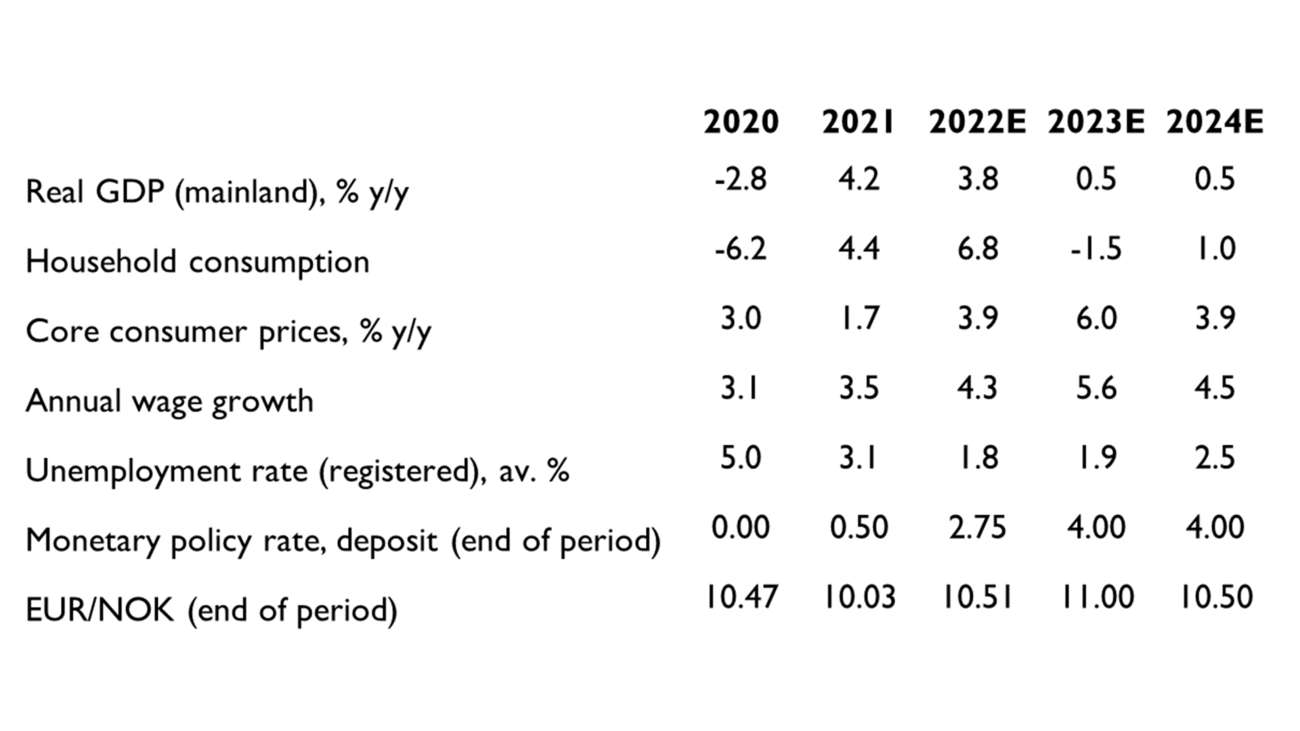

Stanna kvar på sidan | Gå till en relaterad sida på svenskaThe Norwegian economy has shown greater resilience to higher rates and inflation than expected. Household consumption and housing prices have held up and unemployment has remained record low. Real wage growth and higher activity in the oil sector help underpin a high activity level also going forward. Stronger wage growth and the significant NOK depreciation since the turn of the year prolong price pressures. That’s why the policy rate will most likely reach 4%. A higher rate would dampen activity and we therefore still expect the coming year to be largely stagnant for the Norwegian economy overall. Unemployment will start to rise after the summer and we continue to believe that rate hikes will gradually drive housing prices lower. The NOK exchange rate will likely recover slightly over time.

