- Name:

- Stella Mylläri

- Title:

- Nordea Sustainable Finance Advisory

This year marked the inaugural year for companies in scope for EU Taxonomy reporting to disclose not only eligibility, but also EU Taxonomy alignment for the objectives included in the Climate Delegated Act. Nordea ESG Research shows that the alignment numbers are surprisingly low for Nordic companies. In addition, eligibility under the EU Taxonomy varies depending on the sector, which is further reflected in the alignment and eligibility figures of different country shares.

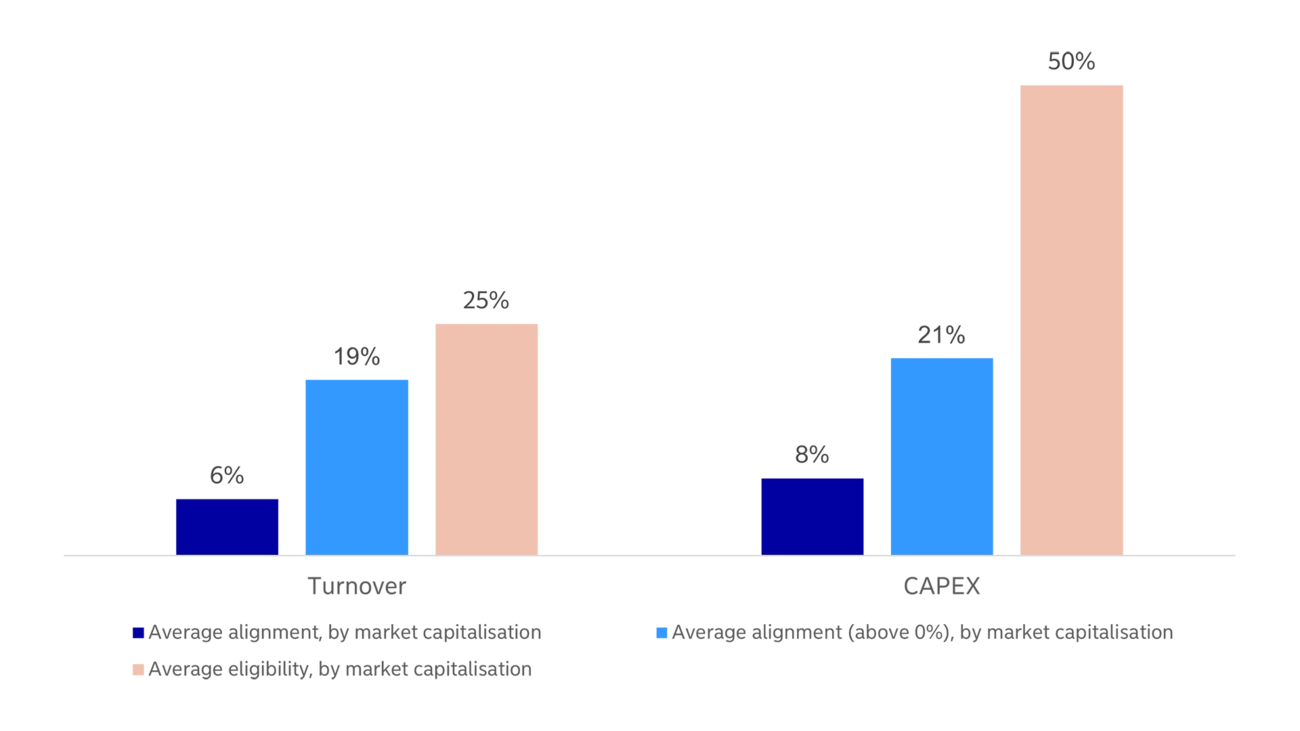

Based on ~210 Nordic-listed companies in Nordea ESG Research’s universe that have reported thus far, the average turnover alignment weighted by market capitalisation was 6%. However, when the turnover alignment was equally weighted, it increased to 7.6%. Out of all the companies, only 40% reported some degree of Taxonomy alignment (i.e. more than 0%). Among these listed companies, the average alignment reached 18.7% (or 19.2% equally-weighted).

The average turnover eligibility of the universe was 24.6% in 2022 (equally weighting all companies).

