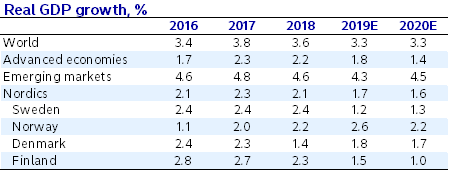

“There is a myriad of signals across the global stage and drawing firm conclusions on the economic outlook is dangerous given the complex interplay of those on the positive side of the balance sheet and those in the negative column,” says Nordea’s Group Chief Economist, Helge J. Pedersen, adding that the Nordic economies are also moving in different directions these years.

While the many signals on the geopolitical arena are familiar now, familiarity makes them no less powerful. The US-China trade war isn’t going away, the Brexit stranglehold on Europe is locked in, inverted bond yield curves hint at recession and European growth remains tepid at best. Yet, on the credit side, the US economy shows little sign of slowing, we see green shoots in Asia and global stocks are enjoying a lively and bountiful 2019 so far. And, while the global context offers the same backdrop for the Nordics, all is not equal among Scandinavia’s component parts.

Take Denmark, for example. The economy is in the middle of a healthy economic upswing and there are few indications to suggest this will stop any time soon. Fundamentals are also more robust compared to the credit growth that underpinned the pre-financial crisis era, strengthening the buffer should a global slowdown ensue. We stick to our forecast of Danish economic growth of some 1.75% both this year and in 2020 – mainly driven by domestic demand.

Norway too seems ready to show some muscle with solid growth likely to run parallel to a tighter labour market. There’s optimism fueling the economy and a reinvigoration of investment in the oil sector and a likely wage pick-up should also underpin private consumption. Even the prospect of inflation should be kept in check as wage growth offsets the impact of a potentially stronger NOK. Whatever Norges Bank does meanwhile, it is unlikely to faze currency markets as it keeps to its gradual rate-rise strategy.

But it’s quite a different matter in Sweden. From the heady heights of 2.4% growth in 2018, the economy could slow to 1.2% in 2019 and that will only improve slightly in 2020. Lower housing investment and sluggish private consumption, due to the uncertainty in the housing market, have contributed to dampening growth and spillover from Europe’s travails means that exports will not get much support, at least not before 2020.

As for Finland, there is a mixed bag feeling, given that the economy is expected to slow to a growth rate of 1% in 2020, but with the employment rate rising again in the spring of 2019, there is a fair degree of optimism underpinning expectations, that is, as long as global uncertainties do not derail the momentum.

For further information:

Helge J. Pedersen, Group Chief Economist, Tel: +45 55471532 | Mob: +45 22697912

e-mail: helge.pedersen [at] nordea.com (helge[dot]pedersen[at]nordea[dot]com)

We build strong and close relationships through our engagement with customers and society. Whenever people strive to reach their goals and realise their dreams, we are there to provide relevant financial solutions. We are the largest bank in the Nordic region and among the ten largest financial groups in Europe in terms of total market capitalisation with around 11 million customers. The Nordea share is listed on the Nasdaq Helsinki, Nasdaq Copenhagen and Nasdaq Stockholm exchanges. Read more about us on nordea.com.