Economy

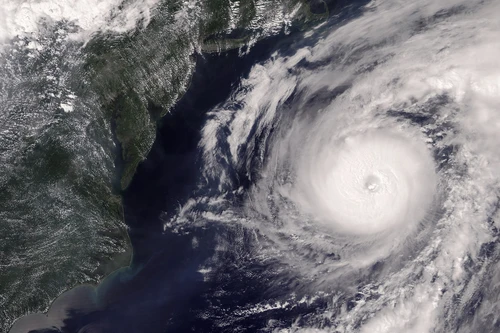

Chief Economist's Corner: Cold winds blow from the east, while it's foggy and unstable in the west

The unstable conditions continue to dominate the forecasts, and nothing suggests an imminent shift.

Read moreFollow our expert insights about how the markets and inflation develop in the Nordics and globally.

Economy

The unstable conditions continue to dominate the forecasts, and nothing suggests an imminent shift.

Read more

Markets and investment

Ever wondered what banks or other financial institutions do with your money when you save or invest? Here is an explanation of asset management and Nordea’s role as an asset manager.

Read more

Economic Outlook

Households have regained confidence, and conditions are in place for consumption to substantially increase. The export industry has weathered several global challenges, and the outlook is healthy. The unemployment rate is set to fall to 5%, according to the new BAS measure.

Read more

Economic Outlook

The global economic outlook has continued to be rather stable, despite geopolitical uncertainty. However, the level of uncertainty continues to be high, and the confidence among corporates and households is repeatedly tested.

Read more

Economy

The global economy proved to be more resilient to President Trump's aggressive trade policy than many feared. This provides the basis for a tempered – but real – optimism as we enter the new year.

Read more

Markets and investment

As the European regulatory environment for cryptocurrencies has matured and the demand for virtual currencies and cryptocurrencies is growing across the Nordics, Nordea has decided to allow customers to trade in a crypto-linked product on its platforms.

Read more

Markets and investment

Our analysis of the main public infrastructure programmes in Europe points to a substantial step-up in investment due in 2026, which contrasts with the capital drain we’re seeing for US cleantech. This is driving investors’ sentiment for infrastructure, which, for the first time in years in Q2 2025, was higher in Europe than in the US, topped by the Nordics.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Some of the downside risks in the global economy have vanished since our spring forecast due to President Trump’s trade deals and the fiscal agreement in the US.

Read more

Economy

As the summer of 2025 draws to a close, Nordea analyst Joel Lundh provides a comprehensive overview of the global economic landscape. From financial markets to world events, this article summarizes the key developments that have shaped the international economy in recent months.

Read more

Markets and investment

Nordea Asset Management introduces a new fund for private and institutional investors who want to invest in Europe’s independent energy supply, industrial production and collective security.

Read more

Economic Outlook

President Trump’s policy actions have caused a lot of volatility in the financial markets and the economic outlook since our previous forecast. Uncertainty is high, and, given Trump’s tendency to cause chaos, this is expected to continue.

Read more