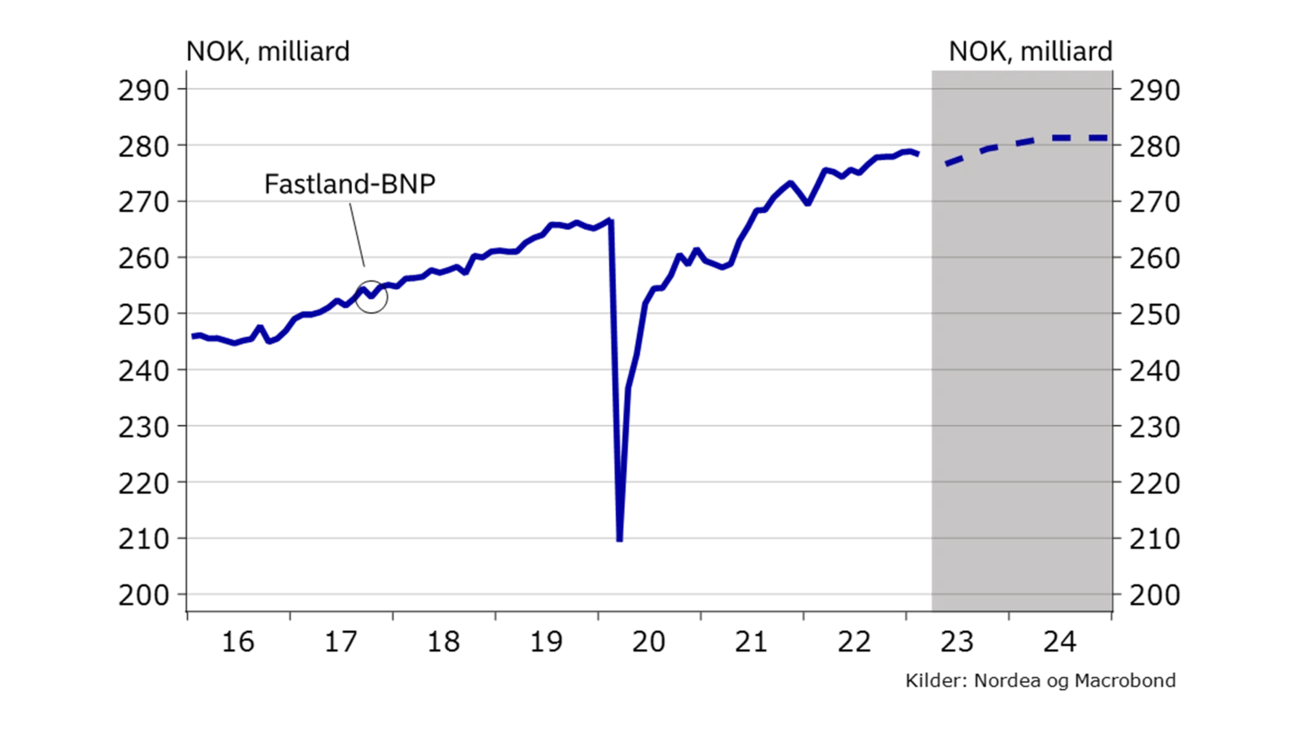

The Norwegian economy has shown greater resilience to higher rates and inflation than expected. Activity in the Norwegian economy has held up surprisingly well. The most positive surprise is consumer spending, particularly in light of the very pessimistic consumer confidence readings. The property market slowed down in H2 2022 but ap-pears to have fully recovered this year. Registered unemployment has stayed at a record-low 1.7% since August 2022.

