- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Economic activity is now at a very high level, and unemployment is lower than before the coronavirus pandemic. Businesses are reporting capacity constraints and growing hiring challenges. Competition for labour and high inflation are pushing up wages, while the war in Ukraine intensifies the inflationary pressure. With an economy under pressure and rising price and wage growth, Norges Bank will continue its quarterly rate hikes until end-2023. Housing prices look set to remain fairly stable, but we would not rule out a small decline. The NOK may strengthen over time if energy prices remain high.

The Norwegian economy continued to grow after the coronavirus restrictions were lifted at the beginning of the year. The spreading of the more infectious but milder Omicron variant became just a bump on the road for the economy, as we envisaged in the January issue of Nordea Economic Outlook. Since restrictions were lifted, consumption of services has increased and the people put on furlough are back at work. Activity in the Norwegian economy is now at a very high level. Registered unemployment, which peaked at over 10% in 2020 and stood at 2.4% in January 2022, fell to 1.9% in April 2022. Unemployment is thus now lower than before the pandemic and at its lowest level since 2008.

|

3.5% 1.6% 2.5% |

|

Source: Nordea estimates |

Norwegian economic activity looks set to rise further going forward. Recent data from Norges Bank’s regional network survey show that Norwegian businesses are planning to expand capacity in the period ahead. For many, capacity constraints and labour shortages have become an increasing problem. The war in Ukraine has led to increased uncertainty about the future economic performance of Europe and many of Norway’s trading partners.

But the Norwegian economy is relatively shielded from the direct consequences of the war and the sanctions as Ukraine and Russia only account for a small share of Norwegian foreign trade. However, Russia’s invasion has underscored the need for alternatives to Russian oil and gas. Many European countries now see Norwegian oil and gas as a key element in their efforts to reduce Europe’s dependence on Russian energy over time. Coupled with high oil and gas prices, this will underpin growth in Norwegian oil investment, which already before the war was set to rise significantly ahead. Higher oil investment will be a key driver of growth in both the Norwegian manufacturing industry and the economy in the coming years.

