- Name:

- Kjetil Olsen

- Title:

- Chief Economist, Norway

How much will the pressure on the Norwegian economy affect wage growth and inflation going forward? That is one of the key questions Norges Bank needs to consider when setting interest rates. In Norway, there has historically been a clear correlation between the wage growth agreed beyond the expected price increases and the labour market situation. If labour shortages do not improve significantly ahead of this year’s pay talks, wage growth, and thus the interest rate peak, could exceed Norges Bank’s expectations.

The currently high price increases in Norway are largely driven by international factors outside of Norges Bank’s control. But does it mean that inflation in Norway will abate automatically once external price impulses start to fade? Or will high inflation and low unemployment affect wage growth and thus price increases further ahead?

Wage formation in Norway is governed by the so-called wage-norm model (“Frontfagsmodellen”) in which wage negotiations are first conducted in the industries primarily exposed to foreign competition, and the resulting wage settlement acts as a wage norm for the overall economy. This means that profitability in the exposed industrial sector is basically indicative of the Norwegian wage growth level.

This does not mean that the current situation and outlook for the Norwegian economy are not important for wage growth. Given the huge labour shortages, wage earners have more bargaining power than usual. At the same time, local pay talks at individual workplaces could result in both higher and lower wage growth for the Norwegian economy in general than the negotiated wage norm. Also, expectations of high price growth could drive wage demands higher in the wage-leading industries as well to avoid eroding purchasing power.

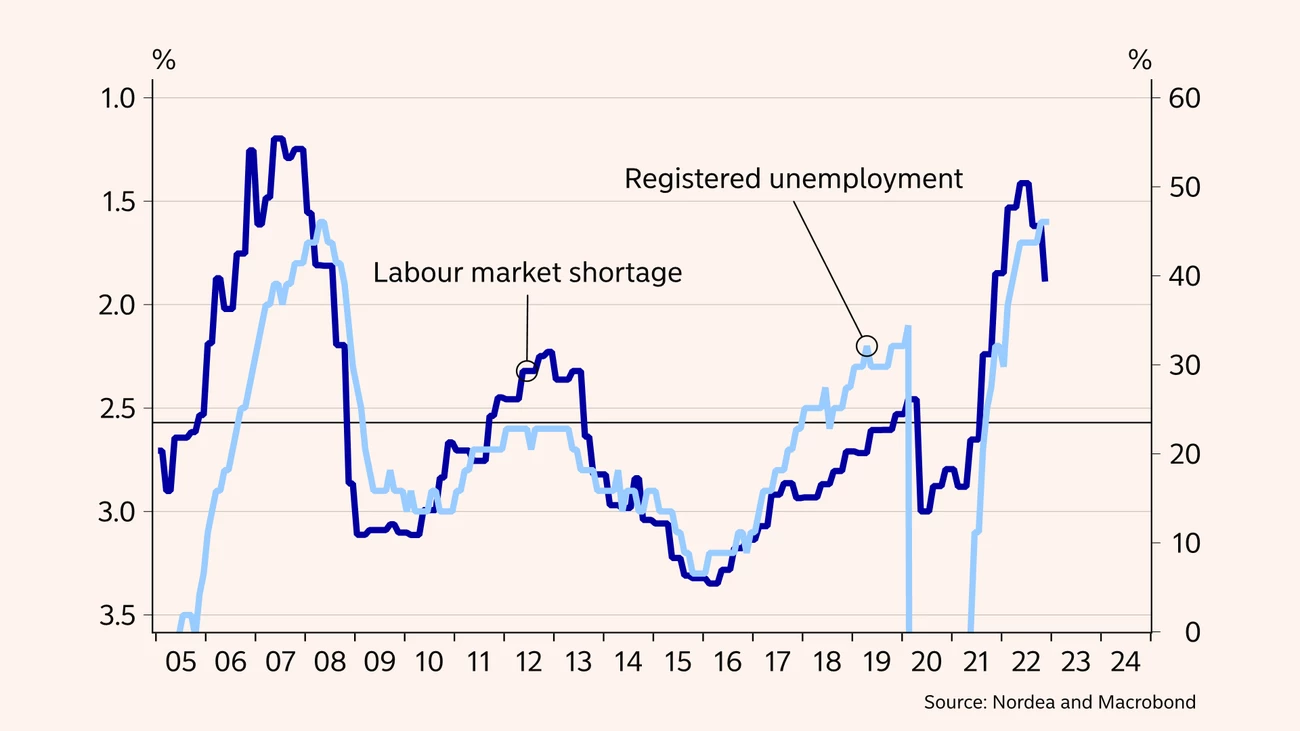

Chart A illustrates the correlation between the labour market situation and real wage growth; the latter being actual annual wage growth less price increases expected in the same year, according to the Technical Calculation Committee for Wage Settlements (TBU). As a measure of the labour market situation, we use the indicator of labour shortage from Norges Bank’s regional network. This measure can be more reliable than the unemployment level, as it does not depend on a specific equilibrium unemployment level or normal unemployment (see chart B for comparison).

Except for the past two years, which were affected by pandemic-related uncertainty, big differences between industries and an unclear cyclical situation, our calculations show a clear correlation between labour market pressure and real wage growth. History also shows that it takes a lot for nominal wage growth to be lower than the TBU’s expected price increases - since 2005, it has happened only once, in 2016 when unemployment was twice as high as it is now and labour shortages were record-low, according to the regional network. families’ purchasing power (disposable income adjusted for price growth) in percent relative to January 2020.

Wage growth could exceed Norges Bank’s expectations.

Norges Bank projects wage growth to be marginally lower this year than the expected price increases (see the dotted line in chart A). However, history has shown that it can be difficult to obtain such a “low” wage growth. Unless the Norwegian economy takes a real beating and labour shortages improve sharply before the spring pay talks, there is a risk that wage growth and thus the interest rate peak will exceed Norges Bank’s estimates.

This article first appeared in the Nordea Economic Outlook: The balancing act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more