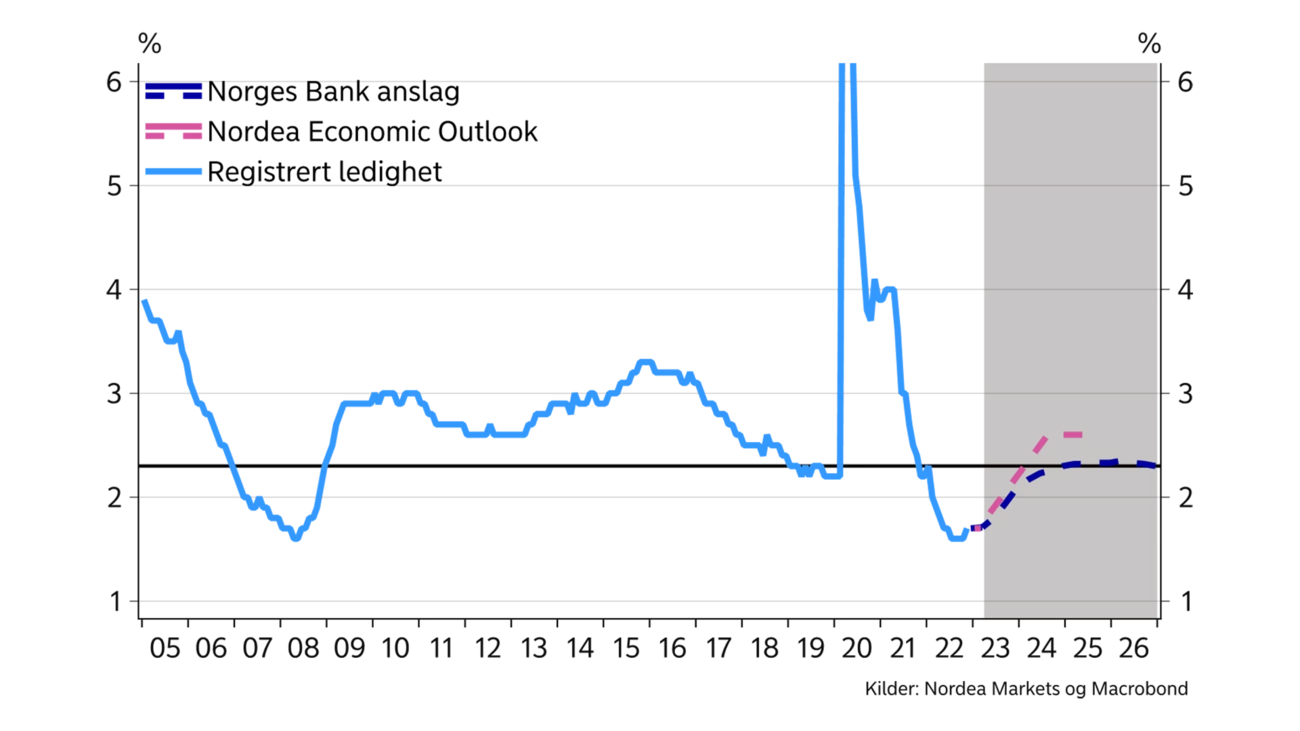

A more resilient economy is one of the reasons why we expect Norges Bank to hike the policy rate a few times more. So far, only the construction sector has shown clear signs of weakness. Higher interest rates will gradually lead to a broader decline in economic activity in Norway. We are quite sure that eroding purchasing power will make many households tighten their belts going forward. Higher interest rates will continue to slow down residential invest-ment. At the same time, lower growth in both domestic and global demand could weaken the investment outlook among mainland businesses. Businesses have been reporting lower growth expectations for some time, and they are likely to be correct. It will just take a bit longer and probably require even higher interest rates. Higher energy and oil investments will still be an important counterweight. Thus, we do not expect any severe downturn in the Norwegian economy.

Over the past year, many consumers in Norway have experienced one of the biggest declines in purchasing power ever. Still, household spending has been remarkably robust. Many experienced a similar upturn in purchasing power during the pandemic when Norges Bank cut rates to zero. The drop in disposable income is sharp from one year to the next, but not very big compared to the pre-pandemic situation. At the same time, overall consumption was lower than before the pandemic until this time last year. Many have thus saved up a lot. Norway has gone from a situation with much higher savings than usual to one with much lower savings than typically. Spending has therefore been more stable than purchasing power trends would suggest viewed in isolation.

Overall, households still have large savings buffers. If consumers use their savings, spending could be higher in future than the trend in income would suggest. However, as interest rates rise further, we think that many households will have to cut back on spending. We therefore expect quite a weak trend in overall spending going forward. On the other hand, unemployment is low, and many are in work – most of whom will likely experience real wage growth this year and in 2024. This will pre-vent a sharp drop in spending.

