- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

The NOK has plunged over the past year. The usual NOK drivers, such as oil prices and stock market performance, explain little. The main factor is likely a clearly narrower interest rate differential between Norway and our biggest trading partners. Norges Bank’s NOK sales on behalf of the government has added to the weakening since the autumn.

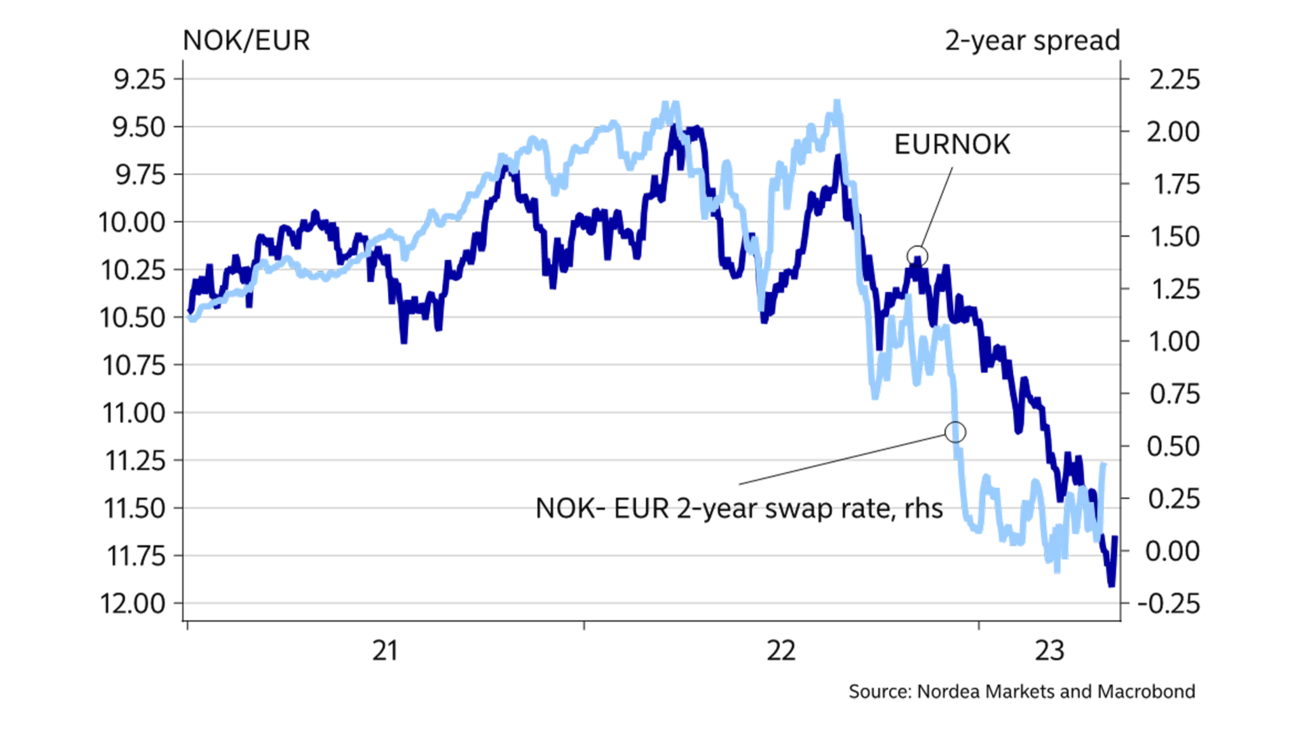

Over the past year, the NOK has lost about 20% versus both the USD and the EUR. Until last autumn, the weakening was most pronounced against the USD. Since then, the NOK has also weakened sharply versus the EUR. We believe that the main reason for the past year’s NOK weakening is the clearly narrower interest rate differential against our main trading partners. Over the past year, other central banks have hiked interest rates more aggressively than Norges Bank. The NOK has gone from a high-yield currency to a low-yield currency.

The NOK performance against the EUR since the autumn is illustrative. Very high inflation and better eco-nomic development than feared have led to a rate spike in the Euro area that was almost unthinkable a year ago. Since July, the ECB has raised its policy rate from -0.5% to 3.25%. Despite the rate hikes, also from Norges Bank, the favourable yield differential for the NOK has eroded. While Norway’s key policy rate was about two percent-age points higher than in Europe, the gap is now close to zero (chart A). When the relative return on NOK positions is reduced in this way, the NOK becomes a less attractive investment currency. Other currencies that have weakened almost as much as the NOK against the EUR include the AUD and CAD (chart B).

However, part of the recent NOK depreciation stems solely from domestic factors, including Norges Bank’s NOK sales. The bank sells NOK on behalf of the Ministry of Finance to transfer a portion of tax receipts from oil companies to the Government Pension Fund. As oil exports are invoiced in foreign currency, the oil companies have to exchange currency into NOK to pay taxes. Over time, Norges Bank’s NOK sales will balance out the oil companies’ NOK purchases, but since oil taxes are paid with a lagged effect, the currency transactions might still impact the NOK exchange rate. The oil companies buy NOK in parallel with exports, while Norges Bank cannot sell NOK until taxes are paid some six months later. In the period until the summer, the oil tax payments are based on last year’s extremely high gas prices. The current oil and gas prices generate far lower income and thus lower NOK purchases from the oil companies. This will not show in lower tax receipts until August, with accordingly lower transfers to the Government Pension Fund. From the summer, lower NOK sales from Norges Bank will result in a better balance in the NOK market. This could help curb the NOK weakening, and viewed in isolation, it points to a somewhat stronger NOK. Higher oil investment would also lead to increased NOK purchases from the oil companies beyond what they need to pay in taxes.

Exchange rates are a relative play where interest rate differentials play a role.

The introduction of resource rent tax for the fish farming industry has likely led to somewhat lower foreign ownership of stocks traded on Oslo Stock Exchange. Foreign investors’ sale of stocks involves the sale of NOK versus other currencies, and viewed in isolation, leads to a weaker NOK. However, the amounts in question are modest compared to Norges Bank’s NOK sales. The effect on the NOK exchange rate has thus probably been limited.

Near term, we cannot rule out further NOK depreciation. But slightly longer out, we expect some recovery thanks to lower NOK sales from Norges Bank, higher oil in-vestments and additional rate hikes from Norges Bank.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more