Capex-alignment surpassed figures of turnover alignment, reaching 8.2%, for both market capitalisation and equally-weighting methodologies. When taking into account only companies with some degree of Taxonomy alignment, the average alignment increased yet again, reaching 21% (or 23% weighted for market capitalisation), which is also higher than that of turnover.

The average capex eligibility for the universe is 50%.

Source: Nordea, company data

The reasoning behind the higher alignment under capex than turnover may be explained by companies directing their capital flows towards a greener tomorrow. Seeing this reflected in numbers is comforting, and the positive capex alignment could be an indicator of potential higher turnover alignment in the future. Even though the eligibility numbers are low for both turnover and capex, there is still some potential for the companies included in the universe to further increase the share of EU Taxonomy aligned turnover and revenues, displayed by the gap between eligibility and alignment.

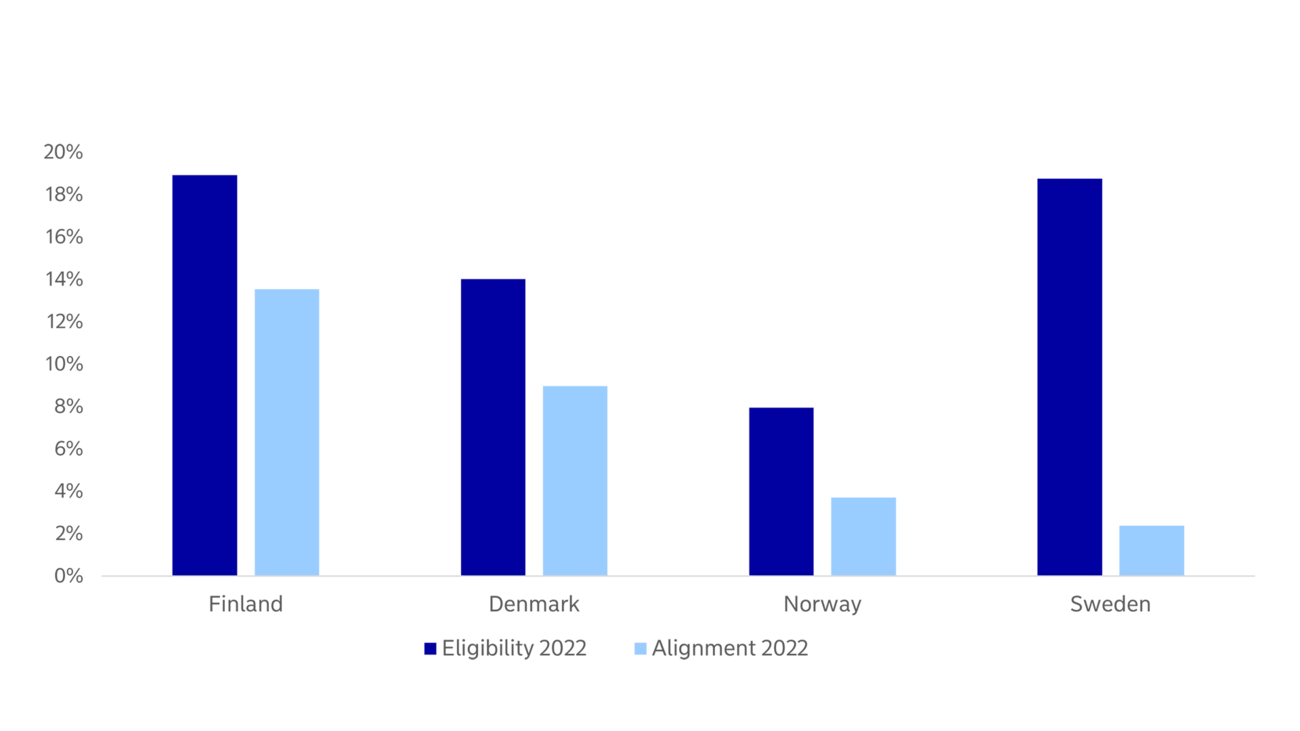

By country, Sweden shows the lowest degree of alignment out of the four Nordic countries, with market capitalisation-weighted being 2.4% and equal-weighted 6.1%. This is due to the sector exposure of the country, which is heavy on real estate. If we weight Nordea’s universe by market capitalisation, Finland is the country with the highest alignment, which is a result of many of its large caps’ alignment contribution, just like Denmark with the second-highest alignment.