O / 2023 will likely be a year with largely stagnant activity.

P / Unemployment will rise slightly from a very low level.

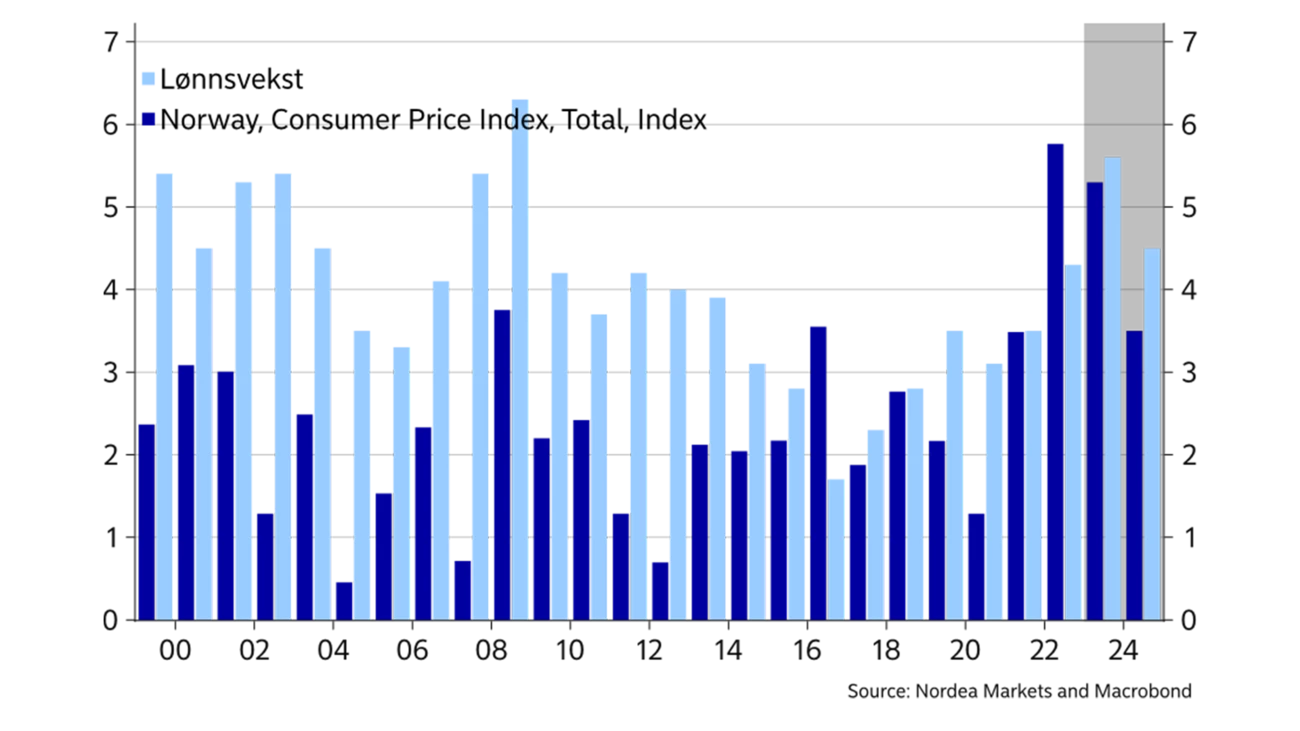

After a brief strike, the negotiations in the wage-leading sectors landed on a settlement of 5.2%, of which a larger share than usual is allocated in central wage increases. At the same time, an increase for low-wage groups was agreed. The wage deal thus ensures good wage growth for low-income groups, those with weak bargaining power locally or where capacity for higher wages is not very good. There is also a clear tendency for the final wage growth rate to be higher than that negotiated for the wage-leading sectors in the current situation with a tight labour market and generally good profitability. Although we expect a slowdown in the Norwegian economy and slightly higher unemployment, the competition for manpower is still fierce. The number of vacancies is record-high. Hence, we expect overall wage growth will end slightly above 5½ % this year. If so, this will be the highest annual wage increase since 2008. For next year, we project slightly lower nominal wage growth in step with lower inflation, but higher real wage growth.

