- Name:

- Sara Midtgaard

- Title:

- Senior Macro and FX Strategist, Nordea

Our Nordea forecast implies a slight further weakening of NOK towards year-end and a somewhat stronger NOK next year. But if Trump becomes president, the rate cut cycle in the US could soon end, and the USD could strengthen further. We therefore see a clear risk of a weaker NOK than our current forecasts imply.

There is a close negative correlation between the value of the dollar and the value of the Norwegian krone, as we highlighted in our recent NOK update. We have for some time expected strong key figures to push US interest rates higher, strengthen the dollar and thus push the NOK weaker within the short term. This has to large degree already happened. Our forecast implies a somewhat stronger NOK through 2025, based on continued rate cuts from the Fed. The market is still pricing in 5 more cuts before 2025 is over.

However, with a Trump presidency, we doubt the Fed will continue the cutting cycle for long in 2025, with a stronger USD as a result. Therefore, we see a clear risk of a weaker NOK than our current forecasts imply with a Trump presidency.

We see Trump's trade, immigration and fiscal policies as highly inflationary.

Firstly, Trump wants to impose a 60 percent tariff on imports from China while also implementing a 10 percent universal tariff on imports from all countries. Such a policy would make it impossible to avoid tariffs by rerouting imports via a third country and should lift prices on all imported consumer goods.

Secondly, the whole purpose of the tariff policy is to create incentives to move production of goods to the US. But in order to do so, both investments and labour are needed. Capacity challenges could quickly arise if Trump also deports a large part of the estimated 8.3 million unauthorized immigrants that work in the United States, pushing wage costs higher.

A working paper done by Peterson Institute for International Economics, sees a 4-7 percentage points higher inflation through 2025 if Trump is elected versus Harris. Higher inflation will push US rates even higher and support the dollar.