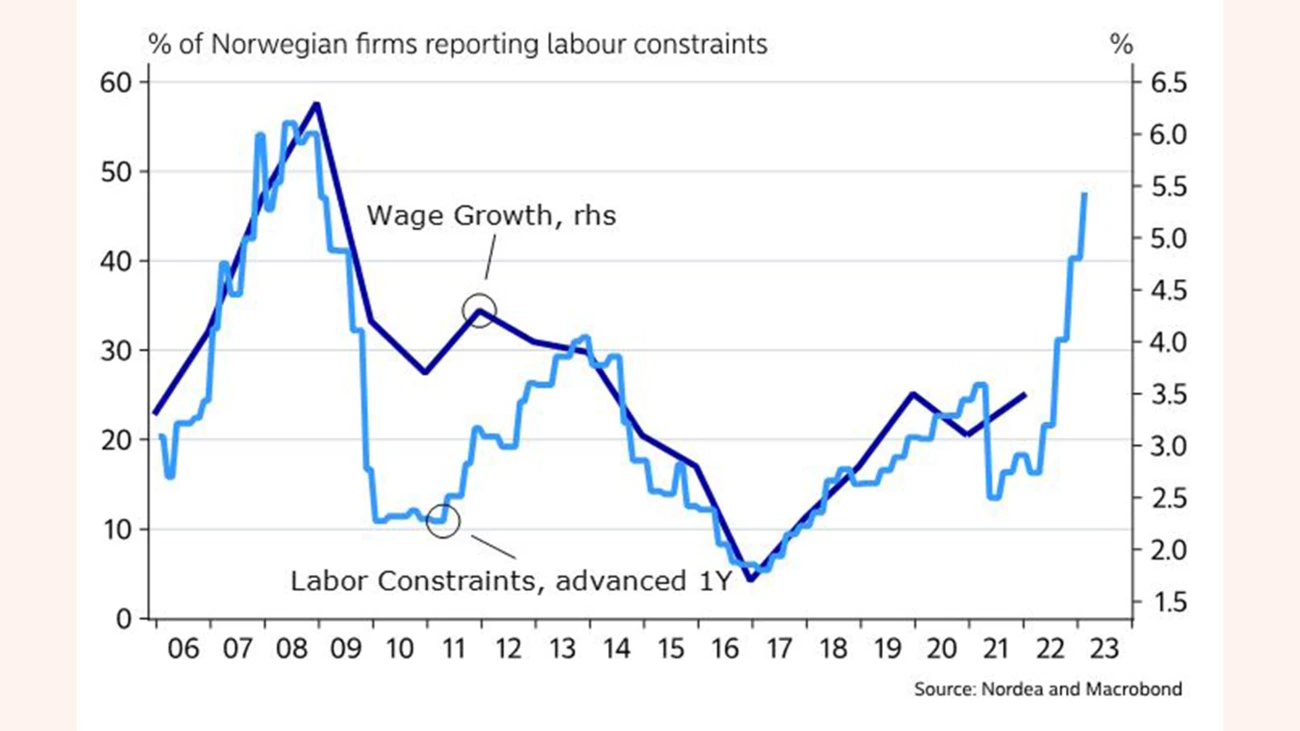

The competition for labour and high inflation are pushing up wages. As a result of wage drift, wage growth will probably exceed the pay rise agreed on through collective bargaining (3.7%), just as we saw last year. We think wage growth will end up at 4¼-4½% this year. With sustained low unemployment and fierce competition for labour, we expect wage growth to remain around 4% also next year. Hence, despite high electricity and fuel prices, consumers’ purchasing power looks set to rise in the coming years. Also, the government’s compensation scheme will significantly dampen the effect of the high electricity prices on inflation and households’ living costs.

Households have saved more money than usual during the pandemic, and now the savings ratio is gradually approaching more normal levels. Combined with more people in work, this points to good growth in overall consumption despite rising interest rates as some of the savings buffer accumulated during the pandemic could be spent on consumption in the years ahead. A further increase in household consumption will be another key driver of economic growth going forward.