There are prospects of somewhat lower overall inflation this year versus last year’s 5.8%. The drop in energy prices from last year’s very high level will curb price growth in 2023, as energy prices have fallen, and base effects are kicking in. We look for overall inflation of somewhat above 5% this year and foresee it declining further next year.

While overall inflation will abate, there is reason to believe that underlying price growth (adjusted for energy prices) will remain high. Inflation has been and will likely continue to be broad-based. Increased import costs, wage costs and rents will contribute to underlying price growth of 6% this year, before it starts to decline next year. However, it will likely take a long time before core inflation returns to Norges Bank’s target of around 2%.

Highest wage growth this year since 2008.

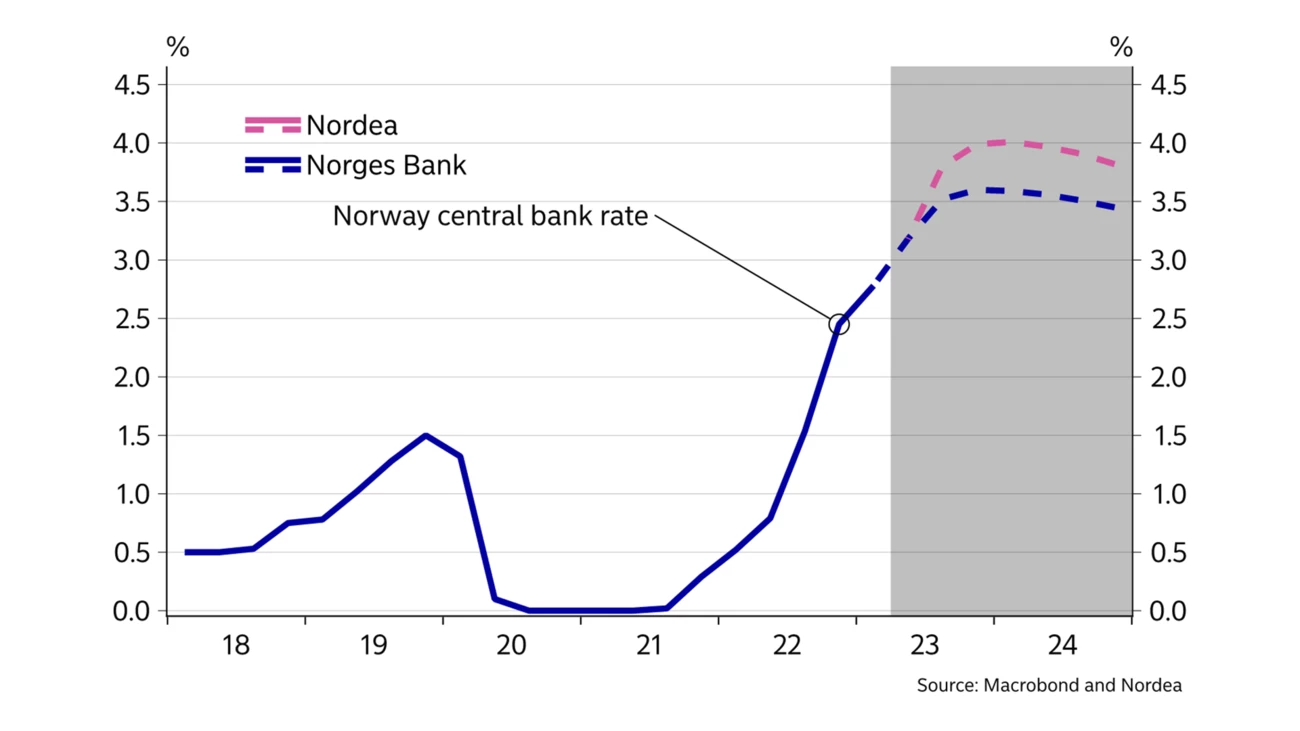

Norges Bank hiked its policy rate to 3.25% in May and announced a likely hike to 3.50% in June. Norges Bank’s March forecast included a 40% probability of a rate hike to 3.75% before the end of summer.

