- Name:

- Susanne Spector

- Title:

- Nordea Chief Analyst

Swedish home prices are falling rapidly as households adjust to surging mortgage rates. The situation is not as serious as in the 1990s, but there is risk of a sharp price correction.

The current housing market decline in Sweden is the fifth since the beginning of the 1990s. Prices are falling rapidly and sometimes parallels are drawn to the housing market crash in the 1990s. In this text, we therefore compare the economic conditions to previous declines in home prices.

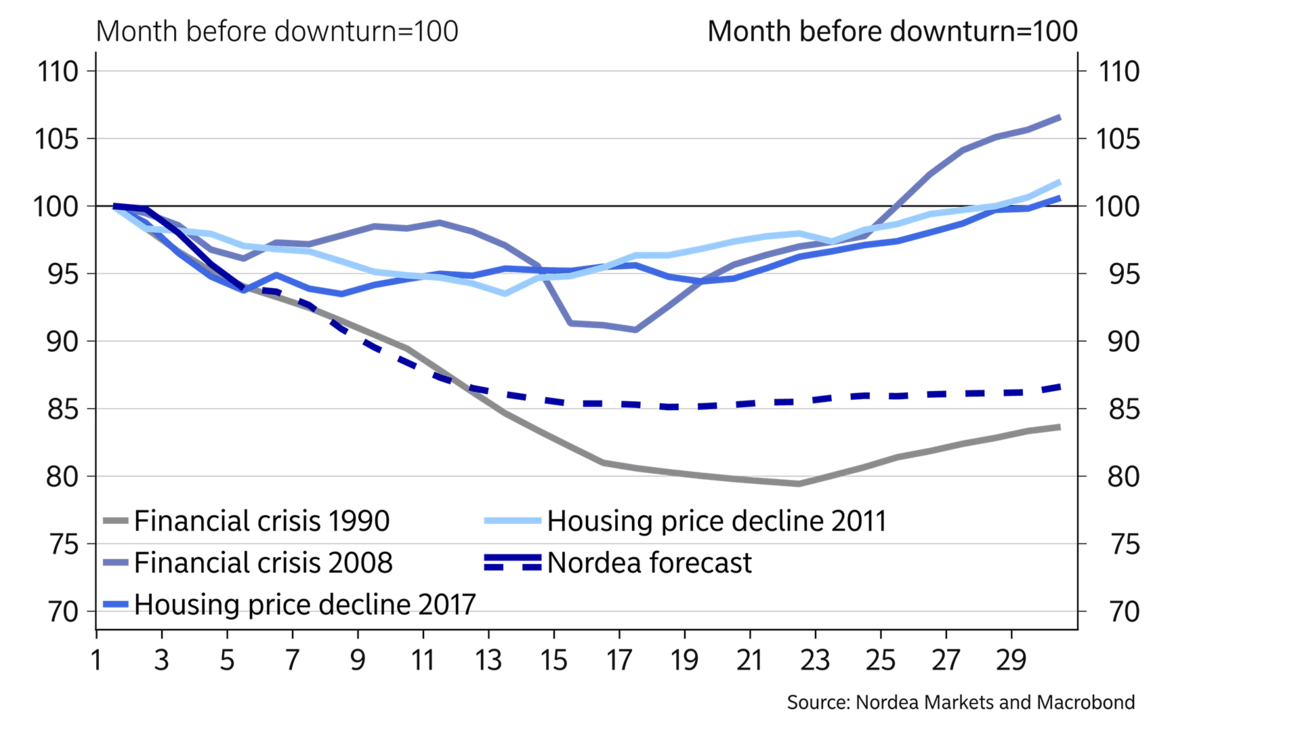

Home prices have dropped by 6% between March and July this year. The development might seem dramatic but is so far in line with previous downturns on the housing market. Historically, the decline in the 1990s stands out both in terms of magnitude and duration. Back then, the crisis was sparked by a domestic cost crisis, the defence of a pegged exchange rate and sharply rising interest rates. The tax reform in 1990-91 cut interest deductions, which contributed to a rapid increase in households’ interest expenses. High construction activity led to increased housing supply and employment plummeted. The combination of these trends set the stage for the perfect storm in the housing market. House prices dropped 21% and it took nearly seven years to recover from the decline. By contrast, in 2008, 2011 and 2017 it only took 25 to 30 months to recover from the more moderate falls in home prices of 7-10% nationwide.

Previous price falls have on average bottomed after 13 months. If the current downtrend follows the same pattern, home prices will continue to fall until the spring of 2023 and start to recover from the summer of 2024.

The table shows how some key variables developed just before and during previous housing market declines. The importance of interest rates on home prices is clear – all price falls except for in 2017 were triggered by rising interest expenses. During the crisis in the 1990s, the financial crisis of 2008 and the decline in 2011, large interest rate cuts supported home prices. In 2008, the policy rate was cut by 4.5 percentage points within a short time, limiting further price declines despite falling employment while the policy rate was negative in 2017.

In 2011 and 2017, employment rose despite falling home prices. One reason for the decline in 2011 was rising interest rates, whereas the downturn in 2017 was more supply-driven after a period of high construction activity. A mutual cause for both of these declines was also cooling demand due to stricter mortgage regulation.

The current decline has some elements in common with both downturns. It was mainly triggered by rapidly rising interest rates but the high construction activity could contribute to prolonging the downtrend. On the other hand, mortgage rules could be eased in case of larger price declines. So far, employment is also rising.

Rapidly rising mortgage rates, which have increased more and faster than expected, are a key factor in the current decline. High inflation erodes households’ purchasing power and housing construction is at historically high levels. At the same time, the labour market is stronger than ever. The current situation could be summarised as households keeping their jobs but having less money left in their wallets at the end of the month. The price decline is thus considered to be more of a correction to a new interest rate level rather than a housing market crash. Unlike in 2008 and 2011, we do not expect the housing market to be supported by any rate cuts in the near term. Overall, this points to further pressure on home prices and a slower recovery compared to previous crises during the 2000s. We thus expect home prices to fall by 15% from the peak earlier this year. But the conditions may change quickly. In a scenario with higher-than-expected interest rate increases or a deteriorating labour market, the storm winds could become stronger next year.

The price decline is considered a correction to a new interest rate environment rather than a housing market crash.

Rapidly rising mortgage rates, which have increased more and faster than expected, are a key factor in the current decline. High inflation erodes households’ purchasing power and housing construction is at historically high levels. At the same time, the labour market is stronger than ever. The current situation could be summarised as households keeping their jobs but having less money left in their wallets at the end of the month. The price decline is thus considered to be more of a correction to a new interest rate level rather than a housing market crash. Unlike in 2008 and 2011, we do not expect the housing market to be supported by any rate cuts in the near term. Overall, this points to further pressure on home prices and a slower recovery compared to previous crises during the 2000s. We thus expect home prices to fall by 15% from the peak earlier this year. But the conditions may change quickly. In a scenario with higher-than-expected interest rate increases or a deteriorating labour market, the storm winds could become stronger next year.

This article first appeared in the Nordea Economic Outlook: Feeling the Squeeze, published on 7 September 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more