|

2019 |

2020 |

2021 |

2022E |

2023E |

|

|

Real GDP (mainland), % y/y |

2.0 |

-2.3 |

4.2 |

3.5 |

2.0 |

|

Household consumptionJust FYI |

1.1 |

-6.6 |

5.0 |

6.0 |

3.5 |

|

Core consumer prices, % y/y |

2.2 |

3.0 |

1.7 |

2.9 |

2.6 |

|

Annual wage growth |

3.5 |

3.1 |

3.5 |

4.5 |

4.0 |

|

Unemployment rate (registered), % (average) |

2.3 |

5.0 |

3.1 |

1.8 |

1.7 |

|

Monetary policy rate, deposit (end of period) |

1.50 |

0.00 |

0.50 |

1.50 |

2.50 |

|

EUR/NOK (end of period) |

9.87 |

10.47 |

10.03 |

10.00 |

9.50 |

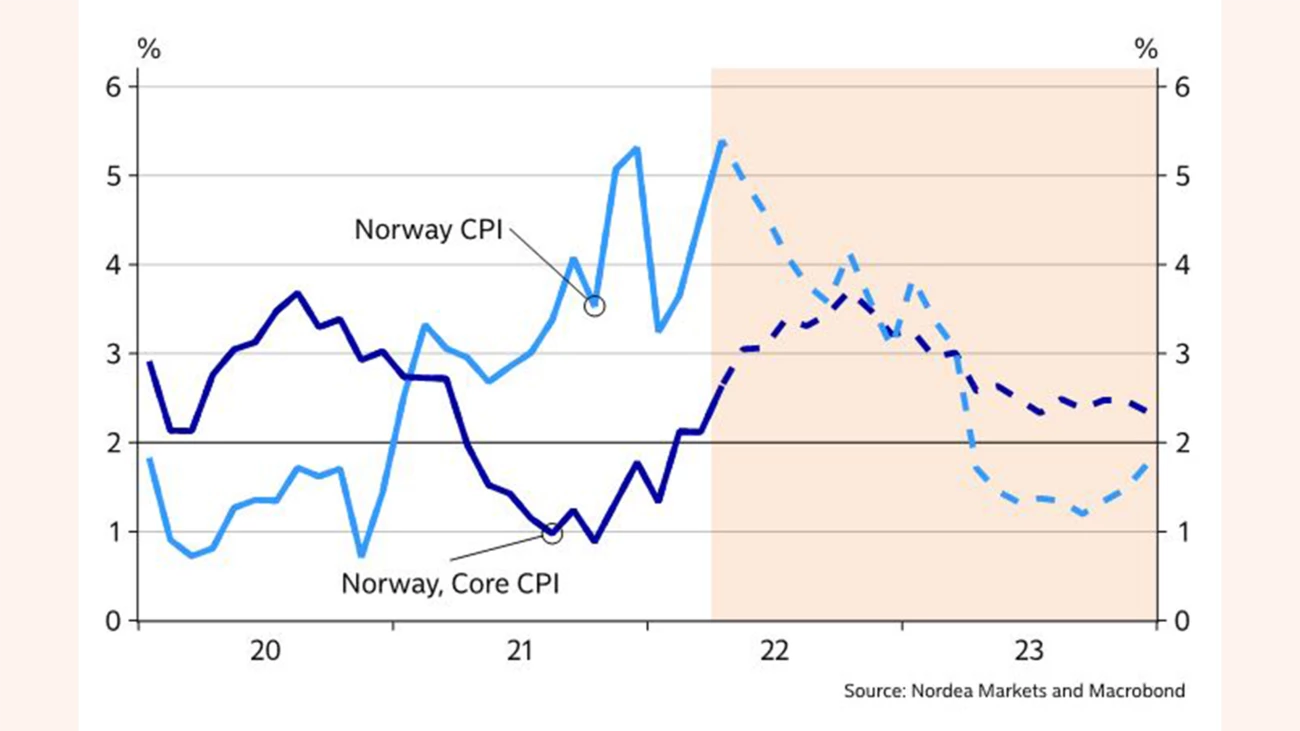

We are fairly sure that inflation adjusted for energy prices and VAT will continue to rise due to higher prices of imported goods, higher wage growth and higher rents. Global prices of food, energy goods, transportation and other input goods have risen further after the war in Ukraine broke out. Markets still struggle with bottlenecks in manufacturing and transportation, and the introduction of new severe coronavirus restrictions in China will prolong the global supply chain disruptions. But a somewhat stronger NOK will dampen the effect of the rising prices in Norway. All in all, we still believe that core inflation will remain well above Norges Bank’s 2% target over the next couple of years.

Headline inflation (including energy prices) ran at 5.4% in April. If not for the government’s compensation scheme for high electricity prices, inflation would have been as high as 7.2%. Unless energy prices spike up sharply, the year-over-year effect of the high energy prices will wane during the year. And the extension of the compensation scheme until March next year will also contribute to sending headline inflation much lower in the period ahead.

In light of the strong economic growth and higher wage and price growth, Norges Bank no longer sees a need for the very low interest rate levels sanctioned during the pandemic. Consequently, Norges Bank has hiked its policy rate three times so far to 0.75%. The latest rate path from Norges Bank shows the policy rate rising to 1.5% by end-2022 and to 2.5% by end-2023. Then the policy rate will be higher than what Norges Bank calls a normal level.

We believe it will take a lot for Norges Bank to raise interest rates more than four times per calendar year.

The market has periodically priced in more rate hikes than suggested by the central bank’s rate path. We believe it will take a lot for Norges Bank to raise interest rates more than four times per calendar year. The bank has expressed concern about the effects of a tightening pace faster than that. For it to happen, we think that Norges Bank will have to see confidence in its inflation target being at risk of fading. This would require wage growth significantly above what has been agreed so far – something that we do not foresee in our baseline scenario. Consequently we expect Norges Bank to stick to its plan from March, hiking its policy rate by 0.25 percentage point every quarter until end-2023. However, we would not be surprised if Norges Bank will have to signal further rate hikes beyond 2.5% in 2024.

Recently, NIBOR has declined due to better structural liquidity in the Norwegian money market. As from 1 April, Norges Bank started to buy foreign currency (selling NOK) for an amount corresponding to NOK 2bn per day. The NOK selling was triggered by exceptionally large tax receipts from oil companies, which are now making far more money due to the high oil and gas prices. As a result, government oil revenues now by far exceed what is needed to cover the budget deficit. This, in turn, means that the surplus is transferred to the oil fund, albeit in foreign currency. With Norges Bank’s NOK selling, the amount of NOK in the Norwegian banking system has increased considerably, and the liquidity premium over NIBOR has declined from over 60 basis points to around 40 basis points. We expect the premium over NIBOR to remain largely unchanged going forward. This means that in future NIBOR will rise more or less in step with Norges Bank’s rate hikes.

Housing prices rose sharply during the first three months of the year despite the higher interest rates. The new act on the sale of real estate has meant that fewer homes than usual have been put on the market. As a result, prices have risen more than normally at the start of the year. When the homes that should have been put on the market at the beginning of the year are listed for sale over the coming months, the increased supply could trigger a downward correction in housing prices. Also, higher interest rates point to lower housing prices ahead. But higher wages pull in the opposite direction. At the same time it has become more expensive to build new homes due to a sharp price increase on construction materials. This could limit the supply of new homes and thus put a floor under housing prices. Overall, we think housing prices will move largely sideways over the next couple of years. See also this theme article on the Norwegian housing market.

Housing prices should move largely sideways in the next couple of years, but we cannot rule out a small decline.

The NOK has weakened lately as a result of increased financial market volatility stemming from rising interest rates globally and the central banks’ trimming of their balance sheets. At the same time, oil and gas prices remain high. We think that the NOK will remain weak towards the end of the year due to the heightened uncertainty. In addition, Norges Bank will probably have to gradually sell more NOK to balance the NOK flows from the large tax receipts from oil companies. The future trend in oil and gas prices is highly uncertain, and a downward correction would be detrimental to the NOK. But if energy prices remain elevated over time, as we think they will, the NOK could strengthen again. Norwegian oil investment looks set to increase sharply ahead, and this will force the oil and gas companies to buy more NOK to pay their Norwegian suppliers and employees. This also points to a stronger NOK over time.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more