In the near term, the AI revolution will likely drive increased greenhouse gas emissions, with its heavy need for computer power from servers housed in data centres. Longer out, however, it has the potential to give fresh impetus to the energy transformation and the green transition.

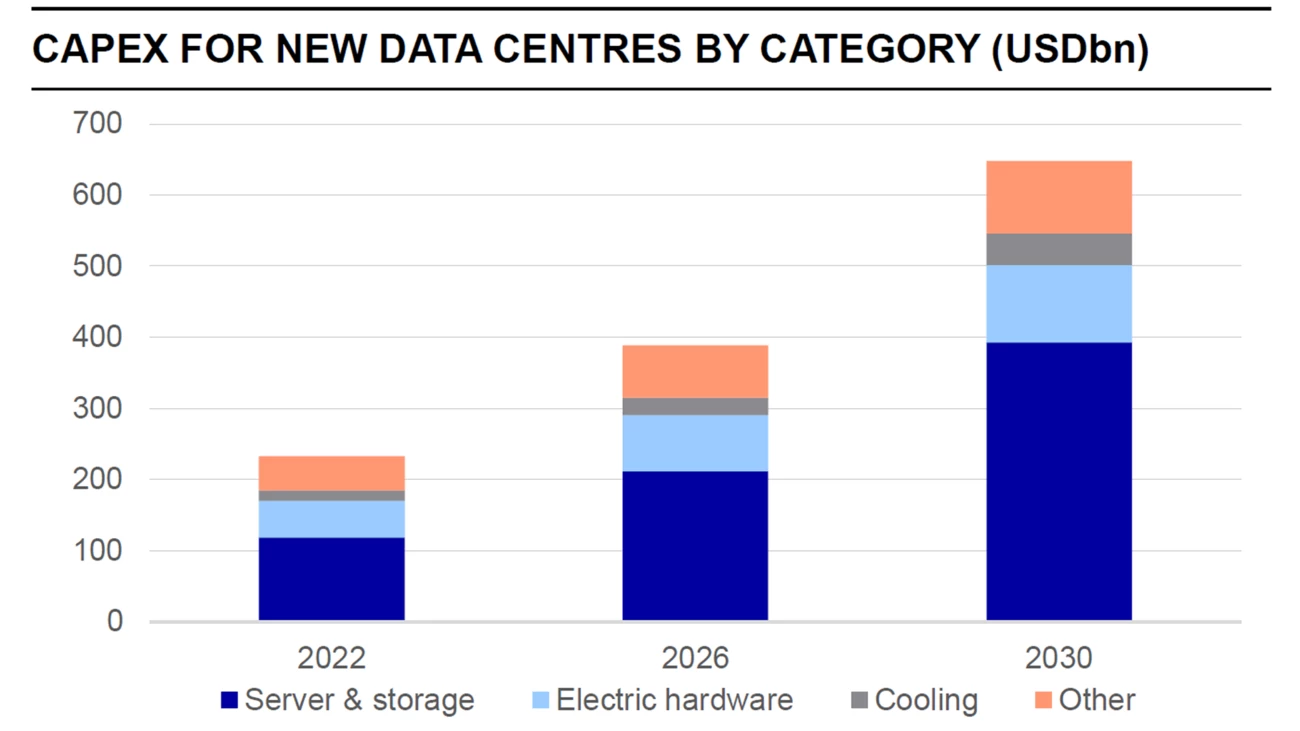

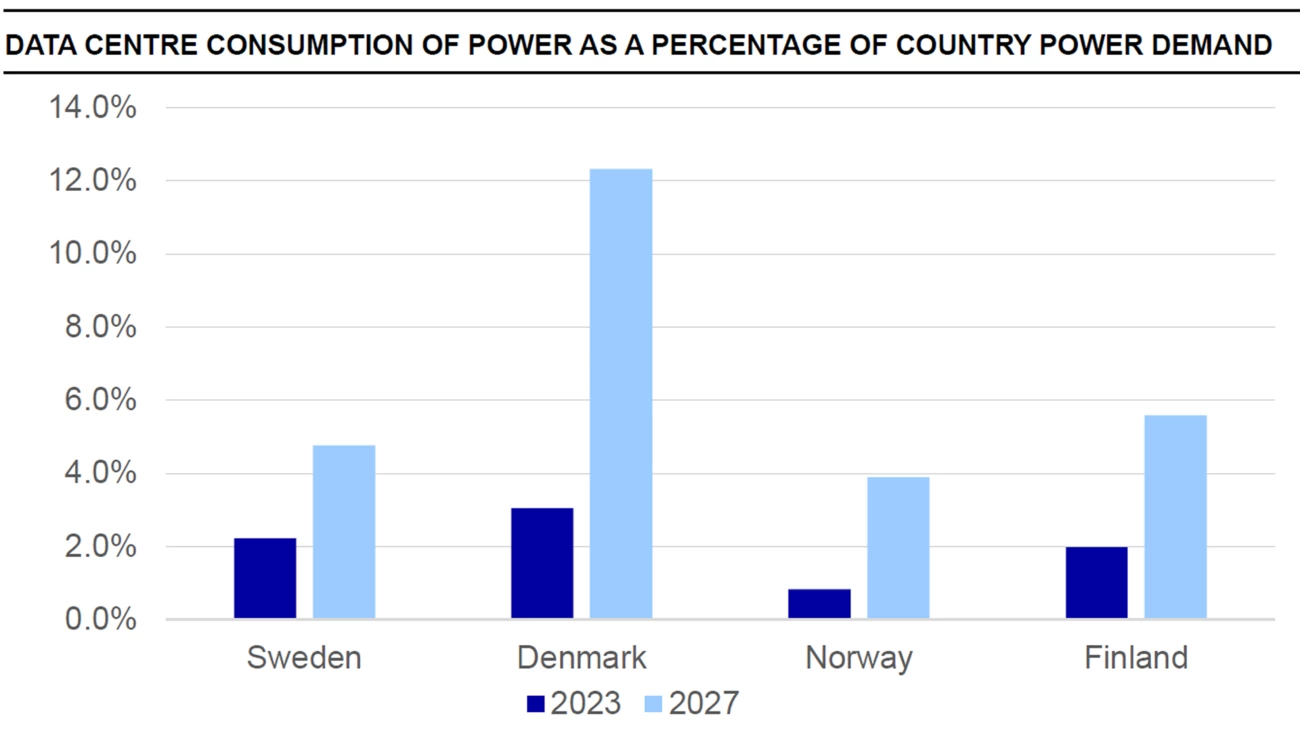

In our recent report, we built a scenario around data centre expansion in 2024-30, and find global data centre capex growing to around USD 650bn by 2030. We see three key levers to make our scenario happen: energy supply, grid infrastructure and specialised cooling. We also see the Nordic region standing out as a potential data centre hub of the future.

The data centre revolution

There are currently around 8,000 data centres in the world, consuming some 1-1.5% of global electricity and generating around 1% of the world’s total greenhouse gas emissions, according to the International Energy Agency (IEA). The rise of AI will transform the size of data centres and their infrastructure, as well as exponentially increase the amount of energy they consume.

In fact, AI will multiply data centres' energy requirements, due to the massive processing power required for specific tasks, including training large language models such as ChatGPT. With more energy-thirsty graphic processing unit (GPU) architecture replacing central processing units (CPU), these data centres will have vast power and cooling needs.

Today's data centre infrastructure is often not equipped to handle AI workloads, as traditional cloud computing was built for more general functions, such as web servers or e-commerce websites. As a result, data centre infrastructure and the energy supply will need to transform.

The AI revolution will not be possible unless data centres become smarter, more sustainable and more strategically-located assets. In our view, if this were successful, it would offer tremendous opportunities to companies exposed to data centre infrastructure, ranging from HVAC to power, grid and energy supply firms.