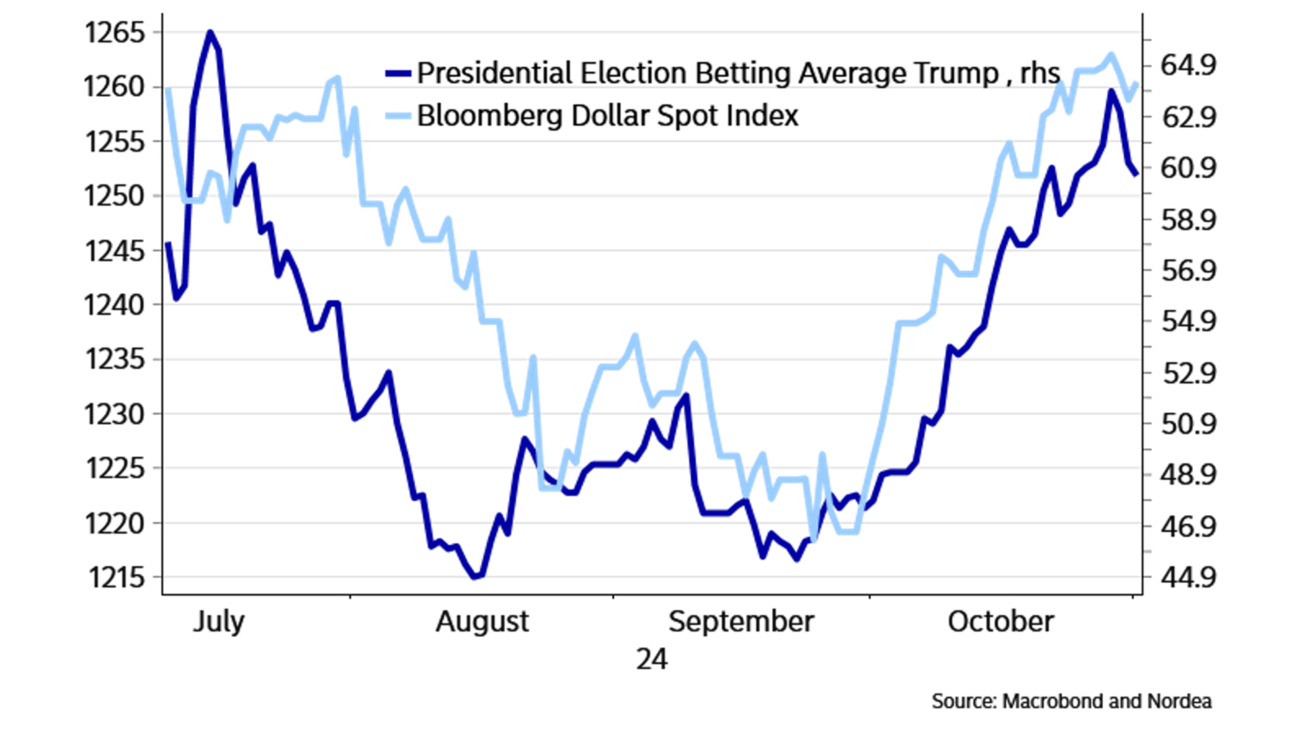

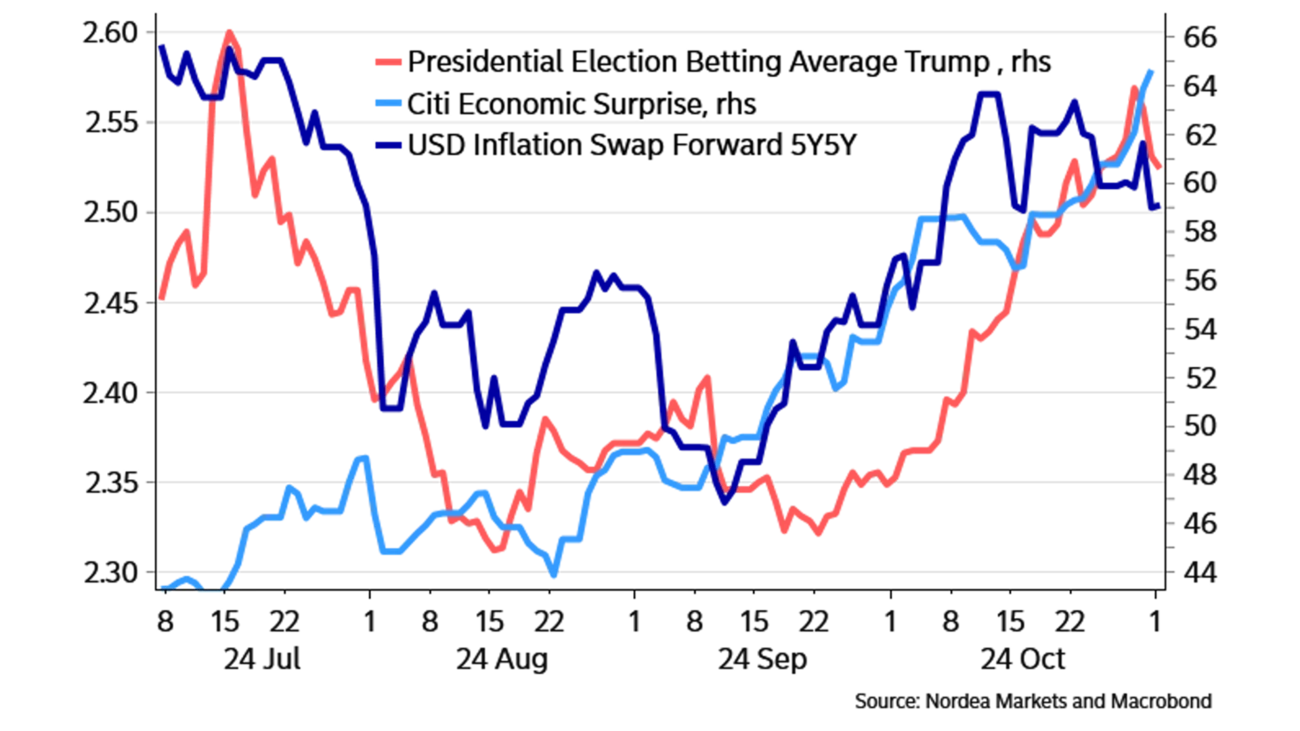

Attention to the US election has increased in the market recently, and the correlation between the dollar and betting-implied probability of a Trump win has been strikingly strong, especially through October, see Figure 1. It clearly looks like the market interprets a Trump victory as positive for the USD. Trump betting can also explain the moves in inflation expectations better than the moves in macro data lately, see Figure 2.

Neither we, nor the market, know the outcome of the election. But given that the market is still pricing in 5 interest rate cuts from the Fed before 2025 is over, we do not believe the market has fully priced in a Trump victory. As we see it, and given the inflationary impulses the Peterson Institute for International Economics estimates with Trump's politics, we doubt that the Fed will be able to continue the cutting cycle for long in 2025. Therefore, we see an upside risk for the USD, within the next year, if Trump wins the election and a corresponding downside risk for the NOK. Similarly, we see an upside risk for both US and Norwegian interest rates.

We see an upside risk for the USD, within the next year, if Trump wins the election and a corresponding downside risk for the NOK.

Although the market now interprets Trump's victory as positive for the dollar, the uncertainty is exceptionally high in the long term (3 years). Although his policies appear to be highly inflationary, especially in the short and medium term, the GDP could probably be hit quite hard negatively in the long run. How negative is highly uncertain and depends in particular on how many illegal immigrants Trump manages to deport and to what degree other countries retaliate by raising tariffs on import of US goods. The Peterson Institute for International Economics has estimated that the US GDP could be 2-10 percentage points weaker in the long term with Trump policies compared to Harris’. We therefore see the long-term effects on the USD and the NOK with a Trump presidency as highly uncertain, with inflation up and growth down.

To summarize: Within the next year, we believe a Trump victory would be positive for the USD and negative for the NOK. In the long term, however, there is a great deal of uncertainty: It depends on whether Trump would manage to implement his politics, and if so, how other countries would respond to the new tariff rates.

See the original research article.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more