By Tuuli Koivu, Jan von Gerich, Juho Kostiainen, Mitro Hartikainen, Helge J. Pedersen, Torbjörn Isaksson and Kjetil Olsen

Our baseline scenario set forth in the latest Nordea Economic Outlook from January 2025 is that Trump will implement tariffs on European imports, but we expect them to be rather low and the implementation process to be transparent, reducing the currently high level of uncertainty. However, Trump’s plans on tariffs have been changing almost every day and there is still a lot of uncertainty around the final scale and coverage of the tariffs.

What should we expect from Trump?

We see at least three different motivations for Trump to impost tariffs on European countries:

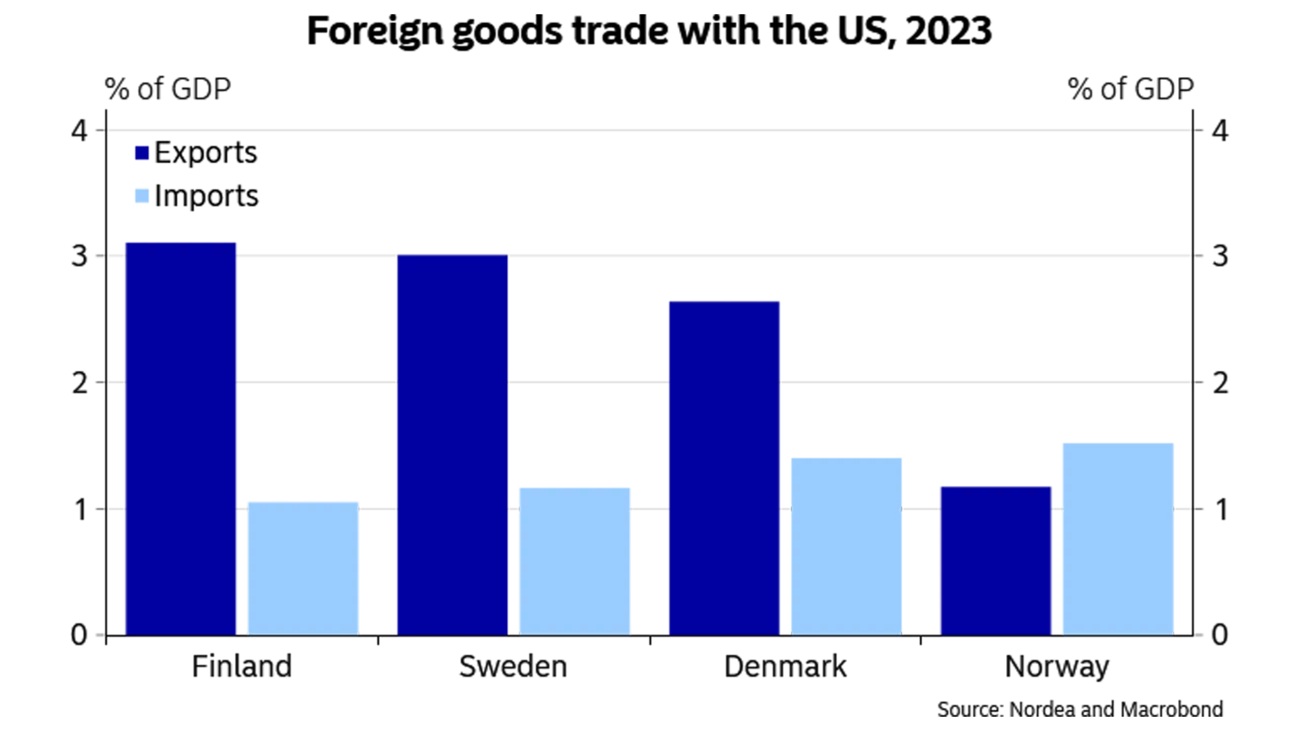

- It is well known that for Trump, the large US goods trade deficit is a sufficient argument to impose tariffs, especially on those countries that run bilateral trade surpluses with the US.

The US has the largest goods trade deficit with China, the EU, Mexico and Vietnam and from this perspective it would be a surprise if the EU was not facing additional tariffs imposed by Trump.

- Trump has recently emphasised the importance of tariffs as a way to increase federal budget revenues.

A scenario that has caught a lot of attention recently is that Trump could deliver a permanent decline in the corporate income tax rate to 15% (he lowered it to 21% in his first term) by imposing tariffs as a counterbalancing fact to the budgetary legislation.

- Trump could also use tariffs as a negotiation tool to achieve geopolitical goals.

In his communication Trump often combines the low defence budgets in a number of EU countries with tariffs and he has even threatened Denmark with higher tariffs if they cannot come to a common understanding on Greenland (in practice, it is not possible for Trump to target Danish exports separately from the EU).

In sum, no matter which type of motivation that dominates Trump’s tariff policy, the EU will likely be one of his key targets on this front.