- Name:

- Ebba Ramel

- Title:

- Sustainable Finance Advisory

Investors have been interested in social investments for some time, but the labelled bond market has lagged behind due to difficulties defining social impact metrics. In 2020, the COVID-19 pandemic created an urgent need for funding to tackle social issues, which translated to a significant increase in social bonds, issued primarily by public agencies.

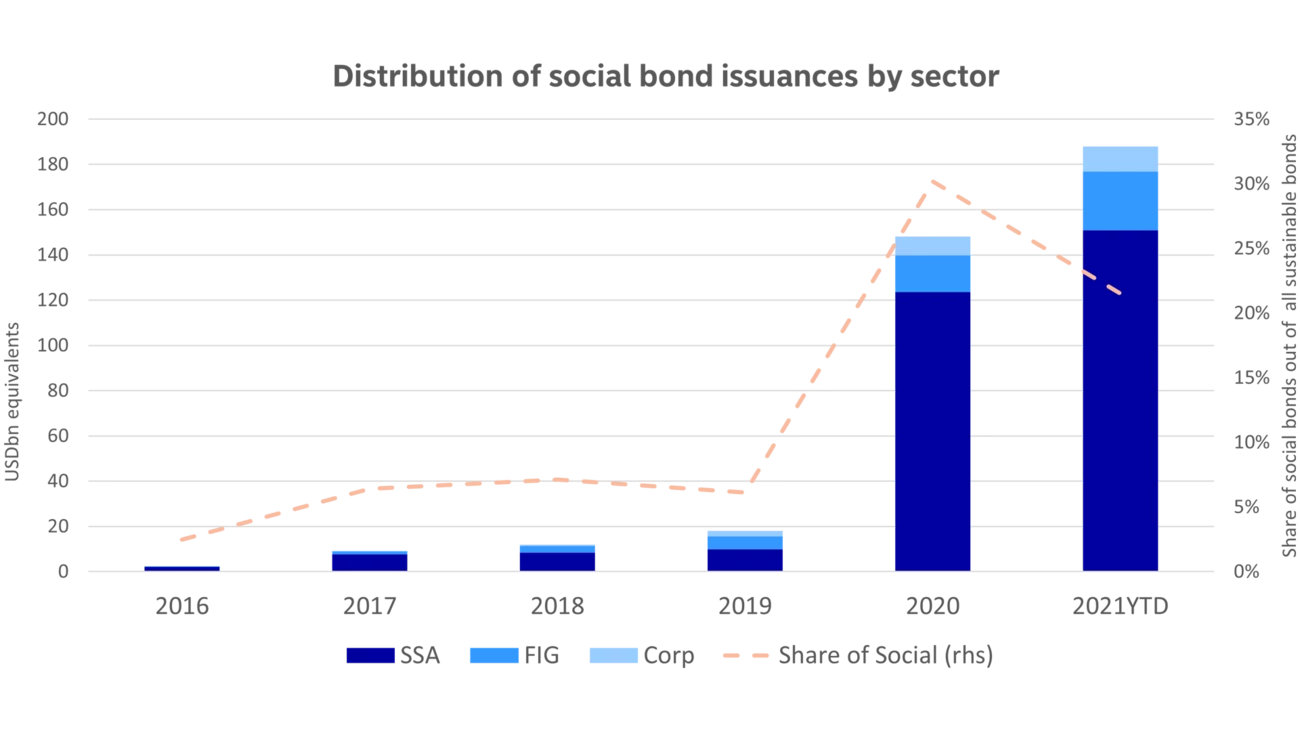

The lion’s share of social bonds in 2020 were issued to mitigate effects of the COVID-19 pandemic and to promptly provide needed public health and stimulus responses. The figure below illustrates the development of bond issuances over the last five years. While the relative share of social bonds out of all sustainable use-of-proceed bond issuances (green, social and sustainability) has declined since the peak of the pandemic from 30% to 22% between 2020 and 2021 year-to-date, the absolute number of social issuances is still increasing. The numbers reveal the rising importance of social debt, which we expect to persist in the long-run.

While green financing targets environmental objectives, projects financed under social bonds aim to address or mitigate a social issue or contribute to positive social developments. A main component of social bonds, as opposed to the green bond format, is the definition of a target population which will benefit from the project financed.

Unlike sovereigns, supranationals and agencies (SSAs), few corporate actors have issued social bonds to date. Social financing could provide benefits in various sectors. In a Nordic context, this could include real estate companies providing affordable housing or industries financing programmes designed to prevent or reduce unemployment.

The numbers reveal the rising importance of social debt, which we expect to persist in the long-run.

Key to the use-of-proceeds market is transparency on allocation of proceeds, as well as impact reporting. A recurring challenge in the social debt market is finding the accurate impact reporting metrics, as many social investments are long term, and will not give immediate benefits. In addition, social impacts can often be the result of several initiatives, making the impact difficult to derive from a particular investment or project. In 2020, the International Capital Market Association (ICMA) launched a paper, “Working Towards a Harmonized Framework for Impact Reporting for Social Bonds”, which aims to catalyse a broader discussion among issuers and investors on the reporting on projects to which social bond proceeds have been allocated. The paper provides some guidance on tangible first steps for issuers, as well as examples of impact indicators. Together with corporate first movers issuing socially-focused debt, such as Trianon and Studentbostäder, we expect this to lead the way to increased social debt going forward.

Earlier this spring, the social loan principles were published by leading market participants, and the Swedish local government funding agency, Kommuninvest, launched social loans, both putting additional light on the social debt format.

Further, the sustainability-linked debt format gives a lot of room for innovation and can be a relevant format for driving social change. As of now, many of the initial sustainability-linked debt structures have focused on climate and broader environmental KPIs, but we believe that they increasingly will be used by corporates to commit to their social ambitions and initiatives.

Social washing refers to the misrepresentation of companies to appear more social than they actually are. Collaboration from standard-setters will be crucial within the next months to avoid social washing, which could undermine market confidence in social debt products before they can gain traction.

On the selection of eligible projects or socially-focused KPIs, a concrete definition of how to define target group, report on impact and measure social progress will be needed to target actions. From a reporting perspective, as explored in our recent reporting standards overview, we have come quite far when it comes to defining meaningful and increasingly standardised metrics to measure environmental impact. On a social dimension, there is still a significant way to go.

Until then, in order to assess credibility of projects, investors will have to walk the extra mile and take a wider scope in evaluating projects by assessing the company’s overall processes and oversight with regards to social topics.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more