Source: Nordea, company data

From a sector perspective, energy, which includes renewables, is the sector with the highest EU Taxonomy alignment, followed by materials and real estate. Among the companies that reported their capex alignment in 2022, there was only one company within the energy sector reporting a 100% capex alignment. Analysis of the sector trends with regard to capex shows that energy has the highest alignment, followed by oil services, both driven by investments in renewables.

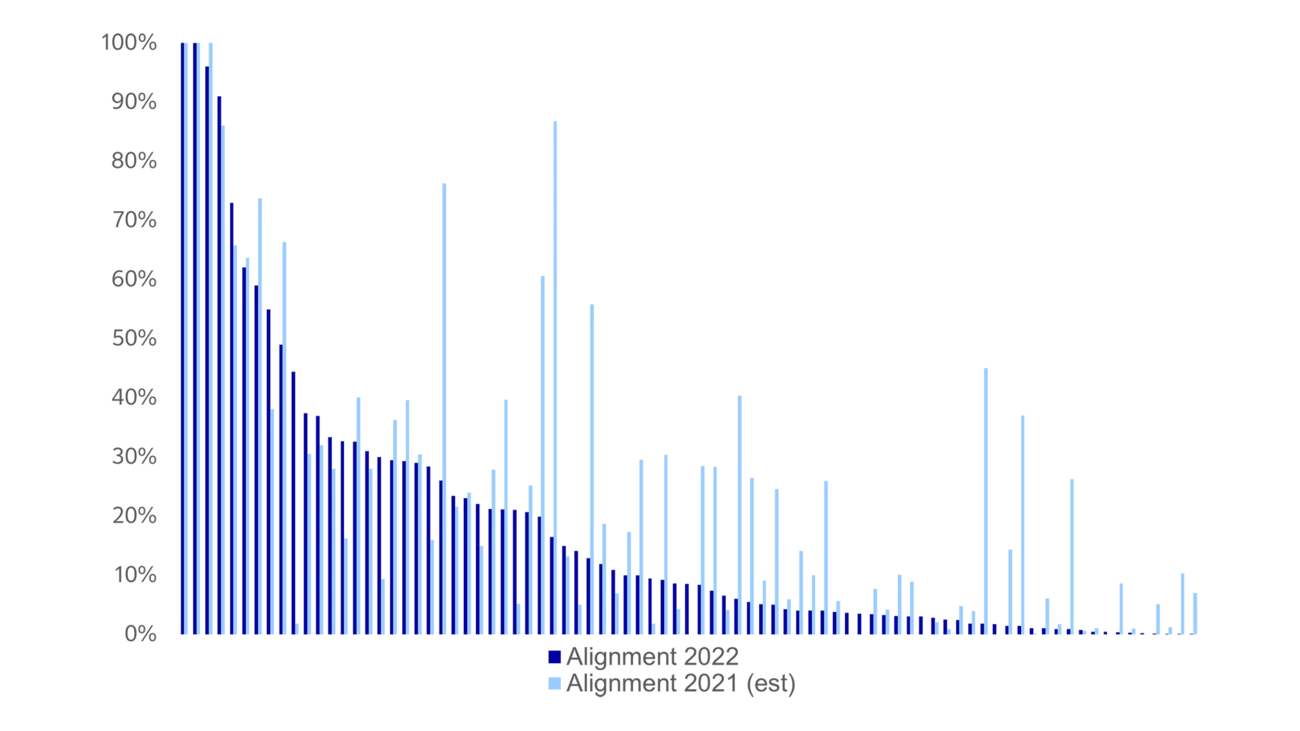

It is apparent that companies have adopted a cautious year-one approach to their disclosures, as alignment figures were lower than Nordea ESG Research team’s estimates from 2021. We expect to see some positive upgrades for the coming years, as companies become more comfortable with the process.

Source: Nordea, company data

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more