We believe that Norges Bank will hike its policy rate to 4.0% during the summer/autumn and keep it unchanged well into 2024. The bank still worries that growth in prices and wages will take hold at an elevated level, although growth and economic pressures should subside going forward. The NOK exchange rate is still a big concern for Norges Bank. The sharp NOK weakening since the turn of the year will increase imported price growth and could prolong economic pressures. The sectors in the Norwegian economy exposed to foreign competition are benefiting greatly from the weaker currency. Higher wage growth than expected as well as a weaker NOK and a more resilient economy than antici-pated will likely prompt Norges Bank to review its rate path once more and hike the policy rate more than signalled previously.

We consider the risks to our rate forecast to be balanced. It cannot be ruled out that Norges Bank has to hike rates above 4.0% if economic activity proves more resilient than expected, and growth in wages and prices over-shoots current projections. Conversely, the economy might slow down more and sooner than we expect at present, and price pressures could ease sooner. This could drive rates lower than we now expect, but we think it will take time before Norges Bank starts to con-sider rate cuts. Unemployment will rise somewhat but likely remain at a low level in a historical perspective. At the same time, core inflation looks likely to remain well above 2% in the years ahead. So it is far from certain that 2024 will bring rate cuts like the market currently prices in.

Q / Wage growth has risen in line with tighter labour market conditions and higher price growth.

R / Rate peak set to be slightly higher than previously expected.

Given Norges Bank’s rate hikes, housing price trends have been surprisingly strong this year, increasing 6.8% so far this year. Seasonally adjusted, housing prices have thus hardly declined from the peak last summer. This is in sharp contrast to many comparable economies such as Sweden. The changes in home loan regulations, which took effect from 2023, have probably contributed to a better development in prices of existing homes than would otherwise have been the case. Borrowers must now be able to sustain a rate increase of three percentage points points instead of five (but in any case, a rate of 7%). This means that banks can lend more to borrowers than under the old rules. Also, changes to equity requirements for secondary homes in Oslo (from 40% to 15%) have likely also contributed to the strong trend, notably for small flats in Oslo.

We expect home prices to fall somewhat after the summer from today’s level, partly because it does not reflect Norges Bank’s latest rate hikes and partly because we think interest rates will increase more. However, we project only a moderate housing price decline of some 2-5%. Over time, housing prices could rise again, particularly in central areas such as Oslo with limited construction activity. Overall, we look for a largely flat housing price trend in the coming years.

The NOK will remain weak in a historical perspective.

The NOK has weakened sharply since last autumn, not least against the EUR. The usual NOK drivers, such as oil prices and stock market performance, are probably part of the explanation. But in our view, the clearly narrower interest rate differential between Norway and the Euro area has been a main driver. Interest rates in Norway have been higher than in Europe since before the financial crisis. Now, this rate advantage has vanished due to the ECB’s aggressive rate hikes over the past six months. We have gone from being a high-rate country to a low-rate country.

In addition, Norges Bank’s NOK sales on behalf of the government have likely contributed to the NOK depreciation. You can read more about the reasons for the weak NOK in our theme article on page 23.

Near term, we cannot rule out that the NOK might weaken even further. We think the NOK exchange rate will recover a bit over time, though. We are quite sure that Norges Bank will have to scale down its NOK sales after the summer due to lower oil tax payments. This could improve the balance in the NOK market and curb further depreciation of the NOK at the rate seen so far this year. Also, a sharp reduction in Norges Bank’s NOK sales could make market participants with negative NOK positions throw in the cards, which should trigger NOK strengthening. At the same time, Norwegian oil invest-ment looks set to increase, and this will force the oil and gas companies to buy more NOK to pay their Norwegian suppliers and employees. This also points to a stronger NOK over time. Further rate hikes from Norges Bank could also contribute. But the NOK will remain weak in a historical perspective. We expect EUR/NOK to trade around 11.00 at end-2023, and towards 10.60 at end-2024.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more